Who will the 'retail apocalypse' claim in 2018?

- Published

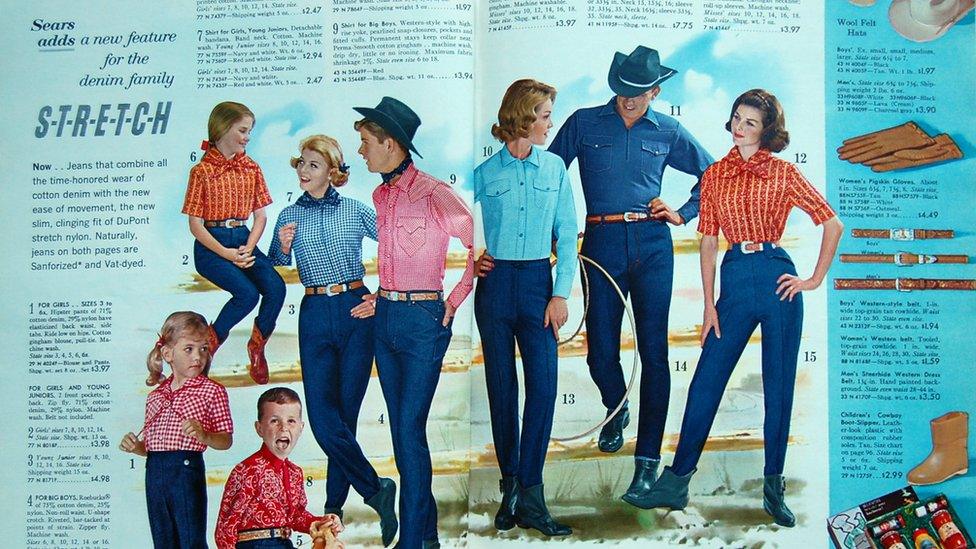

Pages from Sears' 1962 Christmas catalogue

From Sears to Toys R Us, the so-called retail "apocalypse" has claimed some of the holiday season's biggest brands. But the slaughter doesn't end when the ball drops, retail analysts say.

The Reaping

Shopping is changing. While many retailers bank on Christmas sales to boost their yearly revenues, brick-and-mortar shops are finding it harder and harder to keep up with online giants like Amazon.

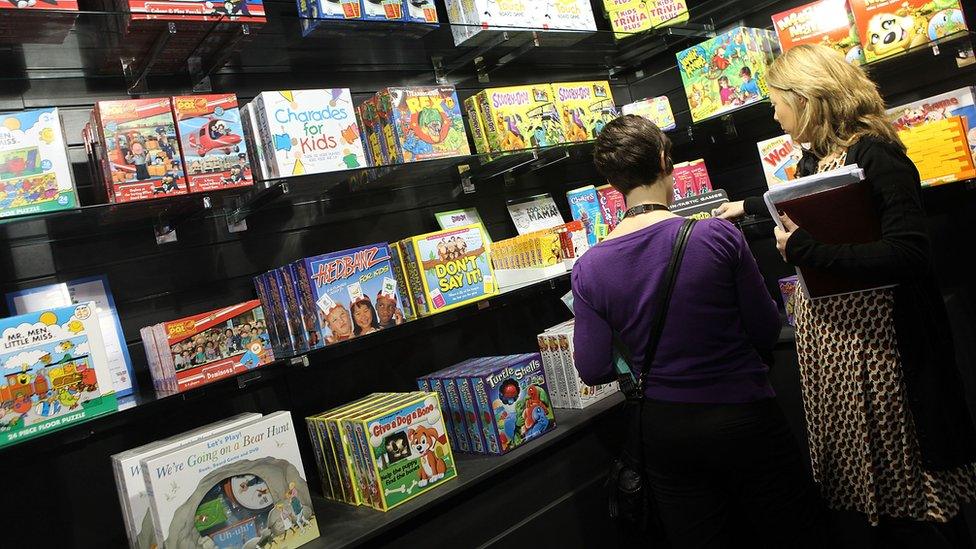

Toys R Us, which filed for bankruptcy protection in the US in September, nearly collapsed in the UK in December.

It brokered a deal in the 11th hour with its creditors, but must still close 26 of its 105 stores in the UK.

Meanwhile in North America, traditional department stores are facing an uphill battle. Stocks in JCPenney have fallen from above $9 (C$11; £7) last December to just above $3.

Hudson's Bay Company, the Canadian retailer which recently bought high-end American department stores Saks Fifth Avenue and Lord and Taylor, has also watched its stock yo-yo and has toyed with the idea of privatisation.

The dire straits have led some media outlets to dub 2017 the year of the "retail apocalypse". But according to retail consultant Patrick Rodmell, that reaping is only beginning.

"It's Darwinian theory, the weak are being culled from the herd," he says.

The Reckoning

If you want to see what a full-blown retail apocalypse looks like, take a look north at Sears Canada, which filed for bankruptcy last June. This autumn, it laid off 12,000 employees across the country.

But the closures did not just affect current employees - more than 13,000 retired employees were shocked to learn that their defined-benefit pension plan had a $212m (C$270m; £158m) shortfall. They have filed a petition to have the plan be first on the list of creditors. Meanwhile, many former employees are preparing themselves for a leaner retirement.

Bruce Winder, a Canadian retail expert, says the collapse of Sears Canada sent "shockwaves" through the industry. Although smaller retailers had gone bankrupt before - notably the once-hip American Apparel - Sears was the first giant to fall.

"You look at Sears (Canada) and you look at Toys R Us… you're starting to see some of these legacy brands bow out now," Winder told the BBC.

Sears Holdings, the US company that runs both Sears department stores and Kmart, has also revealed a $1.6bn shortfall for more than 200,000 employees.

The parent company is seen by many on Wall Street as a shoo-in for bankruptcy in the coming year.

But how did it get here?

It all comes down to experience, experts say.

With online firms making it easy for customers to buy products with the click of the button and receive it in a matter of days, if not hours, brick-and-mortar stores must offer something beyond simple merchandise.

Knowledgeable staff, easy returns and engaging displays are all things stores must deliver if they expect a customer to get off their couch, says Rodmell, who is president of Toronto-based retail consultancy Rodmell & Co.

"When was the last time anybody you heard anybody say 'I can't wait to get to Sears?"

Canada Goose's high-end parkas have seen

The Redemption

Although many businesses will struggle in the new year, others are poised for success.

Walmart continues to see strong sales, and has made significant investments in online delivery, even partnering with Google to offer voice-activated shopping.

Like Walmart, many of 2018's biggest successes will be value-driven stores, or high-end specialty stores like Canada Goose, the parka outfitter that sells winter coats for as much as £900, Winder says.

"Some of the higher end retailers are doing pretty good, and some of the lower end retailers like Dollarama are doing really good, but some of the ones in the middle are suffering."

Businesses that were once overlooked as outdated may make a comeback too, if they can combine a clear branding strategy with a strong online presence.

Canadian bookstore and lifestyle retailer Indigo has gained ground where other competitors - notably Barnes & Noble and Borders - have failed.

Founded in 1996, the company has carefully branched off from just selling books to selling "experiences", says Susan McGibbon, the chief experience officer at retail consultancy 360 Collective.

Their stores now carry everything from gourmet jam to throw blankets, provided by top-notch staff.

"They've got smart business people in the store and they really understand customer experience," she says.

The company has been doing so well on its home turf that it plans on expanding in the US in the new year - a rare move for a Canadian company.

- Published24 October 2017

- Published13 December 2017

- Published27 October 2017

- Published1 December 2017