Northern Rock group seeks 'stolen' shares redress

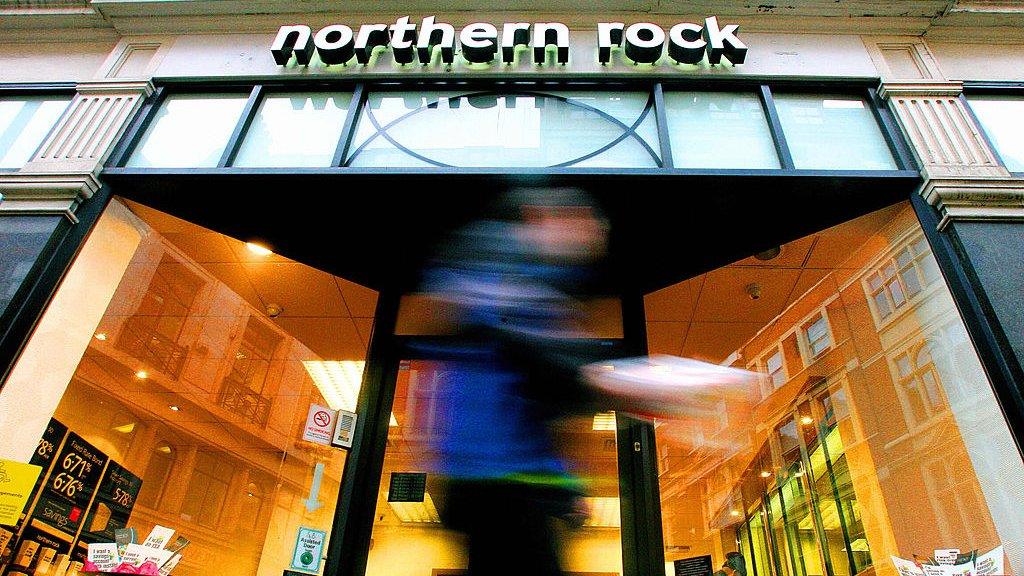

Customers lined up to withdraw their money from Northern Rock in York in 2007

- Published

Former Northern Rock shareholders have launched a fresh bid for compensation from the government for shares they claim were "effectively stolen".

The Northern Rock Shareholder Action Group (NRSAG) wants "fair compensation" for shares that were valued at zero when the bank was nationalised in 2008.

The group has asked the Treasury Select Committee to determine how much the government made from selling the bank's assets and for the money to be redistributed.

The Treasury has been approached for comment.

Northern Rock was a casualty of the sub-prime mortgage crisis of 2007.

Rather than using customer deposits as the source of funds to lend to homeowners, the Newcastle-headquartered bank borrowed in the international money markets.

When the sub-prime crisis hit America, those markets took fright and stopped lending to anything that looked like it might be over-exposed to the housing market - massively affecting Northern Rock.

These problems led to a run on the bank and it was nationalised in February 2008.

'Weren't given a choice'

Shareholders received no compensation from the Treasury when their shares were taken from them, according to NRSAG co-chair Peter Camponi.

He said the group's appeal was being made after all loans to the taxpayer had been paid in full.

Mr Camponi added the government has now made a profit from the sale of the bank's assets and this "surplus" cash should be given back to shareholders.

"Effectively our shares were stolen," he said.

"We didn't have a say in the matter. We weren't given a choice. It just happened overnight.

"That is not what has happened to any of the other banks that actually needed financial assistance."

In its letter to the Treasury Select Committee, the group said this is an "opportunity to right a grave wrong".

Peter Camponi is a co-chair of the Northern Rock Shareholder Action Group

Mr Camponi said many of the bank's 150,000 small shareholders were working class people who were awarded shares when they took out financial products such as mortgages.

He also said the charity sector in north-east England could benefit from this redistribution of money.

The Northern Rock Foundation, a charity set up by the bank, owned about 15% of the shares, he said, but ceased operating a few years ago.

Mr Camponi hopes compensation received from the Treasury would also be distributed to causes in the region.

Follow BBC North East on X (formerly Twitter), external, Facebook, external and Instagram, external. Send your story ideas to northeastandcumbria@bbc.co.uk.

More stories from BBC North East and Cumbria

- Published12 September 2017

- Published22 April 2014

- Published28 February 2012