Canada's Supreme Court rules in favour of national carbon tax

- Published

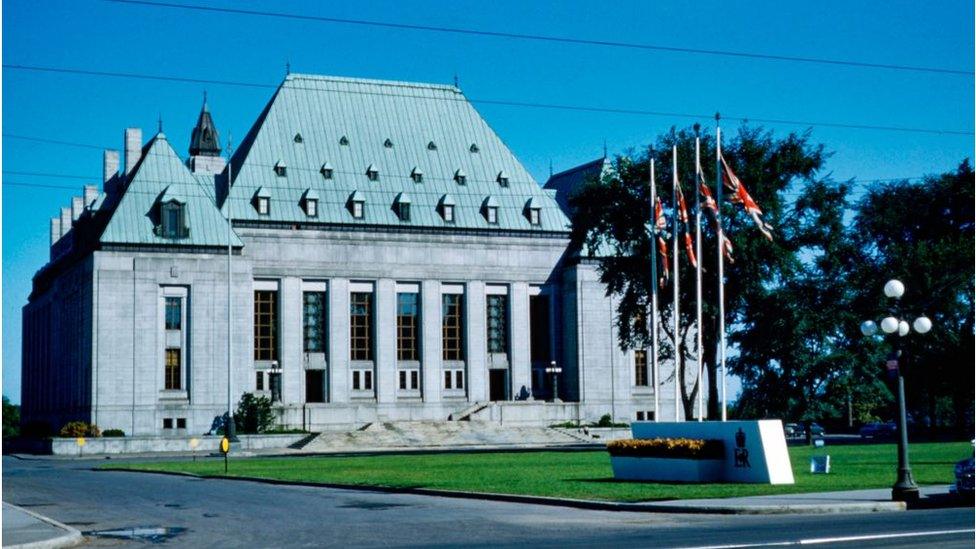

The Supreme Court of Canada

Canada's national carbon tax will remain intact after the country's Supreme Court ruled in favour of its legality.

The federal law sets minimum standards for carbon pricing with the intent to price out emissions over time.

Three provincial governments had pushed back on the plan, arguing Ottawa overstepped its role with the scheme.

The court's decision bolsters the key component in a national effort to curb greenhouse gas emissions.

The tax plan has been the central driving force in Prime Minister Justin Trudeau's goal of achieving net-zero emissions by 2050.

But it was a topic of contention in the last federal election, with conservative opponents arguing it hurts consumers and energy producers.

What is Trudeau's carbon tax?

The 2018 Greenhouse Gas Pricing Act is a national framework for carbon pricing.

It sets minimum pricing standards for provinces to meet.

Provinces were allowed to implement their own plans.

However, the law gives the federal government in Ottawa the power to apply its own carbon tax, known as the "backstop", on those provinces that either fall short of the national standard or have not implemented their own system.

Seven of Canada's 13 provinces and territories currently pay the "backstop" rate.

Its current price sits at C$30 (£17.35) per tonne of carbon dioxide released and will rise sharply to C$170 (£98.38) per tonne by 2030.

The Trudeau government has expressed a desire to exceed its emissions reduction commitments under the Paris climate accords.

What did the Supreme Court say?

The top court in the country ruled in a split decision on Thursday that climate change is a threat to the whole country and demands a coordinated national approach.

"Climate change is real. It is caused by greenhouse gas emissions resulting from human activities, and it poses a grave threat to humanity's future," Chief Justice Richard Wagner wrote, on behalf of the majority.

Six justices agreed, with Mr Wagner writing: "Parliament has jurisdiction to enact this law as a matter of national concern."

Shortly after the ruling, federal Environment Minister Jonathan Wilkinson released a statement hailing it as "a win for the millions of Canadians who believe we must build a prosperous economy that fights climate change".

'A political win for Trudeau'

Analysis by Jessica Murphy, Toronto

This is both a court victory and a political win for Justin Trudeau, whose carbon pricing scheme was contentious from the get-go.

Just over a decade ago, proposing a carbon tax was viewed as political poison for a politician in Canada.

But now, despite legal challenges and political criticism, Trudeau's has prevailed - even if polls indicate it's a mixed bag in terms of its popularity with Canadians.

The carbon pricing scheme - central to his government's efforts to meet its climate goals - has faced fierce criticism from its right-leaning political adversaries.

And it's unlikely this legal success will win over the naysayers.

Ontario's premier, Doug Ford, reacting to recent news of a hike in the carbon price, called it a "burden on the backs of hard-working people". (Costs to consumers are meant to be offset by an annual tax rebate).

And on Thursday, reacting to the ruling, Alberta Premier Jason Kenney was sharply critical of the top court's ruling, saying it will allow Ottawa to "bigfoot" over the provinces.

Kenney said there "are better ways to help the environment than by punishing people for living ordinary lives, for heating their homes and driving to work."

Who opposed it?

Conservative Party leader Erin O'Toole has vowed to repeal the carbon tax on consumers, although he is likely to keep the tax in place for industrial emitters.

"Canada's Conservatives will repeal Justin Trudeau's Carbon Tax. We will protect the environment and fight the reality of climate change, but we won't do it by making the poorest pay more," he said in a statement on Thursday.

Governments in three provinces - Alberta, Ontario and Saskatchewan - argue that the regulation of greenhouse gas emissions should not be dictated by the federal government. They say control over natural resources is a provincial issue.

All three provinces previously challenged the legality of the measure in appeals courts before it ended up at the Supreme Court.

Only Alberta won its lower court challenge. The majority in that case declared the carbon-pricing law to be "a constitutional Trojan horse" that would give the federal government in Ottawa too much regulatory power over the provinces.

Related topics

- Published28 September 2019

- Published11 December 2018

- Published25 June 2020

- Published3 April 2019