Seven ideas to combat high energy costs

- Published

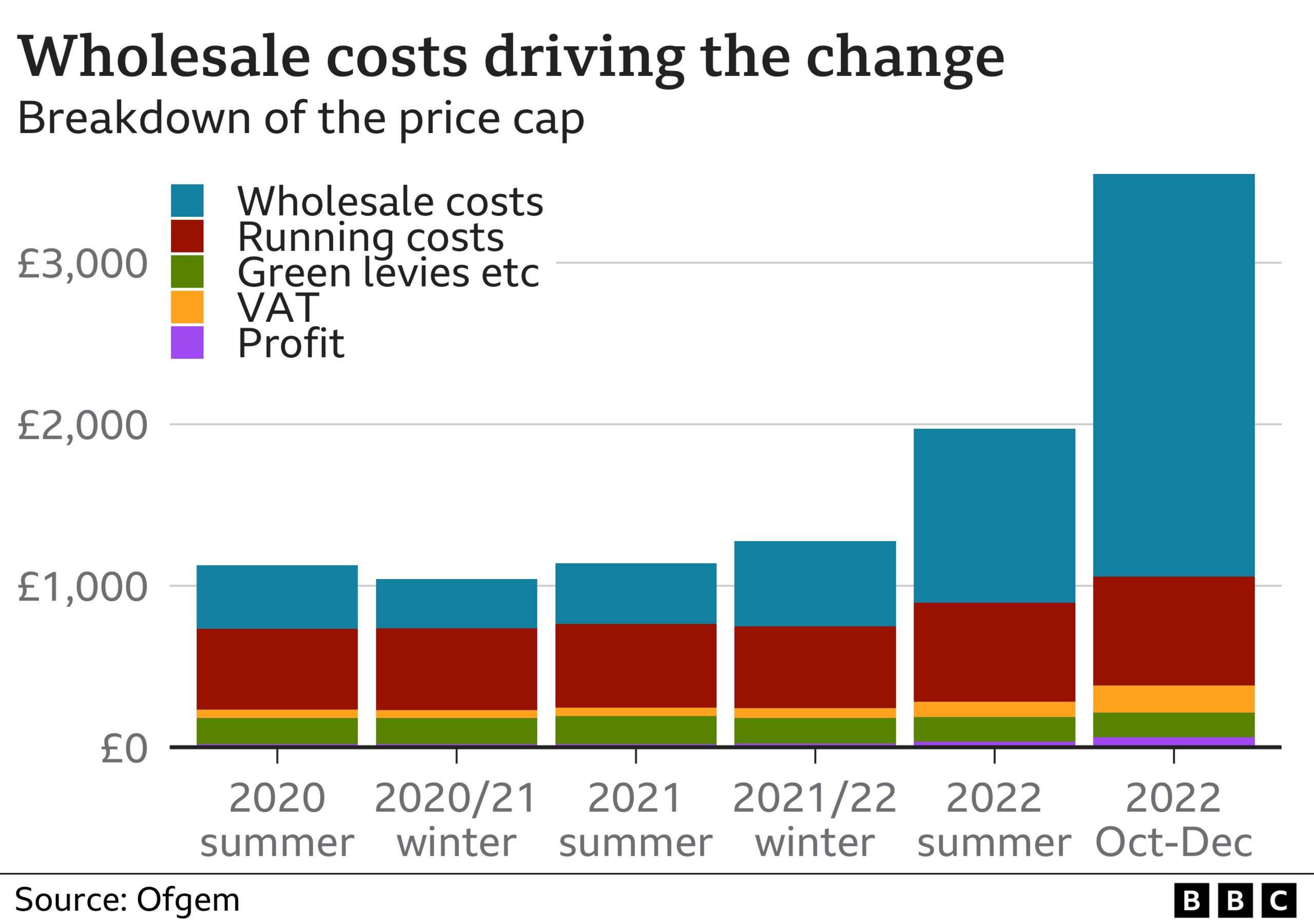

Energy bills are rocketing and the price cap will go up on 1 October, meaning a typical British household will pay £3,549 a year on gas and electricity.

The government has announced some support but there are calls for more to be done. So, what ideas are being proposed to help domestic customers?

An energy cap freeze

Freezing energy bills means maintaining the current price cap in England, Scotland and Wales. This is the maximum amount households pay for each unit of energy and is due to rise by 80% on 1 October.

A £100bn plan to freeze household bills was proposed by energy companies last month. Under the proposal, bills would be subsidised and the current price cap of £1,971 for a typical family would be maintained for two years. Energy companies would access government-backed loans to fund the scheme but customers would ultimately pay for it.

Assuming wholesale gas prices had fallen by the end of the two-year freeze, customers wouldn't get all of the benefit. They would be required to pay a premium on their future bills, so that the money that paid for the freeze could be repaid - possibly over the next 20 or so years.

Liz Truss, the favourite to become the next PM, is reported to be considering a price freeze and is expected to formally outline steps to help with bills soon. If any freeze was introduced it could apply to all households or target the most vulnerable ones only.

Labour and the Liberal Democrats have proposed a similar scheme. However, unlike the the energy companies' plan, Labour would raise the windfall tax to help pay for it. This means customers wouldn't have to pay the money back over future years. However, rather than two years, Labour's freeze would apply for six months - between October 2022 and April 2023.

