Council tax could rise for 470,000 homes in Wales

The last time council tax in Wales was revalued was in 2003, and property prices have increased significantly since then

At a glance

Homes are being revalued for the first time in 20 years

Council tax could increase for more than 470,000 of the most expensive homes in Wales

But it could reduce for around 800,000 households

The Welsh government had intended to introduce the changes in April 2025 - but it may now be later

- Published

Council tax bills could increase for more than 470,000 of the most expensive homes in Wales under new proposals.

Some 800,000 could see cuts in changes that may be implemented as early as April 2025.

Homes are being revalued for the first time in 20 years and new property bands could be created in an attempt to make the tax fairer.

A Welsh council group expressed cost of living concerns and called for help for those facing big changes.

Welsh council tax revaluation goes ahead

- Published2 May 2023

Don't rush into council tax changes, warn councils

- Published1 December 2022

Should house extensions trigger larger tax bills?

- Published12 July 2022

Welsh ministers had intended to introduce the changes next year, but a consultation launched on Tuesday said they could be phased in more slowly.

Welsh Conservatives accused Labour of wanting to hike council tax for "hard working people".

Established in the early 1990s, council tax has long been criticised for being unfair because it is based on property prices - not on people's ability to pay.

The Labour Welsh government and Plaid Cymru - who have a co-operation deal in the Welsh Parliament - have been looking at ways to try to address that.

It will see a revaluation of properties, which have increased significantly since the last exercise in 2003.

There are three options being looked at. In two of these, seven out of 10 homes in lower value property bands would see their council tax bills fall or stay the same.

Estimates from experts at the Institute for Fiscal Studies (IFS) suggest that about 470,000 would see higher bills.

But between 786,000 and 803,000 could see their bills fall.

The options include a system with new tax bands for homes worth more than £1.2m, and a new band for the lowest priced homes.

That would see the most radical changes, with those in lower bands paying less and those in higher paying more.

But one of the options could see things change for fewer people.

Homes would still be revalued, however. 300,000 could see bills rise and a similar figure see bills fall.

The Welsh government has said it has no preference. Ministers want feedback through its consultation, external before deciding what to do.

It is too early to say by how much bills would change. A system of discounts and reductions would reduce the hike for a lot of people.

About half of bill payers currently get a discount of some kind.

The Welsh government says it is trying to share the burden more evenly, not raise more in taxation to spend on services.

How does council tax work now?

The amount of council tax you pay depends on the value of your home, based on prices from 2003.

Homes are graded into bands from A to I.

Those in band A, which are valued at less than £44,000 on 2003 prices, pay the least council tax, while homes in band I - valued at more than £424,000 - pay the most.

There are more homes in band C in Wales (valued from £65,001 - £91,000) than any other band, with residents on average paying £1,538 a year in council tax.

How could council tax in Wales change?

The Welsh government has set out three options but has not decided which to follow.

One will see the least change, where people's home would be revalued within bands A-I but the tax rates would not be altered.

The IFS estimates that 320,000 homes would see cheaper bills, 317,000 would see more expensive bills and 834,000 would see little change.

The second option would revalue homes in the same way, but would see lower bills for bands A to C and increased bills for bands E to I.

Estimates suggest 471,160 would see higher bills, 803,582 would see lower bills, and 197,440 would see little change.

Under the top two options the new system would look like this:

Band A: homes worth up to £112,000

Band B: £112,001 to £155,000

Band C: £155,001 to £211,000

Band D: £211,001 to £278,000

Band E: £278,001 to £376,000

Band F: £376,001 to £516,000

Band G: £516,001 to £748,000

Band H: £748,001 to £987,000

Band I: above £987,001

The third option would be more radical, with a 12 band system with new classifications at the bottom and an extra two bands for the most expensive properties in Wales, called J and K.

Those in band D and below would see lower bills, and those in band E and higher would see increases.

Under the third option, the reductions "would be greater", the Welsh government says, "especially for those living in the lowest value properties".

The IFS's figures suggest 786,090 would see cheaper bills, 212,000 would see little change, while 473,543 would see higher bills.

Under the more radical option the bands will be:

Band A1: homes worth up to £80,000

Band A2: £80,001 to £110,000

Band B: £110,001 to £150,000

Band C: £150,001 to £200,000

Band D: £200,001 to £270,000

Band E: £270,001 to £360,000

Band F: £360,001 to £480,000

Band G: £480,001 to £650,000

Band H: £650,001 to £880,000

Band I: £880,001 to £1.2m

Band J: £1.2m to £1.6m

Band K: homes above £1.6m

Where could be the biggest impact?

The report from the IFS showed why changing council tax is so politically difficult.

It says deprived neighbourhoods could see average bills fall to make the system more fair, but rural areas would get bigger bills because property prices have grown so much.

