How Rishi Sunak's Spring Statement will affect you

- Published

- comments

Everyone across the UK is facing the sharpest rise in their cost of living for decades.

Chancellor Rishi Sunak's Spring Statement is primarily an update on the current state, and future expectations, of the nation's finances.

But he also announced some big, new policies that will affect our personal budgets in the coming months and years.

Bringing together expected changes in earnings, reforms to taxes, and the recently announced energy measures, a middle earner on £27,500 per year can expect to be about £360 worse off this year than they were last, according to economists at the Institute for Fiscal Studies.

Price rises will accelerate

Many of the necessities we buy - notably food, fuel and energy - have been rising in price. On Wednesday, official figures revealed that the cost of a whole host of goods and services, from furniture to toys, have also been increasing sharply.

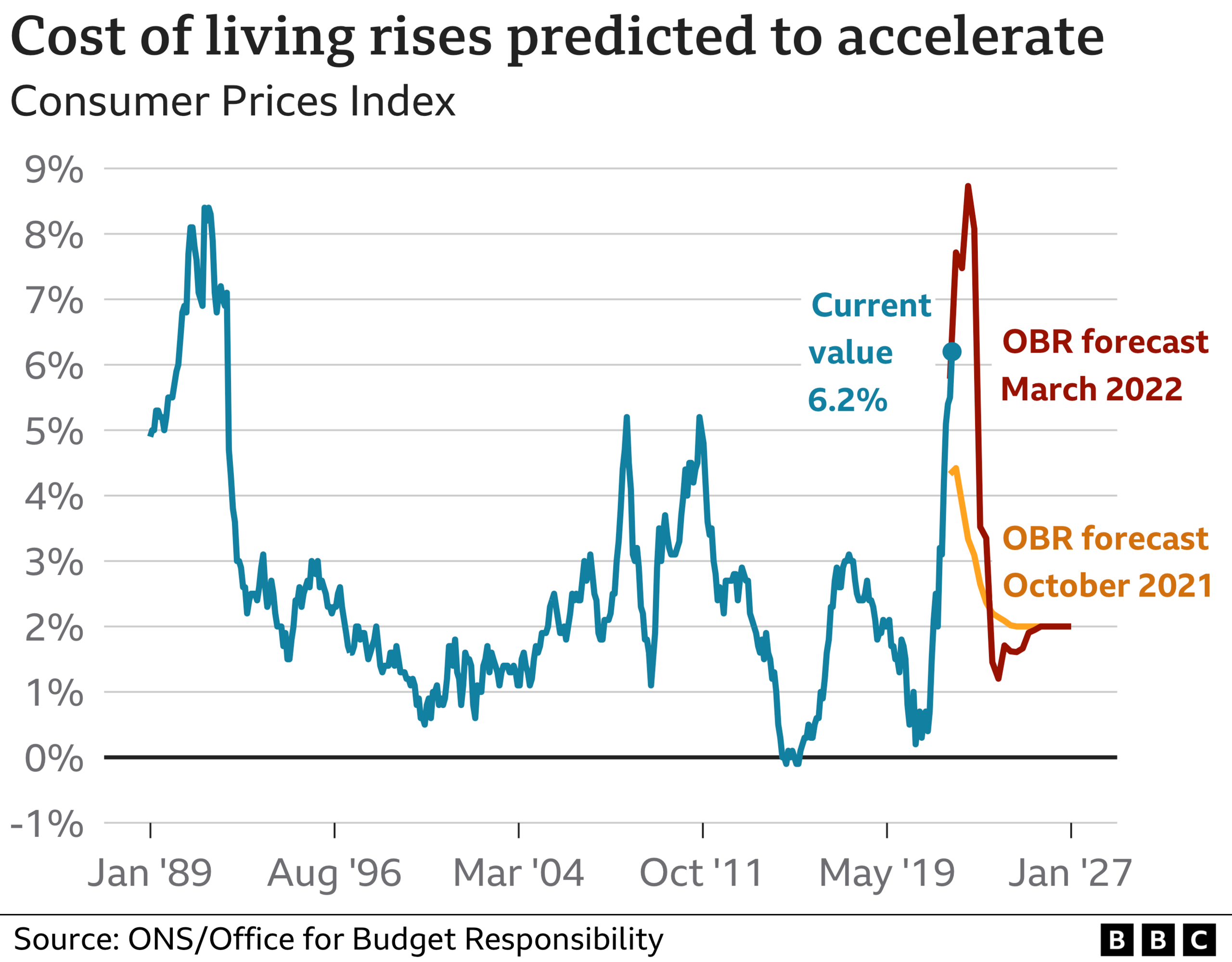

The Office for National Statistics (ONS) said prices rose by 6.2% in the 12 months to February - the fastest for 30 years.

