Pros and cons of Rick Perry's flat tax plan

- Published

- comments

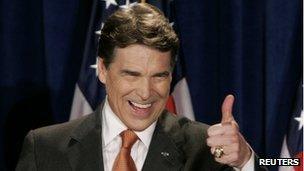

Rick Perry hopes to make a comeback in the Republican race, where he's lagging behind, external, with his plan for a flat tax, external. Herman Cain, the current darling of the Republican right, has also proposed a flat tax as part of his 9-9-9 plan, external.

It's something of a holy grail for economic conservatives and Perry's plan has grabbed him some headlines. But what are the pros and cons?

The huge appeal of a flat tax is its simplicity. Under Perry's plan everyone would pay income tax of 20%. At the moment, the lowest paid Americans (under $8,500) pay 8% of their income, while the richest (more than $379,150) hand over 35%.

Rick Perry has been Texas governor for 10 years

That has been the system of income tax since 1799, when British Prime Minister William Pitt the Younger first introduced one to pay for the fight against Napoleon.

So changing from a progressive tax to a flat tax usually means richer people pay less, poorer people pay more. What you think of that depends on your politics, or perhaps more simply, your income.

Perry can argue nobody loses: His plan is voluntary. That seems to me to change the game. Everyone would choose the scheme that benefits them the most. So everyone wins but revenue falls dramatically. That fact would please fiscal conservatives, but obviously means deeper cuts.

Flat taxes don't only exist in some economists' dream land. They are now a fact of life in much of Eastern Europe.

Russia introduced a flat tax of 13% in 2001. The economy boomed, and tax takes went up. The Heritage Foundation hailed it as the foundation of an economic miracle, external.

Lithuania (24%), the Czech Republic (15%) and Georgia (12%) are among the other former communist countries where it has been adopted.

It has been a feature of American elections before.

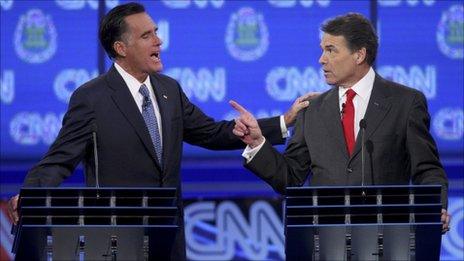

Steve Forbes was a Republican candidate during the 1996 and 2000 primaries, and both times proposed a flat tax. Mitt Romney attacked it then as "a tax cut for fat cats, external".

Whatever its economic merits, that just about sums up the political danger.

While the right love the purity - and what they would call the fairness of the tax - and can argue putting money in the pockets of the wealthy stimulates the economy, it would easy for Democrats to portray it as an a tax cut for those who need it least.

- Published25 October 2011

- Published19 October 2011

- Published3 January 2012