Will a new foreign property buyer's tax cool Toronto's housing market?

- Published

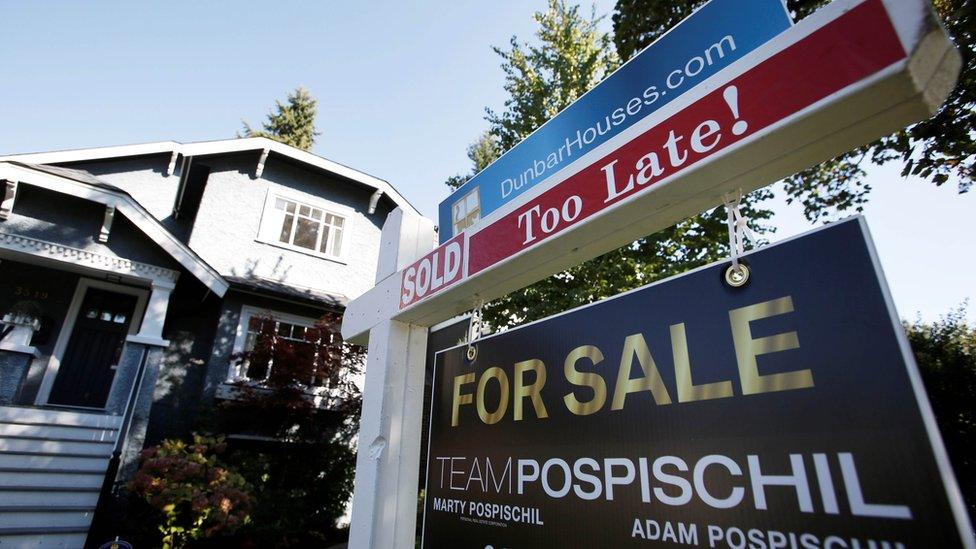

Toronto's housing market is among the hottest in the country

Canada's largest province is implementing a 15% foreign buyer's tax in Southern Ontario.

The provincial announcement comes amid fears that Toronto's red-hot real estate market is fuelled in part by foreign speculation.

British Columbia brought in a similar tax for Vancouver in 2016.

The new measure applies to non-Canadian citizens, non-permanent residents, and corporations buying residential properties containing up to six units.

Premier Kathleen Wynne announced the new speculation tax on Thursday as part of a series of measures to help stabilise the price for property and for rental units in and around Toronto.

She said the tax is aimed at "people looking only for a quick profit, not a place to call home".

The tax, which is effective immediately, is aimed at preventing foreign investors from driving up real estate costs.

It applies to property in the Greater Golden Horseshoe area - one of North America's fastest growing regions, comprised of the Greater Toronto Area and surrounding municipalities.

The average cost of a Toronto home jumped 33.2% over the past year, from an average of $688,000 (US$510,600/£398,000) in March of 2016 to $917,000 (US$680,000/£530,500) in March of 2017.

The average home price in Canada increased 8.2% over the same period.

Home ownership costs are at their highest level as a share of household income since 1990, according to RBC Economics.

Canada's central banker, Stephen Poloz, warned earlier this month that investor speculation is increasingly driving the cost of Toronto home prices.

The foreign buyer's tax in British Columbia appears to have helped bring that skyrocketing market under control.

Housing affordability has eased in metro Vancouver for the first time in over three years, says RBC Economics.

Sydney, Singapore, Switzerland, and Hong Kong have also introduced restrictions on foreign buyers.

Last October, the federal government closed a tax loophole used by foreign homebuyers and announced a more robust mortgage stress test on all new insured mortgages in an effort to cool the real estate markets in Toronto and Vancouver.

- Published2 August 2016

- Published3 October 2016

- Published25 February 2015