The chancellor's Spring Statement confirmed that consumers should be braced for things getting more expensive at a faster rate later in the year.

Official forecasts, from the Office for Budget Responsibility, suggest inflation (which charts the rising cost of living) will average 7.4% this year, peaking at around 9% at the end of the year.

The big question for anyone with a job is whether their pay will rise in line with prices. We already knew that the minimum pay rate for those aged 23 and above - the National Living Wage - will go up by 6.6%, as the hourly rate increases from £8.91 to £9.50.

Inflation-matching wage rises in themselves could create a problem for the economy as a whole, by creating an inflationary spiral. It remains highly unlikely that employers will put up wages by that much when facing their own cost pressures, particularly their firm's energy bills.

Tax promises back on the agenda

In September, the government announced that employees will pay 1.25p more in the pound from their pay packet in National Insurance contributions from this April.

In a significant move, he has now said that the earnings threshold at which people start to pay National Insurance will rise.

At present, most workers start paying National Insurance contributions when their income hits £9,568. They pay 12% of earnings between £9,568 and £50,270, then 2% on any earnings above £50,270.

Now the chancellor has said, from July, National Insurance will be paid on income over £12,570 a year - the same level as income tax starts being paid.

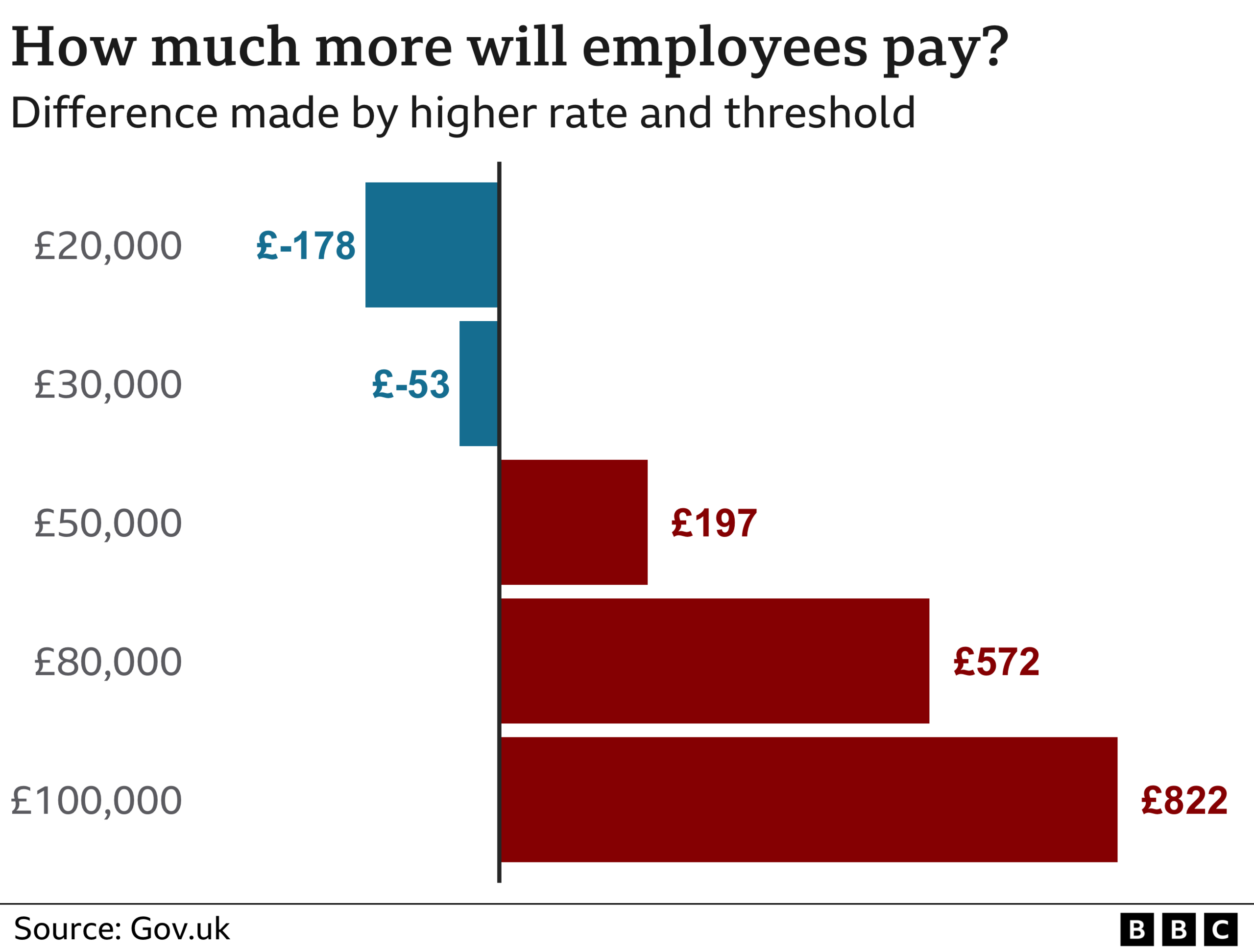

In practice, the two measures will mean that anyone earning less than about £35,000 a year will pay less National Insurance during the year. That is about 70% of all workers. Those who earn more will see a tax rise, albeit smaller than they would have expected.

For an employee earning £20,000 a year, it means an annual National Insurance cut of £180 in 2022-23, instead of an £89 rise expected before the announcement, according to accountancy firm Deloitte

For a £40,000 earner, it means a rise of £70, instead of a previously expected £339 rise

For a £60,000 earner, it means a £320 rise, instead of a previously expected £589 rise

Self-employed people, who pay at a different rate, will see slightly less of a benefit from the chancellor's decision.

Over time, this threshold is frozen, which will steadily mean more low-earners will have to pay.

