People face biggest drop in living standards since 1956

- Published

- comments

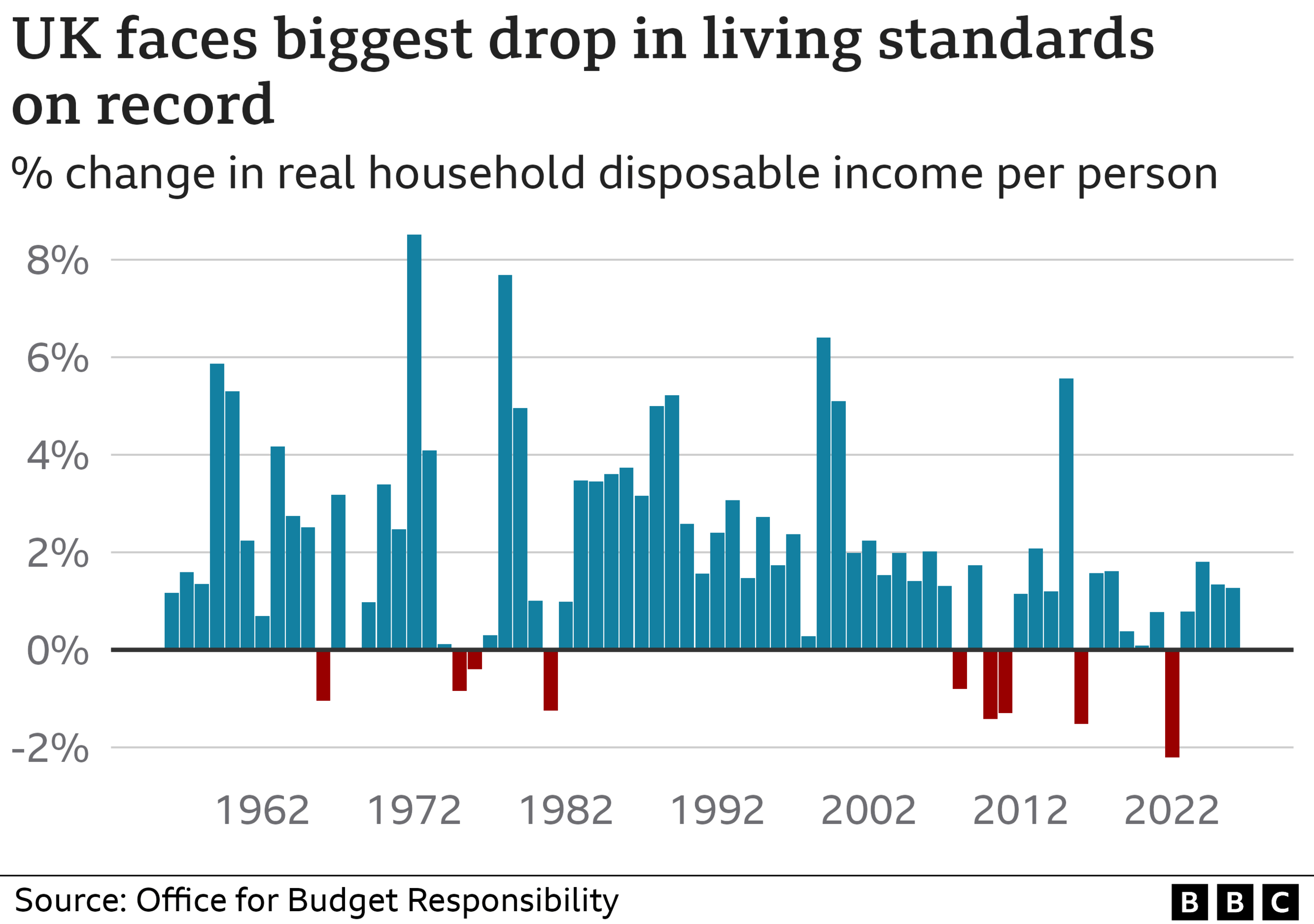

The UK is facing its biggest drop in living standards on record as wages fail to keep pace with rising prices.

