How Grameen founder Muhammad Yunus fell from grace

- Published

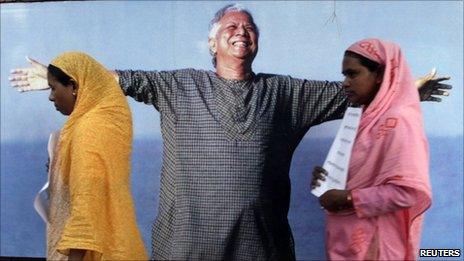

Muhammad Yunus has been a poster boy for the microfinance industry

In 2006 Muhammmad Yunus and the Grameen Bank were awarded the Nobel Peace Prize in recognition of his pioneering work in the fight against poverty through the microcredit system. It has so far been the crowning achievement of his career.

Yet only five years after winning the award, Prof Yunus has been ignominiously turfed out of his job as managing director of the Grameen Bank he created.

So what prompted his spectacular fall from grace? Part of the answer lies in the character of the man, who evokes strong emotions in Bangladesh.

Admirers see him as someone who has arguably done more than any other individual in the developing world to lead the fight against poverty.

But critics see him as a person who brooks no criticism of his management style - someone who fell victim to his own vanity by ill-advisedly trying to set up a political party.

Huge miscalculation

It would be no exaggeration to say that in 2007 Prof Yunus was revered in Bangladesh for winning the Nobel prize. He had, up until then, mostly stayed clear of politics, apart from occasionally joining aid agencies and non-governmental organisations to call for better governance in his home country.

Prof Yunus has increasingly had to defend himself in the courts

In January of that year he was reportedly approached by the military to head a caretaker government, with a view to becoming the new prime minister, and so bring an end to what it saw as a damaging cycle of poorly-performing governments either led by the Bangladesh Nationalist Party or the Awami League.

He later recommended the former head of the Bangladeshi central bank Fakhruddin Ahmed for the job.

Soon afterwards Prof Yunus decided to form his own political party - in a move which even his most ardent supporters have described as a huge miscalculation.

His critics denounced him. He soon realised for himself it was a bad idea when the small support base he had for his party evaporated within hours. The move into politics was rapidly aborted, but it came too late to pacify some of his enemies.

Prime Minister Sheikh Hasina has never forgiven him. The announcement came just as the military began a crackdown on political parties, arresting dozens of top leaders on charges of corruption. Sheikh Hasina herself would be put under arrest a few months later.

She saw Prof Yunus's move as a behind-the-scenes and shabby deal to remove her from politics. It was a charge he denied - arguing that he could not abandon his country in what looked like its hour of need.

If her government was seeking revenge, it was not hard for them to find it. In December, Sheikh Hasina complained that the Grameen Bank was overcharging its eight million borrowers and that it was in effect "sucking blood from the poor".

In humiliating language for Prof Yunus a few months later, they argued that he was past his retirement age and should not have been reappointed as managing director of Grameen Bank once he reached retirement age - at 60 - in 2000.

Within months of first airing their criticisms they began the process of removing Prof Yunus from his position as managing director of the Grameen Bank. It was a spectacularly speedy demise.

Electrifying

But his supporters say he has since bounced back.

Many Grameen Bank employees remain devoted to Prof Yunus

They say the fact that Prof Yunus won the Nobel award along with the bank he formed is significant because there are few institutions - as opposed to international bodies - who win it.

"Doesn't that say something about his institution-building capacity and his successful management style?" argues Bangladesh Daily Star editor Mahfuz Anam.

"While it it is true that the events of 2007 were a setback for Prof Yunus, the government's somewhat clumsy and spiteful efforts to get rid of the country's only Nobel winner have won him sympathy from the Bangladeshi public - not to mention prominent figures on the world stage."

BBC Bengali editor Sabir Mustafa says that he witnessed the professor's ability to win over a world audience in 1995, when he addressed a UN conference on women in Beijing.

"It was a speech that seemed to encapsulate to me all the reasons why Prof Yunus is so renowned internationally," he said.

But at the same time the negative side of his character was also on display.

"He showed little willingness to engage with the Bangladeshi media, even when approached. People often feel he is not prepared to face, let along answer, critical questions about the way Grameen Bank operates,'' says Sabir Mustafa.

Critics also argue that Prof Yunus has always surrounded himself with sycophants and takes criticism of Grameen Bank as a personal affront.

In many respects the arguments over his work mirror some of the bitter divisions within Bangladesh itself - it is a country where the prime minister and the leader of the opposition have not made much effort to conceal their mutual loathing.

Harsher critics of the professor say that even the microcredit concept was not really his brainchild. They argue that it was around long before he latched on to the idea in the early 1980s.

But supporters say that who actually invented microcredit is not the question. Prof Yunus's achievement, they argue, is the distribution of millions of small loans through the foundation of the first bank in the world which provides money to poorer people without asking for collateral.

"What makes his system so unique is that the Grameen Bank of Prof Yunus has made these loans without any guarantee of repayment," says Mr Anam.

"And the amazing thing is that the repayment rate is much better than many commercial banks.

"It is a system that has been copied by innumerable countries in the world, be they socialist, communist or capitalist - surely that is no mean achievement and that will be his legacy."

- Published2 March 2011

- Published2 March 2011

- Published3 November 2010

- Published27 January 2011

- Published12 January 2011

- Published8 December 2010