Early last year Mr Sunak said the thresholds at which income tax is paid would be frozen at April 2021 levels for five years (although Scotland has different levels). That means pay rises will push more people into higher tax bands.

At the end of his speech, he pledged to reduce the basic rate of income tax by 1p in the pound before the end of the Parliament in 2024.

Some help on energy bills

Millions of households are facing a £693 (54%) rise in the cost of a typical annual gas and electricity bill, to about £2,000, when the regulator's new, higher price cap takes effect on 1 April.

The latest analysis from Cornwall Insight suggests there will be a further £541 a year (27%) rise in October, before falling back. The OBR has predicted a £850 rise in October.

Mr Sunak said he had already taken "decisive action", in helping people with their bills. This includes a £150 council tax rebate for 80% of households, followed by a £200 discount on bills in October which will need to be repaid, and an expansion to a support scheme for vulnerable people.

In a longer-term move, he said that VAT would be cut from 5% to 0% on energy efficiency products such as solar panels, insulation and heat pumps.

Fuel duty cut for motorists

Prices to fill up the car with fuel were rising before the war in Ukraine - and the fallout from Russia's invasion has made things worse.

The average price of petrol has risen by more than 40p per litre since last year's Spring Statement.

The chancellor announced a 5p a litre reduction in fuel duty for the next year, which takes some of the sting out of rising prices,

The RAC motoring organisation said that move would knock £3.30 off the cost of filling a typical 55 litre family car.

Benefits and pensions

Benefits and the state pension are rising by 3.1% in April, well below the rising cost of living. This prompted many charities to call on the chancellor to go further.

Mr Sunak did not agree, saying nothing new about benefit and pension levels.

However, if inflation does reach the levels predicted by the OBR. then benefits and the state pension could see a significant rise in April 2023 - as the increases are usually linked to the inflation rate in the preceding autumn.

Local councils will be given another £500m in the Household Support Fund, which supports vulnerable people with payments and grants such as vouchers to help pay their bills.

- Published6 November 2022

- Published23 March 2022

- Published23 March 2022

- Published23 March 2022

- Published3 February 2022