Guo Wengui: US accuses Chinese tycoon of billion-dollar fraud

- Published

US authorities have charged a Chinese property tycoon based in New York with orchestrating a billion-dollar fraud.

Guo Wengui and one of his business partners, Kin Ming Je, are accused of wire fraud, securities fraud, bank fraud and money laundering.

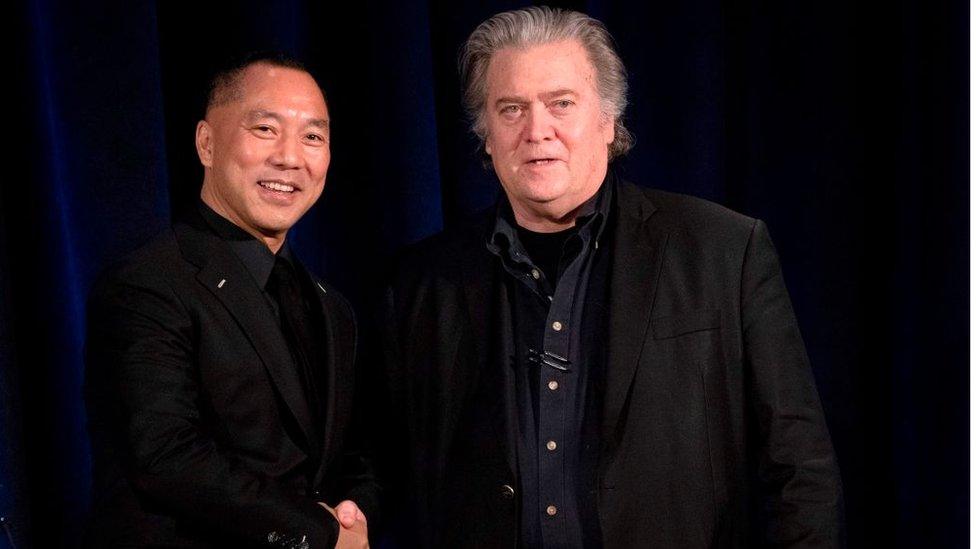

Mr Guo is a critic of the Chinese government and an associate of ex-White House chief strategist Stephen Bannon.

A fire broke out at Mr Guo's Manhattan penthouse apartment hours after he was arrested.

A spokesman for the city's fire department said the fire was put out, no injuries were reported and the cause is still under investigation.

In an online post earlier, Mr Guo said he was handcuffed and interrogated for more than an hour.

He later pleaded not guilty in a Manhattan federal court on Wednesday and was ordered to be detained without bail.

Mr Guo goes by several aliases including Miles Guo, Miles Kwok and "Brother Seven". He was named in the indictment unsealed Wednesday as Ho Wan Kwok.

The indictment alleges that Mr Guo and Mr Je raised $1bn (£830m) from thousands of online followers who thought they were funding media businesses and an exclusive membership club.

They also allegedly used a cryptocurrency called Himalaya Coin to steal millions from investors.

Mr Guo's opposition to the Chinese Communist Party and his links to high-profile, right-wing US politicians and activists earned him hundreds of thousands of online followers, most of them Chinese people living in Western countries.

Prosecutors say he took advantage of his prolific online presence to raise money for his ventures. But instead of being invested in businesses, the funds were allegedly funnelled into personal accounts tied to Mr Guo and Mr Je.

Among other things, the money was spent on a 50,000 sq ft (4,345 sq m) mansion in New Jersey, Lamborghini, Bugatti and Ferrari sports cars, and nearly $1m worth of Chinese and Persian rugs.

Prosecutors say $100 million was put into a high-risk hedge fund and other money was spent on luxury goods including a $140,000 piano, a $62,000 television and a $53,000 fireplace log cradle holder.

Prosecutors say the funds were used to buy this custom-built Bugatti sports car, worth approximately $4.4 million

$2.3 million was spent on maintenance of this 145-foot luxury yacht

Guo Wengui owns the penthouse apartment of a building on Manhattan's Upper East Side

Starting in September last year, the US government seized approximately $634m of the proceeds from 21 different bank accounts.

The indictment alleges that Mr Guo built his following among opponents of the Chinese Communist Party by founding two non-profit organisations.

Who is Guo Wengui?

Mr Guo was a real-estate developer who reportedly became one of China's richest men before leaving the country in 2014.

In 2017, he claimed political asylum in the United States, alleging persecution by Communist Party authorities.

Mr Guo has been the target of social media campaigns backing the Chinese government, but has also been accused of spreading false rumours about Covid and other subjects on his social media accounts and websites.

His outspoken opposition to China's rulers inspired several ventures with Mr Bannon. They have appeared frequently together in online videos, and in 2020, they launched a campaign called the New Federal State of China, with the goal of overthrowing the Chinese Communist Party.

Later that year, Mr Bannon was arrested while on Mr Guo's yacht in Connecticut. Mr Bannon was charged in an unrelated case with fraud in an alleged scheme to defraud people who funded a not-for-profit company to build a wall on the US-Mexico border.

He has pleaded not guilty in that case, and was not named in the indictment against Mr Guo and Mr Je.

Mr Guo and Mr Bannon pictured together in 2018

Last year, Mr Guo's GTV Media Group agreed to pay $539m to the Securities and Exchange Commission, the US financial regulator, to settle a lawsuit alleging the company had misled investors in a cryptocurrency investment scheme. The company did not admit wrongdoing in the case.

Mr Je, who also goes by the name William Je, was named in the indictment as Mr Guo's financier. He is a dual citizen of Britain and Hong Kong, lives in London, and is still at large, authorities said.

He is listed by UK Companies House as the director of two financial services companies headquartered in west London: ACA Capital and Hamilton Investment Management.

Among the funds seized by US authorities were bank accounts linked to Hamilton and to Gettr, an alt-tech social media platform funded in part by Mr Guo.

The BBC has contacted the companies.

In a statement, one of Mr Guo's foundations called the allegations against him "fabricated and unwarranted" and accused the US justice system of being controlled by the Chinese Communist Party, without providing evidence.

Related topics

- Published7 September 2017

- Published28 May 2020