Soaring energy prices could push inflation to a 40-year high of 8.7% in the final three months of 2022, the government forecaster said.

Rising prices and tax hikes mean living standards will not recover to their pre-pandemic level until 2024-25, the Office for Budget Responsibility said.

The chancellor said government would "stand by" people hit by higher prices.

Living standards - disposable household incomes when adjusted for inflation - are expected to drop by 2.2% this year, the OBR said.

That would be their largest fall in a financial year since records began in 1956.

In the Spring Statement, Rishi Sunak said a 5p a litre fuel duty cut would take effect at 18:00 GMT, and he raised the threshold at which workers start paying National Insurance from £9,600 to £12,570.

But the OBR, which publishes its economic forecasts twice a year, said Russia's invasion of Ukraine had "major repercussions for the global economy, whose recovery from the worst of the pandemic was already being buffeted by Omicron, supply bottlenecks, and rising inflation".

The jump in oil and gas prices brought about by the conflict would "weigh heavily on a UK economy that has only just recovered its pre-pandemic level", it added.

Petrol prices had already risen by 20% since the OBR's previous forecast, and household energy bills are set to increase by 54% in April.

If wholesale energy prices remained as high as expected, then energy bills would rise by another 40% in October to take the bill for a typical household to £2,801 a year.

The energy regulator Ofgem has already said bills will increase 54% to £1,971 for a typical household from April.

With prices rising at such a rapid rate, wages would not keep up and and people would spend less, according to the OBR.

As a result, it has dramatically slashed its growth forecast.

In October prior to Russia's invasion of Ukraine it expected the UK economy to grow 6% this year. Now it expects growth of just 3.8% this year.

The chancellor promised to "stand by" families - but some of those families may feel more like he's put his arms around them - only to pick their pockets.

Much of their increased burden isn't the government's fault, reflecting global energy and food costs and supply issues. Come April the average household has to find nearly £1000 extra per year - just to afford the same stuff they did a year ago.

And that's without counting the National Insurance increases, which are still going ahead.

In total, the extra government help announced since October, according to the Office for Budget Responsibility will only compensate for a third of the prospective blow to living standards in the next 12 months.

And it's not just household's fortunes that are at stake but the entire recovery - upon which the chancellor has pinned his hopes of rebuilding the public purse.

The following year will also see slower growth than the OBR predicted five months ago. In 2023, the UK is expected to grow 1.8%, down from 2.1%.

However, from 2024 growth is expected to accelerate faster than expected, rising 2.1% that year and 1.8% in 2025, up from 1.6% and 1.3% respectively.

GDP or Gross Domestic Product is one of the most important ways of showing how well, or badly, an economy is doing.

It's a measure - or an attempt to measure - all the activity of companies, governments and individuals in an economy.

Stevie and Pauline

Stevie Hall in Halifax says rising food, fuel and energy bills have nudged her into debt already.

She told the BBC she had been batch cooking to save money and is only driving when there is a real need.

"We're just trying to get by, I'm trying to stay upbeat about it," she said.

GDP allows businesses to judge when to expand and hire more people, and for government to work out how much to tax and spend.

The OBR said the cut in living standards would have been worse without government support for households, including today's temporary 5p cut in fuel duty; the increase in the National Insurance contributions threshold; and a £9bn energy bill rebate scheme announced in February.

"Taking account of both energy and non-energy pressures on household incomes, the policy measures announced since October offset a third of the overall fall in living standards that would otherwise have occurred in the coming 12 months," it said in its report.

But Institute for Fiscal Studies director Paul Johnson said: "Perhaps what really stands out today is what was missing.

"In the face of what the OBR calls the biggest hit to household finances since comparable records began in 1956-57, [Mr Sunak] has done nothing more for those dependent on benefits, the very poorest, besides a small amount of extra cash for local authorities to dispense at their discretion.

"Their benefits will rise by just 3.1% for the coming financial year. Their cost of living could well rise by 10%."

- Published22 March 2022

- Published17 March 2022

- Published25 January 2022

- Published23 March 2022

- Published27 October 2021