A bigger windfall tax

Energy producers are getting much more money for their oil and gas than they were last year, partly because demand has increased as the world emerges from the pandemic, but more recently because of supply concerns due to Russia's invasion of Ukraine.

Shell reported worldwide profits of £9.4bn between April and June this year while BP made £6.9bn, more than triple the amount it made in the same period last year.

In May, the government introduced a 25% windfall tax on energy companies' oil and gas profits made in the UK. It is time-limited and is expected to raise £5bn in 12 months.

Labour and the Liberal Democrats want a bigger windfall tax (with a 30% rate) and would apply it to profits made before May.

They both want to scrap October's energy cap rise and would use the extra tax revenue to help cover the cost.

Capping energy profits

Ofgem, the UK's energy regulator, caps the profits of energy retailers at 1.9% but this doesn't apply to the companies that extract oil and gas in the North Sea.

They have seen their revenues jump by selling these fossil fuels at the higher prices dictated by the global energy market.

Dale Vince, the owner of energy retailer Ecotricity, has called for the 1.9% cap to be extended to the profits oil and gas extractors make in the North Sea.

He claims this would save households £1,000 a year by bringing down wholesale prices and avoid the need for a windfall tax. Mr Vince told the BBC: "It's illogical to cap the retail profits and not the wholesale profits."

He says the idea would cost the government nothing. But critics think by taking away much of their profits it would deter investment by these firms.

Taking over energy companies

Former Labour prime minister Gordon Brown wants the energy market reformed, external so it is "dictated more by what people can afford than the current wholesale gas price in the marketplace".

He says the government should negotiate with the energy companies to keep prices down and if they can't meet these requirements then it should "as a last resort, operate their essential services from the public sector until the crisis is over".

During the 2008 financial crisis, Mr Brown's government temporarily took failing banks into public ownership to save them from collapse. The government still owns 48.1% of RBS 14 years later.

The Green Party have proposed the permanent nationalisation of the big five UK energy suppliers. They say this would cost £2.85bn and would allow them to return the price cap to where it was last autumn and keep it at that level for a year. They estimate this would cost £37bn.

France is in the process of fully nationalising the energy provider, EDF. It already owns most of the company and has forced it to limit a rise in electricity prices to just 4% for French consumers.

Sell clean energy at a discount

In 2020, more than 43% of the UK's electricity came from renewable sources, external (including wind and solar).

The cost of generating electricity from renewable sources has tumbled in recent years so why isn't this being reflected in electricity bills?

It's because the UK also relies on burning gas to generate electricity and wholesale gas prices are used to set all electricity prices.

Some experts, external are calling for electricity from green sources to be "decoupled" from this in order to give consumers lower prices at some times of the year.

Academics at the UK Energy Research Centre estimate that households could save between £70 to £300 a year.

But all this would involve reforming the energy market and some experts believe that the UK lacks the storage capacity for green electricity to make it worthwhile during the winter.

Store more gas

EU member states have spent the summer filling up their gas storage facilities, which are now 80% full.

The UK has 37.75 Terawatt hours of (TWh) of capacity, according to official figures. That's much less than Germany, Italy and France.

The UK had a large facility at Rough, off the coast of Yorkshire, which provided about 70% of gas storage.

But it was mothballed in 2017, when the government refused to help Centrica pay for maintenance work to extend its life. It argued that spending money on the site would undermine investment in other projects and risk making the market dependent on public money.

The government is now trying to get it reopened.

At full capacity, Rough can store up to 41 TWhs of gas - between 10 and 12 days' worth of the UK's needs. Industry experts say it might be able to hold up to six days' worth by this winter.

Centrica claim that had it been open last winter, Rough would have saved households about £100 on their energy bills.

Use less gas

The EU has agreed to cut gas consumption by 15% between now and March 2023. The target is voluntary but in the event of Russia cutting off gas supplies to the bloc, the EU could declare an emergency and make it mandatory.

Germany is dimming street lights, turning off fountains and turning down thermostats in public buildings.

But in the UK, so far, there's been no government campaign to encourage people to use less energy. There are obviously lots of households who use relatively little to keep warm and who could not cut down in cold weather, but there are others who could turn down the thermostat.

While much of the conversation has been about using either government money or gas and oil company profits to keep bills down, some critics of those approaches argue that only reducing demand can push prices down in the long term.

More energy efficient buildings would also reduce demand but the government has been criticised for not doing more to encourage the installation of insulation in homes and businesses.

In the Conservative leadership campaign there has been plenty of discussion about whether universal help for all domestic energy customers or targeting help at poorer households is better.

Whoever becomes prime minister next week - either Liz Truss or Rishi Sunak - faces a big decision.

Correction 2 December 2024: This piece was corrected to remove a chart sourced to Gas Infrastructure Europe that did not fully reflect the situation with gas storage at the time. We have also amended the piece to reflect that government data on gas storage capacity for the relevant period gave a figure of 24TWH.

Clarification 27 August: An earlier version of this article reported the UK’s gas storage capacity in September 2022 without including the country’s liquified natural gas capacity. According to National Gas Transmission, at the time the UK had 13.75 TWh of LNG storage taking the total to 37.75 TWh.

Related topics

- Published22 October 2024

- Published22 September 2022