What are junk fees and how might Biden tackle them?

- Published

Ticketmaster and SeatGeek will both soon display fees before checkout after a push against so-called "junk fees" by the White House.

President Joe Biden says hidden charges hurt families' budgets and causing significant financial harm.

His administration wants a crackdown on these charges as part of its efforts to promote competition in the US economy.

But even if such fees were scrapped, consumer groups say, firms could simply hike prices to recoup the lost revenue.

What is the latest?

Ticketmaster's parent company Live Nation announced they will start providing upfront prices in September for concerts and events held at venues owned by Live Nation - which is over 200 venues.

For venues not owned by Live Nation, which controls some 70% of the ticketing and live event venues market - it will add the option to view full costs upfront.

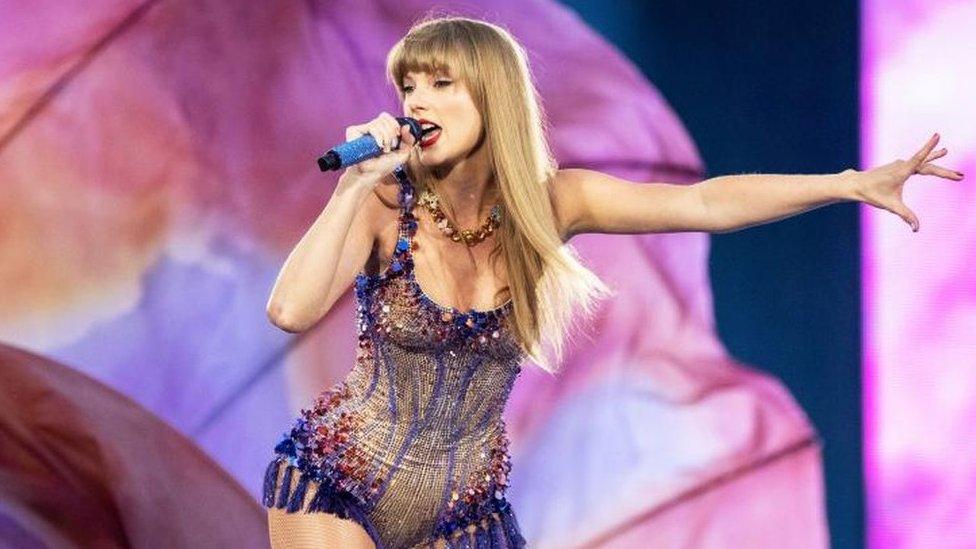

The firm drew the ire of Taylor Swift fans after sales for her upcoming US tour descended into chaos late last year, with high demand for tickets leading to widespread site disruptions and the premature cancellation of sales.

SeatGeek will display true ticket costs at the end of the summer. TickPick already does so.

The moves were announced at a White House ceremony on Thursday, in which Mr Biden said: "These are just the latest private sector leaders who are responding to my call for action.

"I'm asking their competitors to follow suit and adopt an 'all-in' upfront pricing as well."

What are junk fees?

Junk fees are hidden and unexpected charges that are often not included in the initial or listed price of a transaction but are added on at the time of the payment.

The Biden White House claims this practice typically falls into four categories:

"Mandatory fees" that obscure the full price charged by a seller, such as the service fees added to a concert ticket

"Surprise fees" that consumers do not expect, such as the family seating fees charged by airlines

"Predatory fees" that target consumers who are economically vulnerable or locked into a service, such as excessive bank overdraft fees

"Fraudulent fees" that represent an outright misrepresentation by a seller, such as "no fee" bank accounts that make hidden charges in practice

At least 85% of Americans have encountered such fees, according to a 2019 survey by Consumer Reports, and they can drive up costs far beyond what a consumer had expected to pay.

The White House has said these fee schemes disproportionately affect low-income households and people of colour, and harm small and medium-sized businesses.

What is Biden doing about junk fees?

The president is urging Congress to pass a Junk Fees Prevention Act, which would specifically reduce or eliminate four types of junk fees:

Service charges, processing fees and other additional costs tacked on to the online ticket sales for concerts, sporting events and other entertainment

Airline booking fees for family seating

Early termination fees for mobile phone, wireless and cable TV services

Resort fees or destination fees charged at the end of online hotel reservations

"Junk fees may not matter to the very wealthy, but they matter to most other folks," Mr Biden said on Tuesday. "They add up to hundreds of dollars a month.

"I know how unfair it feels when a company overcharges you and gets away with it. Not anymore."

But passage of such legislation looks a longshot in a Congress where control is split between the two main parties.

At least three federal agencies have also taken action over the past two years to reduce junk fees and increase transparency.

That includes the Consumer Financial Protection Bureau, which has ramped up its oversight of surprise overdraft and depositor fees charged by banks. The Center for Responsible Lending has hailed the move as "a big step" in highlighting the harms of charges that "wreak havoc on household budgets".

But there is some disagreement.

"The president's use of the term 'junk fee' is overly broad," said Jim Nussle, president and CEO of the Credit Union National Association, a trade group for the credit union industry.

He argued instead for strengthening bank overdraft protections, which he said are only offered as an opt-in service and act as "a safety net" for low-income and middle-income consumers. US regulators are also targeting junk fees at banks.

"Without the option of overdraft protection - people are more likely to turn to predatory lenders, hurting the same people the administration seeks to help."

Douglas Holtz-Eakin, president of the right-leaning American Action Forum think tank, told the BBC that Mr Biden's "non-serious proposals" are akin to "waving a red flag at the populist public".

He added: "The things they're calling junk fees have been approved by their regulators, who [sic] Biden appointed."

With reporting by Chloe Kim

Related topics

- Published8 February 2023

- Published8 February 2023

- Published8 February 2023