Janet Yellen nomination for Federal Reserve may be rough ride

- Published

- comments

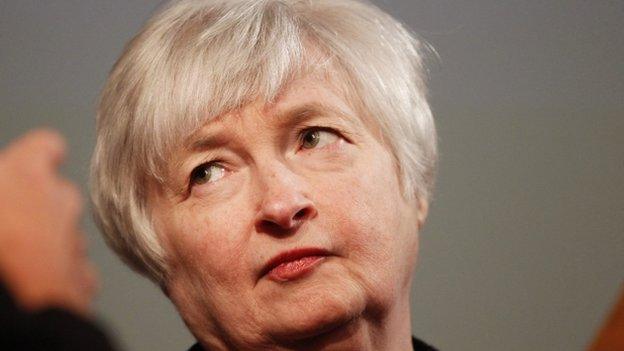

President Obama: "She sounded the alarm early about the housing bubble"

It was perhaps appropriate that President Barack Obama towered over his choice to lead the world's most important central bank.

Janet Yellen has been given a tall order - to keep the American economy on track and not send shudders of fear through the world's economy.

She told the small select audience at the White House that there were too many Americans who couldn't find a job, who worried about paying their bills, and it was the Federal Reserve's job to help.

Her word's on some lips would be a politician's familiar piety. But this was an economist speaking, and one who has declared that people are more than statistics to her.

Speaking with a strong Brooklyn, New York, accent, she declared that more needed to be done to strengthen the recovery, that progress had been made but there was more to do.

That seems like a signal that she is not going to suddenly abandon those measures adopted to cope with a crisis.

'Huge relief'

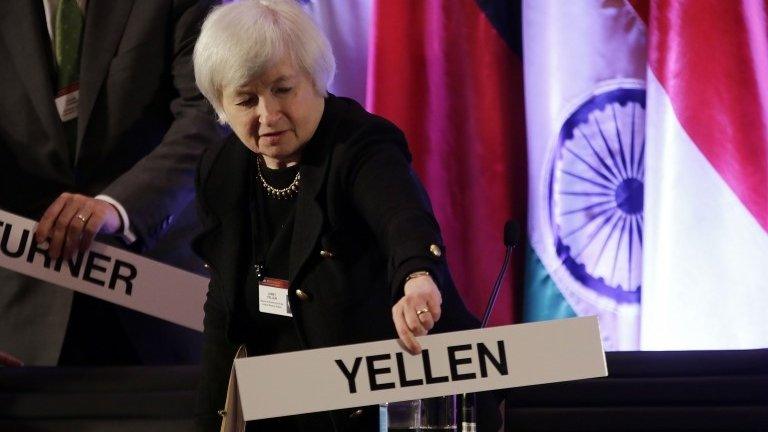

Janet Yellen: "I'm honoured and humbled by the faith that you've placed in me"

When the outgoing chief Ben Bernanke mused earlier this year that the Fed might cut down the amount of money they were pumping into the American economy, the reaction was nervous.

There was huge relief around the globe last month when it didn't happen.

Ms Yellen's words may be taken as some reassurance she's not thinking "mission accomplished". Perhaps I am over interpreting - but she will have to get used to her every word being held up to the light and examined.

Ms Yellen wasn't President Obama's first choice, external, but she's popular in his party. In these hyper-partisan, bad-tempered, scratchy days, that could mean trouble ahead.

She seems a fairly straightforward modern Keynesian, external. The Fed has two main duties. One is to keep an eye on inflation. But unlike many central banks, it also has to worry about unemployment.

During the economic crisis Ms Yellen has pushed for the focus to be on getting more people into work, and that means cheap money and keeping interest rates at rock bottom, external.

And that means not being quite so hawkish about inflation. She was one of those who argued strongly for the inflation target to be 2%., external

Some point out that she hasn't always argued this way: in the 1990s she urged then-Federal Reserve Chair Alan Greenspan to adopt a tighter monetary policy, external.

'A rough ride'

But there is another point that jumps out at me from her CV.

This daughter of a teacher and a doctor has moved smoothly back and forth between public service and academia - without ever joining Wall Street and making big bucks.

That is another thing that endears her to Democrats (and I guess should, in theory, help with the Tea Party as well).

When she was nominated to be the number two at the Fed her Senate hearing went fairly smoothly, getting through 17-6.

One of those voting against, Republican Senate Bob Corker, said she had "dovish" views on inflation.

He says he's likely to do so again, telling CNBC, external: "I am more of an 'eat your vegetables' kind of guy. I'm not a chocolate pie kind of guy and that's where we've been with the Fed for a long, long time."

The markets like her appointment, but she is taking on the most important economic job in the world as the US teeters on the edge of a huge economic crisis, a product purely of its partisan divide.

It seems fairly certain she will get a rough ride up on Capitol Hill.

- Published9 October 2013

- Published9 October 2013

- Published3 February 2014