Tax change will be the 'death of the family farm'

Farmer Bernard Llewellyn worries farms will be bought up by English companies, instead of young Welsh families

- Published

Changes to inheritance tax will be "the death of the family farm", farmers have warned.

The UK government has announced it will introduce a tax of 20% on inherited farming assets above £1m.

But Aled Jones, president of NFU Cymru, said there was "no doubt" the move would leave many farmers without "means, confidence nor the incentive to invest in the future of their business".

Meanwhile the deputy first minister of Wales said more work was needed to fully understand the impact of the changes.

Opposition scaremongering on farm tax changes - FM

- Published5 November 2024

Most farmers won't pay inheritance tax, PM insists

- Published6 November 2024

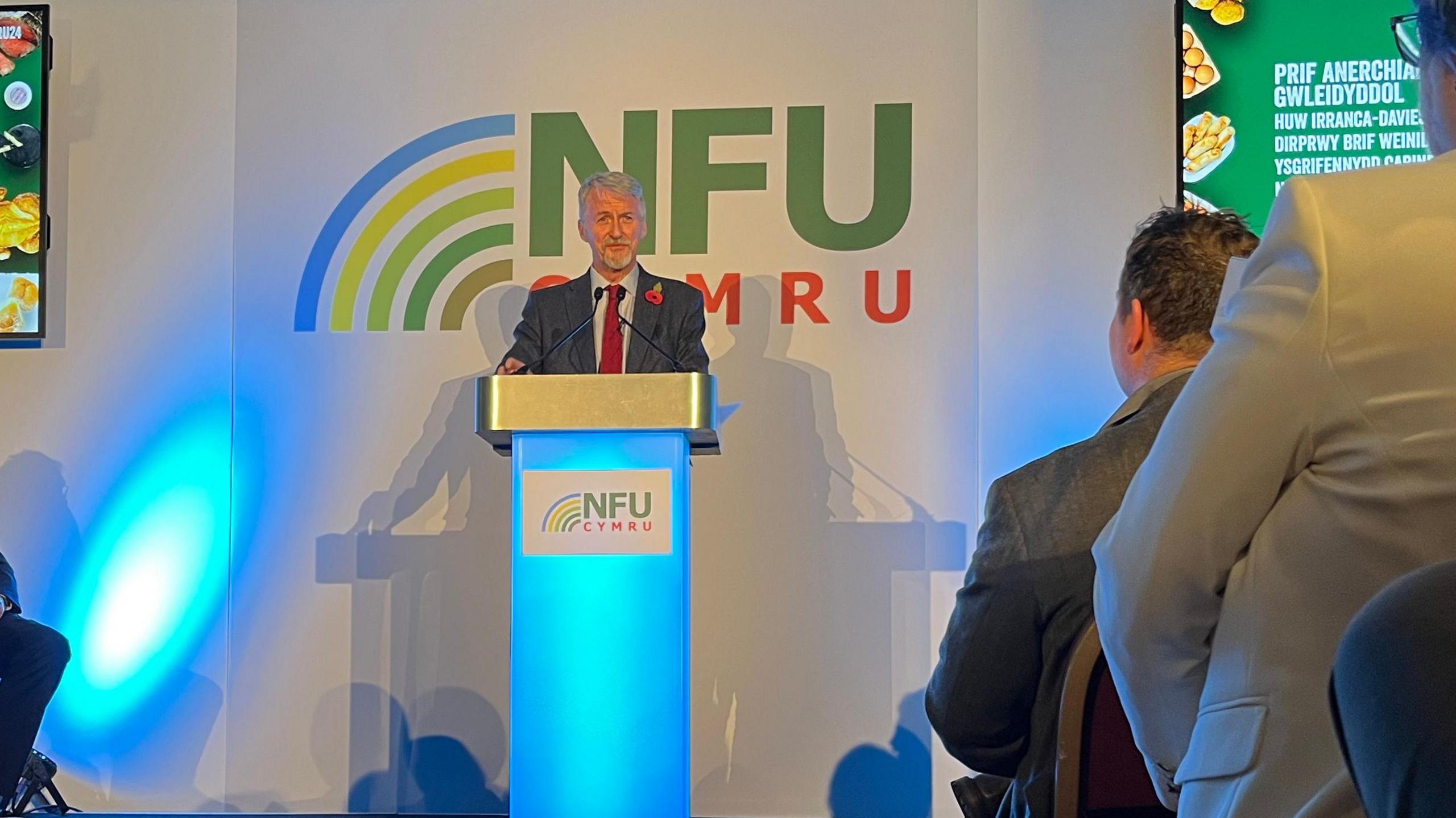

Huw Irranca-Davies, who is also rural affairs secretary, said he wanted to "get away from the noise and understand the granular detail" of what had been proposed by Chancellor Rachel Reeves.

He was facing questions from farmers at the NFU Cymru conference in Llandrindod Wells.

"What does this actually mean for family farms in Wales, bringing in new entrants, succession planning and so on – all of those areas need a bit more work," he said.

Since it was introduced in 1984, agricultural property relief (APR), has allowed land used for crops or rearing animals - as well as farm buildings, cottages and houses - to be exempt from inheritance tax.

But the UK government has now announced the 20% rate, to apply from April 2026.

Huw Irranca-Davies answered questions from farmers at the NFU Cymru conference

Ms Reeves said, in some cases - where other inheritance tax allowances also apply - the APR threshold could in practice be about £3m, meaning she was only targeting the wealthiest landowners.

