Osborne, Corbyn and Johnson all publish latest tax records

- Published

Chancellor George Osborne and Labour leader Jeremy Corbyn have become the latest senior British politicians to publish details of their tax returns.

Mr Osborne, external paid £72,210 in tax in 2014-15 on £198,738 in earnings, comprising his official salary, rental income and share dividends from his family firm.

The Labour leader paid £18,912 in tax on his MP's salary and declared £1,850 of other taxable income.

It came as David Cameron defended the right to "make money lawfully".

Facing MPs for the first time since the row over his family's tax affairs, the prime minister said "artificially reducing tax" should not be confused with legitimate enterprise and wealth creation schemes.

The series of personal disclosures - which also included an updated tax statement , externalfrom Mayor of London Boris Johnson - came after Downing Street said "potential prime ministers" and chancellors should be expected to publish their tax returns in future.

Speaking in the Commons, Mr Corbyn suggested the government was "incapable of taking global action against tax dodging", claiming there was "was one rule for the rich and one for the rest".

Labour's Jeremy Corbyn on tax: "People want justice"

Chancellor George Osborne: ''This is an unprecedented degree of transparency''

But Mr Cameron questioned how long it had taken for the leader of the opposition to publish his own tax return, external.

The Labour leader had to ask Revenue and Customs for a copy amid reports he did not keep one of his own.

In his statement, Mr Cameron - who published a summary of his tax returns on Sunday, external - addressed what he said were "deeply hurtful and profoundly untrue" allegations about his late father's offshore investment fund.

He said the fund, in which the PM owned shares which he sold for a £19,000 profit in 2010 after paying tax, was perfectly legitimate.

He said a number of public sector organisations, including trade unions and the BBC, had similar investment arrangements, describing them as a "standard practice and not designed to avoid tax".

"It is right to tighten the law and change the culture around investment to further outlaw tax evasion and to discourage aggressive tax avoidance," he said.

"But as we do so, we should differentiate between schemes designed to artificially reduce tax and those that are encouraging investment. This is a government - and this should be a country - that believes in aspiration and wealth creation."

He told MPs that he had decided to sell the shares in 2010, before he became PM, to avoid any perception of a conflict of interest.

'National scandal'

Mr Cameron told MPs that he had released an "unprecedented" amount of information about his own tax affairs and believed the leader of the opposition, chancellor and shadow chancellor should also follow suit as they either ran or aspired to run the nation's finances.

But he said that he did not believe MPs should be compelled to routinely publish similar information as the principle of confidentiality in tax information should be maintained.

Labour MP Dennis Skinner ordered out of Commons chamber after 'dodgy Dave' comment

Sir Alan Duncan: Cameron's critics "hate anyone with hint of wealth"

Confirming he would continue to publish his tax return on an annual basis. Mr Osborne said: "This is an unprecedented degree of transparency from a government that has done more than any other to tackle tax evasion."

Responding for Labour in the House of Commons, Mr Corbyn said the prime minister had failed to give a "full account of his involvement in tax havens until this week or take essential action to clean up the system".

"The UK is at the heart of the global tax avoidance industry," he said. "It is a national scandal and it has to stop".

Mr Cameron defended the UK's record on fighting tax evasion saying the government had agreed with all Crown Dependencies and Overseas Territories - except Guernsey and Anguilla - on giving the UK authorities access to their national registers setting out the beneficial ownership of companies listed there.

He also announced plans for a new law making firms criminally liable if their employees fail to prevent the facilitation of tax evasion.

Conservative MP Jacob Rees-Mogg says all MPs should have to publish their tax returns

This would lower the threshold of responsibility for companies whose employees may have advised clients to take actions which would evade - as opposed to avoid - paying tax.

Mr Cameron was backed by Conservative MPs but amid heated exchanges in the Commons, veteran Labour MP Dennis Skinner was suspended from the Chamber for the day after referring to the prime minister as "dodgy Dave" and refusing to withdraw the remark.

Public mood

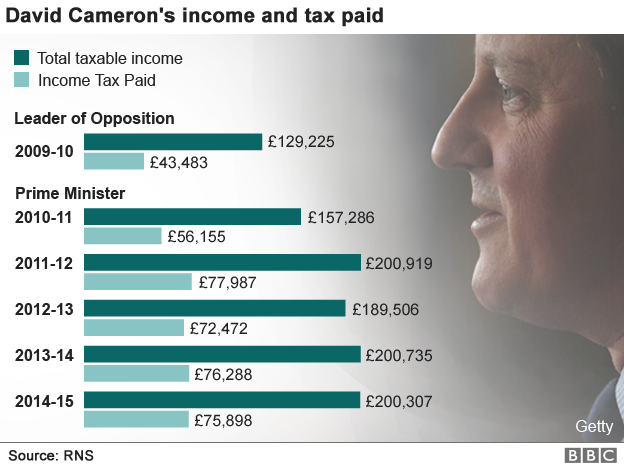

The prime minister released a summary of earnings and tax going back six years after being accused by Labour of misleading the public over money he had invested in his father Ian Cameron's company, Blairmore Holdings.

Labour is continuing to press him to publish his full tax returns dating back to before he became prime minister and are questioning why the original investment was not disclosed in the register of MPs' interests.

Labour has announced a 10-point plan to "clean out" tax havens - including forcing MPs to disclose any offshore holdings.

Nigel Farage has broken ranks by rejecting calls for greater openness over personal tax matters

Boris Johnson released figures showing he has paid more than £1m in tax in the past four years on his earnings from publishing and journalism, as well as his mayoral salary.

Mr Johnson paid £276,505 alone in 2014-15 on a taxable income of £612,583.

Conservative MP Jacob Rees-Mogg has said he expects all MPs to be publishing their tax returns within two years, reflecting changes in the "public mood" over tax transparency and the need, as he put it, for "Caesar's wife to be above suspicion".

But Conservative MP Charles Walker told the BBC's Daily Politics there was "a new culture of bullying" in the UK and warned of a situation where public figures could end up having to release a stream of personal information, such as medical records.

And UKIP leader Nigel Farage said he wouldn't be divulging any details since most people regarded tax as a private matter.

"Neighbours would hate the thought that the people at Number 32 knew what their income was," he told BBC Radio 4's Westminster Hour.

"I'm worried where we are going with this. If we want to have party leaders publish their tax returns then presumably all MPs must do so, presumably then all councillors must do so, bishops of course must do so, generals must do so, newspapers… BBC presenters must do so."

How transparent do you think tax affairs should be, and how much should remain private? You can share your comments by emailing haveyoursay@bbc.co.uk, external.

Please include a contact number if you are willing to speak to a BBC journalist. You can also contact us in the following ways:

WhatsApp: +44 7525 900971

Send pictures/video to yourpics@bbc.co.uk, external

Tweet: @BBC_HaveYourSay, external

Send an SMS or MMS to +44 7624 800 100