The most radical option proposed by the government would cut bills the most in Blaenau Gwent and Denbighshire by 12% and 11%.

But Monmouthshire and the Vale of Glamorgan would see bills grow the most - by 16% and 15% respectively.

Both counties are likely to be battleground seats for Labour and the Conservatives in the general election, expected next year.

Under that options bills would also rise by 5% to 7% in Cardiff, Gwynedd, Anglesey, Pembrokeshire and Powys.

They could fall by 5% to 9% in Flintshire, Neath Port Talbot, Rhondda Cynon Taf, Swansea and Wrexham.

When will it happen?

Under the changes the revaluation could happen as early as April 2025 - which would mean the revaluation will take place based on prices from April this year.

However, the government could defer making changes until the next Senedd term, which would put the date back to 2028.

It could also implement it in stages, starting with one of the less radical options initially, potentially in 2025, before going further later.

Council tax raises about £2.4bn for local government every year.

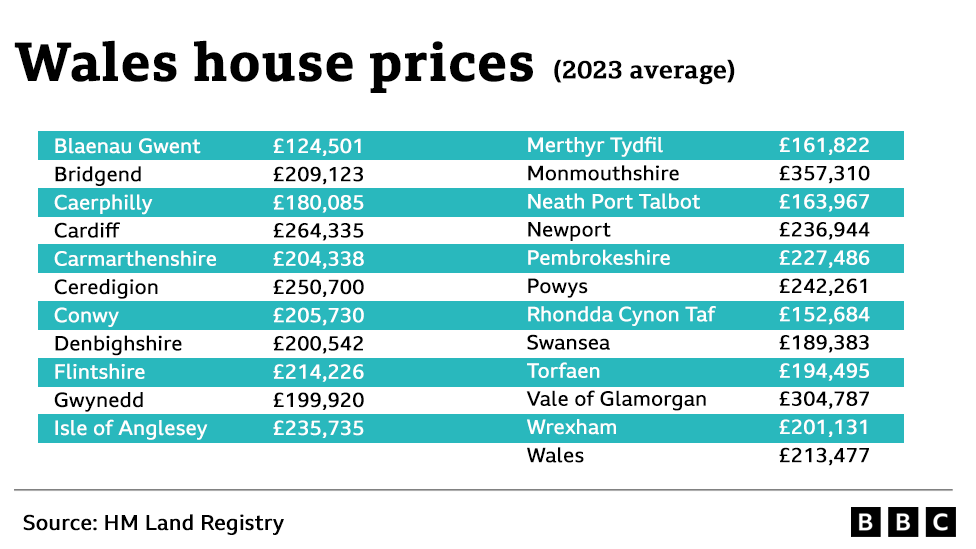

Wales had an average house price of £213,477 in 2023

The Welsh Local Government Association, which represents councils, called for transitional help for those facing significant changes.

WLGA leader Councillor Anthony Hunt said: "We recognise the need to make the system fairer and less regressive but remain concerned around some of the timing implications with the ongoing cost of living crisis."

In the Senedd on Tuesday Labour's Finance Minister Rebecca Evans said she was "very, very keen to look at transitional relief".

She said: "Achieving a fairer council tax will be one of the single most beneficial actions this government can take towards making Wales a more equal nation."

The Institute for Fiscal Studies (IFS), an independent research group, said the UK and Scottish governments should follow the Welsh government’s lead and update council tax.

But it argued “it was a pity” the changes could be delayed beyond April 2025.

In England and Scotland, bills are still based on property values from 1991.

Welsh Conservative Sam Rowlands said: “The Labour government, in the typical spirit of wanting to make taxation more ‘progressive’, is stealthily planning on hiking up council tax for hard working people."

Plaid Cymru's Cefin Campbell said: “This consultation is asking for the views of people across Wales on what a council tax could look like in the future and how we can make it fairer."

“It should be a means-tested tax, rather than it being on your home," says Becky Rees, owner of the Flower Cwtch shop

Blaenau Gwent has the highest band D council tax in Wales. But because the county has more homes in lower-value bands, the average bill there is one of the lowest in Wales.

Becky Rees, owner of the Flower Cwtch shop, said: “It should be a means-tested tax, rather than it being on your home.

“I understand that if you have a high-value home then it is means-tested to some respect," she said. "I personally rent my property because the value of my property is completely out of my control."

Faye Emms said houses in Mumbles already face a premium in council tax

According to RightMove, Mumbles has an average house price of £385,149 - a price that could trigger higher council tax rates under the proposals.

Estate agent Faye Emms said: "I think what would be difficult is if council tax goes up again for the higher priced houses. They are already at a premium."

Related topics

- Published7 December 2021

- Published12 July 2022

- Published4 March 2023