Republicans 2012: Rick Perry unveils flat tax plan

- Published

Rick Perry raised $17m in campaign financing during the third quarter

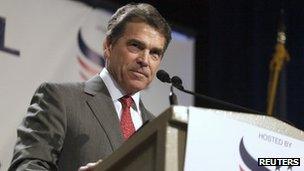

Republican presidential candidate Rick Perry has unveiled a plan to reform the tax code and cut US spending.

The Texas governor said his plan centres on a flat, voluntary tax rate of 20% for incomes and companies.

Mr Perry announced the plans, external in a South Carolina speech on Tuesday.

Mr Perry is retooling his campaign after recently losing momentum in the polls. He became a leading contender when he decided to run in August.

The plan, called "Cut, Balance and Grow" will simplify the tax code so Americans can "file their taxes on a postcard", Mr Perry said.

Brandishing a postcard as he spoke, Mr Perry declared that "tax codes have consequences" as he outlined a broad plan to reform Social Security and Medicare, and balance the budget in eight years.

He outlined a number of exemptions to his flat tax proposal, the broad outlines of which some critics, including his rival for the nomination Mitt Romney, have said would benefit the wealthy.

Mr Perry pledged to end "special breaks for special interests" in Washington through a 20% rate of corporate tax, which is lower than current rates. He also said capital gains and taxes on dividends would be abolished altogether.

Simplifying America's corporate taxes would "shut down the cottage industry of corporate tax evasion", Mr Perry said.

'Bringing dollars home'

The central proposal is a 20% flat tax on companies and personal income, although taxpayers would be given the choice of whether opt for that rate of tax or whether to continue paying tax at current rates.

Tax exemptions would remain in place for mortgage interest, charitable giving, and state and local taxes on families earning less than $500,000 (£313,000) annually.

And, Mr Perry would raise the level at which individuals and dependents start paying tax to $12,500 and would encourage US businesses to repatriate assets and incomes within the US.

The Texas governor also says he would cap government spending at 18% of gross domestic product (GDP) and repeal the Dodd-Frank financial reform legislation, Obama healthcare legislation, and parts of the Sarbanes-Oxley Act, which set regulations for public companies.

The plan would also reform the way young workers accrue Social Security savings and would freeze federal hiring until the budget is balanced.

He pledged to balance the budget by 2020 and seek a balanced budget amendment to the US constitution, a favoured plan of US conservatives in and outside Washington.

Mr Perry told the crowd: "I offer a plan that changes the way Washington does business."

After a series of recent debates Rick Perry has seen poll ratings slide while Mitt Romney's lead holds steady

Experts say flat tax models, such as the plan put forward by Mr Perry, are usually favoured by those hoping to increase efficiency and fairness in the system, while reducing complexity.

"Our current system can create some serious work disincentives, particularly at low and high ends of the income distribution, so the potential efficiency gains are pretty clear," Justin Ross, Professor of Public Finance at Indiana University, told the BBC.

"Our tax system isn't complex because of the different rates. It's complex because it's difficult to measure our taxable income and that is a problem regardless of whether or not you use progressive marginal rates or a single flat rate."

Rival plans

Mr Perry unveiled his economic roadmap as his ratings in opinion polls have dropped.

Mr Romney, the current front-runner for the nomination, has put forward a 59-point economic plan for the US.

Businessman Herman Cain, who has his poll ratings surge in recent weeks, proposes a "9-9-9" tax plan that would replace the current code with a 9% income tax, business tax, and a national sales tax.

Mr Cain's plan has been criticised by a number of analysts, who suggest his proposal would not raise enough cash to cover US costs, and would unfairly hit the poorest in society.

He was recently criticised during a televised debate by Minnesota Congresswoman Michele Bachmann, who said the sales tax would eventually become a national value-added tax.