US Supreme Court weighs fate of student loan forgiveness

- Published

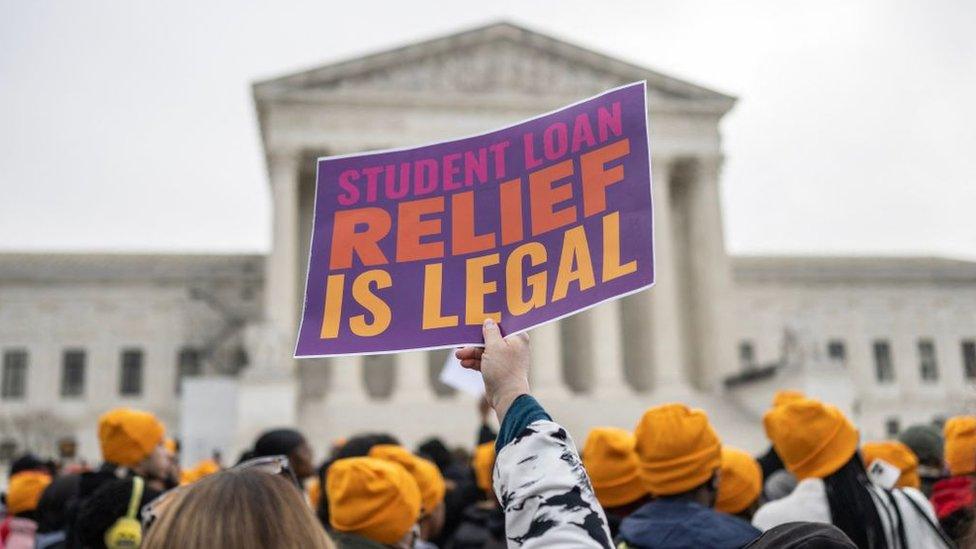

Watch: Students protest about debt outside the Supreme Court

Conservative justices on the US Supreme Court have cast doubt on the legality of a Biden administration proposal to wipe out billions in student debt.

President Joe Biden announced the plan - forgiving up to $10,000 (£8,310) per borrower, and $20,000 in some cases - last year, but lower courts blocked it.

Millions of borrowers are in limbo as the nation's highest court deliberates over a pair of legal challenges.

The decision could impact the loans of more than 40 million Americans.

That includes, according to White House estimates, almost 20 million people who may have their entire student loan balances cancelled.

The Supreme Court, which has a 6-3 conservative majority, will make a final ruling on the cases in June.

The Biden administration argues that, under a 2003 law known as the Higher Education Relief Opportunities for Students Act or Heroes Act, it had the power to "waive or modify" loan provisions to protect borrowers affected by "a war or other military operation or national emergency".

At oral arguments on Tuesday, government lawyers were pushed on that broad interpretation of the law.

"We're talking about half a trillion dollars and 43 million Americans. How does that fit under the normal understanding of modified?" Chief Justice John Roberts asked US Solicitor General Elizabeth Prelogar.

Mrs Prelogar replied that, in the given context, "modify" could entail making broad changes to protect borrowers. She added that the administration was not seeking to assert regulatory authority but to implement a benefits programme.

Without the plan in place, "defaults and delinquencies will surge", she said.

The twin cases on the court docket hinge on whether challengers to the loan forgiveness plan can demonstrate they would be harmed by the programme. If so, they would have the legal right to sue and prevent the plan from being implemented in its current form.

The first case is a challenge from six Republican-led states, including Missouri.

Plaintiffs in the first suit argue that Missouri's federal loan servicer - the Missouri Higher Education Loan Authority (Mohela) - will suffer financially as it would no longer receive millions of dollars in fees for loans forgiven by the programme.

Justice Elena Kagan questioned why the suit wasn't brought by Mohela and was instead brought by the states.

The second lawsuit involves two student loan borrowers, Myra Brown and Alexander Taylor. Ms Brown did not qualify for forgiveness, while Mr Taylor did not qualify for the $20,000 maximum.

Hundreds of activists rallied outside the Supreme Court ahead of oral arguments on Tuesday

Conservative justices focused on whether it was appropriate for some Americans to receive debt relief but not others, with Justice Samuel Alito asking: "Why is it fair? Why was it fair to the people who didn't get arguably comparable relief?"

But the court's liberal justices pushed back. Justice Sonia Sotomayor noted that "different people got different benefits because they qualified under different programs", while Biden appointee Ketanji Brown Jackson claimed "the same fairness issue would arise with respect to any federal benefit programs".

Student loan repayments were initially paused under the Trump administration in 2020 because of the coronavirus pandemic.

Mr Biden kept that pause in place until he decided, in August, to eliminate more than $400bn in debt - up to $10,000 each for those earning less than $125,000, and up to $20,000 for students on need-based Pell Grants.

The White House estimates that nearly 90% of the country's student borrowers will qualify for relief under its plan, and about 26 million people have already applied for forgiveness. But relief is on hold as legal challenges to the plan make their way through the courts.

Ahead of the hearing, hundreds of activists braved the cold and rain to participate in rallies outside the Supreme Court in Washington DC on Monday and Tuesday.

They were joined by some of the Democratic Party's most outspoken figures on student debt. Congresswoman Ayanna Pressley said opponents of loan forgiveness were "disconnected from the hardship of everyday folks" while Senator Elizabeth Warren warned "an extremist court" may take away the opportunity "to build more secure futures".

When do student loan repayments resume?

The White House has not indicated what it will do if justices strike down its proposal. Mr Biden said Monday he is "confident the legal authority to carry out that plan is there. I promise you: I have your back".

If the court strikes down the plan, it will likely force the administration back to the drawing board so they can try again with an amended proposal, which could take months. And even if the court sides with the government, more legal challenges may yet be filed.

That means the clock is ticking for many borrowers. Loan repayments are on pause while the country's pandemic emergency measures remain in effect, but if challenges to the debt relief plan are not resolved by the end of June, payments will resume 60 days later.

- Published28 February 2023

- Published4 November 2022