But farming unions in Wales dispute this, claiming many smaller family farms will be affected by the changes.

Mr Jones said: "The changes announced are not only a threat to our family farm structure and our tenanted sector but also to our nation’s food security."

Bernard Llewellyn, a farmer in Carmarthenshire, said another effect of the change could be that land sold to pay tax was "taken up by companies from the other side of the border" to plant trees and "mitigate their carbon".

This would be in place of "the land being used by a young farming family to produce food which is desperately needed in this country", he said.

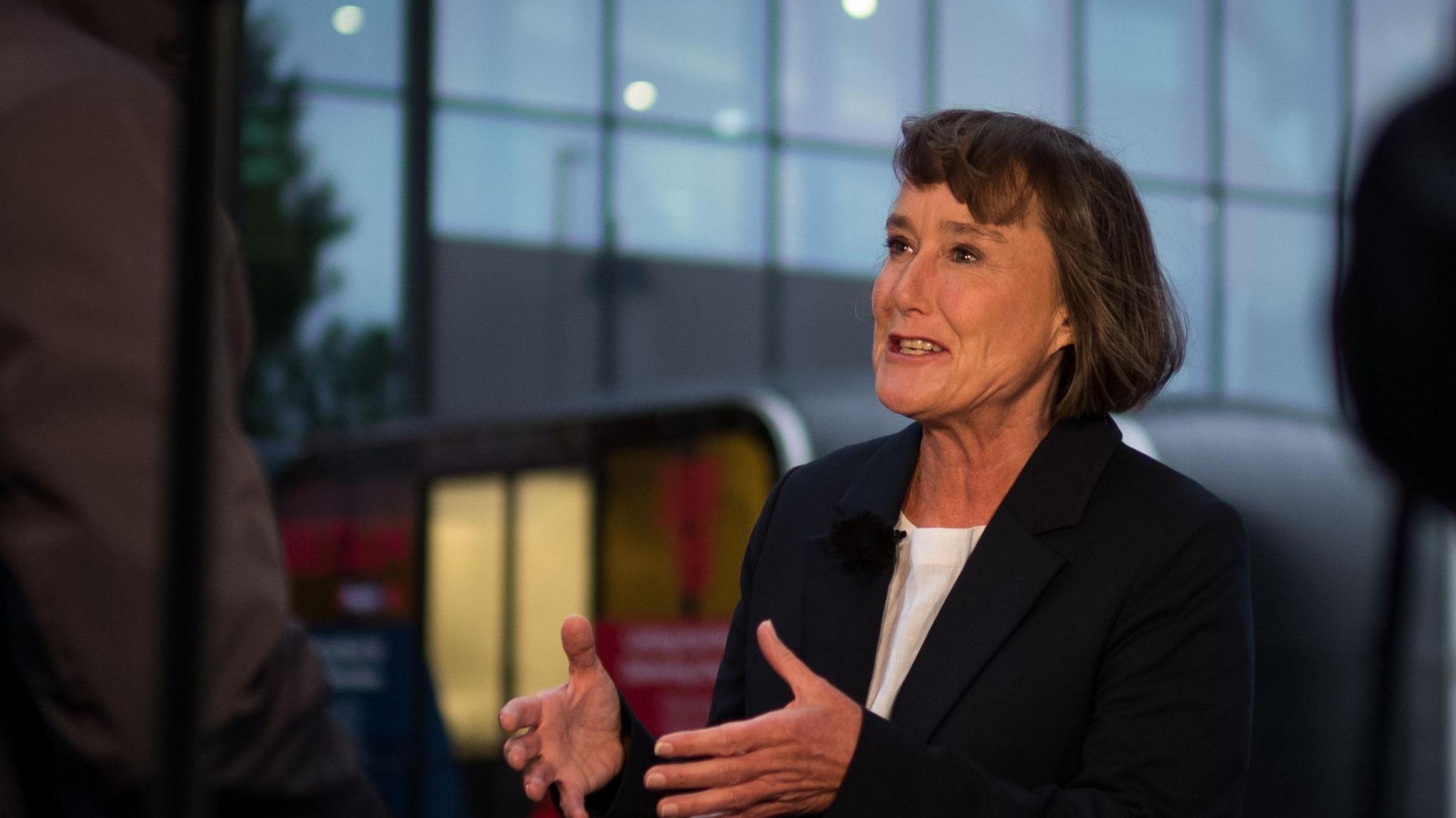

Kate Miles, manager of farming mental health charity DPJ Foundation said the organisation was being contacted by farmers deeply worried by the situation.

"We’re seeing this level of fear, of worry and of outrage across the country… a really powerful maelstrom of emotions that has a serious adverse impact on mental health," she said.

Kate Miles, of mental health charity DPJ Foundation, says there's "fear, worry and outrage" among farmers

Mr Irranca-Davies defended the chancellor for having to make "unenviable choices" to fill a "£22bn black hole in the public finances".

"Every farming family here will also rely on the NHS, on bringing down waiting times, on transport improvements – and that’s all part of the budget decisions too," he said.

But he added that anything that "might jeopardise" the "trajectory towards a sustainable future for Welsh farming" was concerning.

"The treasury case has been made very clearly and their assessment of the impact is that it will be marginal… the unions are putting forward a very different case."

"I know there’ll be ongoing discussions."

Related topics

- Published3 November 2024

- Published31 October 2024