Tax affairs: Public or private?

- Published

Mary Cameron's £200,000 gift to the prime minister has come under the spotlight

Revelations about Prime Minister David Cameron's financial affairs have spurred protests on the streets and other politicians to make public their income details, but how much should private individuals have to declare?

Labour leader Jeremy Corbyn is due to publish his tax returns, and Scottish National Party leader Nicola Sturgeon has published hers.

Meanwhile, UKIP's Nigel Farage has rejected calls for greater openness over personal tax matters.

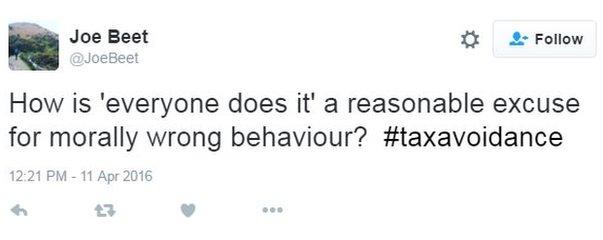

Unsurprisingly, there are mixed opinions on whether to declare and how much.

Share and declare

Paul Brazier emails the BBC: "Transparency of tax for all in elected office."

When it comes to Mr Cameron's wealth, Raymond Harris writes: "Five hundred thousand pounds is a figure most working people won't see in their lifetime, so I think he should not be hiding it off shore. He should be paying tax on it."

Valtid Caushi says: "Pay your tax. It is our unborn children who they are robbing, not the current generation."

Wendy Wright emails: "As in Sweden, everyone's tax returns should be public property. This would help to prevent a wide range of financial wrongdoing and help to ensure that everyone paid the proper amount of tax. All current loopholes to avoid tax should be closed immediately."

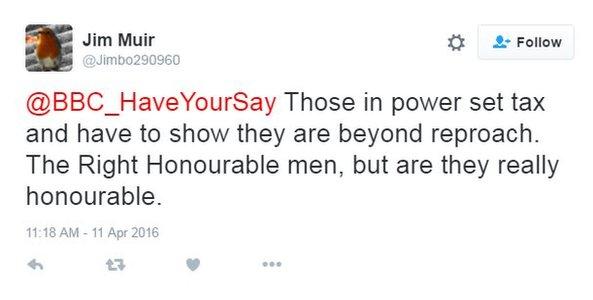

Jim Muir (not the BBC correspondent) tweets:

Private and personal

David Snelson, in Petersfield, says: "This trend towards all senior politicians publishing tax returns is worrying. We don't pay them that much money, and we now want to delve into all aspects of their personal affairs. Who can we expect to want to lead us in the future. Would Churchill have wanted to be prime minister in such circumstances? Be careful what you wish for!"

Stephen Nichols calls this political point-scoring, with Mr Cameron doing nothing illegal, "nothing anybody with a good financial adviser wouldn't be doing". "If there are loopholes, then change the laws," he adds.

Philip, in Glasgow, says tax returns should be kept private for everyone, adding: "The urgent need is not sorting out offshore tax jurisdictions, but sorting out the tax credits mess."

DSPG is not interested in leaders publishing tax returns, adding: "These should be a private matter, although possibly routinely examined by some central body such as the Register of Interests. I wouldn't want my neighbour to know how much bank interest I get every year (and thus an indication of my assets) especially as I don't flaunt a Bentley on the drive and a Rolex on my wrist."

Kath Stevens says she doesn't know what all the fuss is about, adding: "Just about every university vice-chancellor in the UK has a salary of over £200,000 a year, some are getting over £400,000, let alone barristers, chief executives of large councils, probably health authorities, probably senior civil servants, some of you BBC people and senior management in large companies, and don't get me started about the ludicrous amounts bankers are still pocketing. Time everyone got a grip on current reality."

Gary Aiken takes it further: "This is just a witch-hunt," he says. "Salary has always been a private matter."

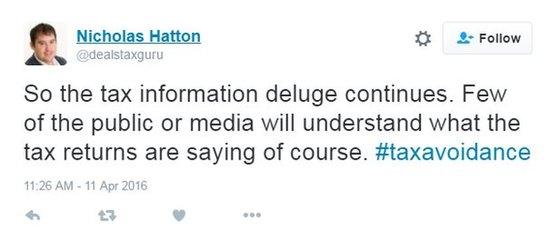

And finally, how clear is all of this?

Compiled by Sherie Ryder