Detroit becomes largest US city to file for bankruptcy

- Published

Michelle Fleury visited the abandoned Packard manufacturing plant, once producing luxury cars at the heart of Detroit's motor car industry

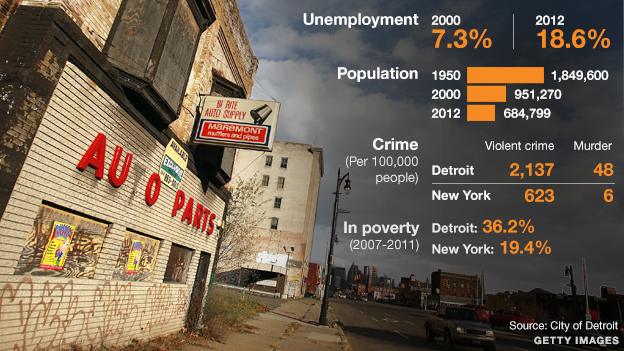

Detroit may be gearing up for a battle with creditors the day after it became the largest US city ever to file for bankruptcy, with $18bn (£12bn) of debt.

Creditors fear they will not be paid, Michigan Governor Rick Snyder said, adding the city is "basically broke".

Court papers filed on Thursday night listed 100,000 entities as creditors to the city. But unions have described the bankruptcy filing as a power grab.

Detroit, once a symbol of US industrial power, has faced decades of decline.

It is seeking protection from creditors who include public-sector workers and their pension funds.

Detroit's problems stem from declining industry. Public services are nearing collapse and about 70,000 properties lie abandoned.

Mayor Dave Bing has vowed that public services will keep running and wages for public workers will be paid.

A new start?

Mr Snyder said in a televised statement on Friday morning: "Currently those creditors have a situation where they don't know what they'll get paid, and whether they'll get paid at all."

"The growth of Detroit is critically important for all of us," he said. "Let's Detroit on the path to being a great city again."

"Today is a major step to getting on that path," the governor added.

On Thursday, Michigan state-appointed emergency manager Kevyn Orr asked a federal judge to place the city into bankruptcy protection.

If it is approved, he would be allowed to liquidate city assets to satisfy creditors and pensions.

Detroit - known as Motor City for its once-thriving automobile industry - stopped unsecured-debt payments last month to keep the city running, as Mr Orr negotiated with creditors.

He proposed a deal last month in which creditors would accept 10 cents for every dollar they were owed.

But two pension funds representing retired city workers resisted the plan. Thursday's bankruptcy filing comes days ahead of a hearing that would have tried to stop the city from making such a move.

Mr Orr suggested at the time there was a 50-50 chance of the city needing to file for bankruptcy. He also said the city's long-term debt could be as high as $20bn.

At a press briefing on Thursday, Mr Orr said filing for bankruptcy was the "first step toward restoring the city".

Alongside him, Detroit Mayor Dave Bing said that residents had to make a new start, and assured them the city would stay open despite the filing.

"Paychecks for our city employees will continue. Services will continue," he said.

'Busting the unions'

But Ed McNeil, the lead negotiator for a coalition of 33 unions, told Reuters news agency the move was about "busting the unions".

Governor Rick Snyder announced: "Let me be blunt. Detroit's broke"

"This is not about fixing the city's finances," he said. "It's about the governor and his own agenda to take over the city of Detroit."

In a letter accompanying Thursday's filing, Michigan's Governor Rick Snyder, a Republican, said he had approved the request for Chapter 9 bankruptcy.

"It is clear that the financial emergency in Detroit cannot be successfully addressed outside of such a filing, and it is the only reasonable alternative that is available".

The White House said it was closely monitoring developments in Detroit.

Analysts say there are concerns businesses might ditch their operations in Detroit.

But US car company General Motors said on Thursday it did not expect any impact on its operations.

The city has struggled with its finances for some time, driven by a number of factors, including a steep population loss.

The murder rate is at a 40-year high and only one third of its ambulances were in service in early 2013.

And Detroit's government has been hit by a string of corruption scandals over the years.

Between 2000-10, the number of residents declined by 250,000 as residents moved away.

Detroit is only the latest US city to file for bankruptcy in recent years.

In 2012, three California cities - Stockton, Mammoth Lakes and San Bernardino - took the step.

But Thursday's move in Detroit is significantly larger than any of the earlier filings.

- Published19 July 2013

- Published14 June 2013

- Published19 July 2013