Mystery surrounds 11,000 tax bills sent to flat

Dylan Davies said it was "horrendous" when 11,000 tax bills arrived at his Cardiff flat

At a glance

A Cardiff flat owner received 11,000 tax bills for Chinese businesses

HMRC says how this happened remains a "mystery" but investigations continue

It apologised for its delayed response and said it does not believe it to be a case of fraud

The chief executive assured MPs that preventative measures were being considered and urged people to continue to reach out with issues

- Published

Tax bosses investigating how a man received thousands of tax bills for Chinese companies have branded the situation a "mystery".

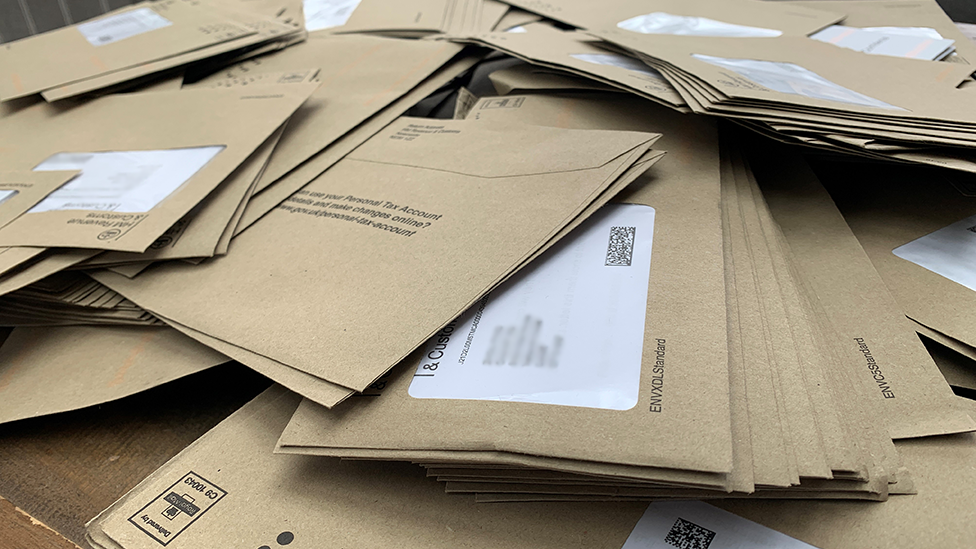

Dylan Davies got bills for 11,000 Chinese companies after they used his Cardiff address to register for VAT.

He described the experience as “horrendous” after receiving hundreds of brown envelopes through his door each week.

HM Revenue and Customs (HMRC) has apologised for its delayed response, after a committee of MPs quizzed bosses.

Ben Lake, Plaid Cymru MP for Ceredigion, asked why so many overseas businesses would want to register at a Cardiff address.

"That is a mystery," said HMRC chief executive Jim Harra.

"We are aware of a serviced office address that is quite a similar address to your constituent but is not the same address so that may not be the correct explanation."

He added it was a "very odd incident" and he did not feel "we've really got to the bottom yet of why it happened".

Mr Harra said he was "confident" no widespread fraud had been perpetrated against HMRC, but could not rule it out.

"If this was an attempt at fraud it would be very unusual for fraudsters to use an address that is not under their control,” he said.

However, he acknowledged the incident had caused distress and inconvenience.

"We have been looking at how we can tighten up our procedures to prevent people being impacted,” he said.

The law changed in January 2021, meaning online marketplaces such as Amazon or eBay must collect VAT from overseas traders and pay it to HMRC.

But if a company has a UK address for VAT, that it does not have to provide proof of, it is responsible for the payment.

Plaid Cymru MP Ben Lake says Mr Davies is still receiving "dozens more" letters.

Mr Harra admitted collecting debts from overseas businesses could be a "challenge".

He said that more than 2,000 of the overseas firms incorrectly registered to Mr Davies’ flat owed a debt.

"In the case of these businesses, until we have resolved this addresses issue we now have no address with which to correspond with them about their debts," he added.

He said HMRC was looking at how its powers to collect debts from overseas businesses might need to be strengthened and modernised.

Mr Lake said he was "very concerned" about the systems in place and asked for reassurance Mr Davies would not receive any action against him.

He said his Mr Davies was continuing to receive "dozens more" letters.

Mr Harra said a flag had been put on the address to prevent more letters being sent.

"Whilst we have put additional processes in place to try and prevent this from happening, I suspect they will not be perfect," he said.

He added that he was grateful Mr Davies had contacted HMRC.

"I apologise that we then didn't act promptly on that contact, but I would encourage anyone who does receive contact for a business that they have no association with to get in touch with us."

Related topics

- Published23 March 2023

- Published30 January 2023

- Published16 November 2022