Stories from court hearings as home repossessions hit five-year high

The stories behind those who face losing their homes were heard by BBC reporters across six courts

- Published

The stories of people facing court proceedings to repossess their homes have been shared with the BBC as mortgage repossessions reach a five-year high.

BBC journalists in the East of England and London attended various county courts as mortgage-holders and renters appeared in front of judges.

They included a couple now £13,000 in arrears on a home they bought, and a woman who faced the repossession of a house she left following a marriage breakdown 15 years earlier.

The BBC also heard landlords were grappling with financial pressures - while the body representing lenders said seeking to repossess a home was "always a last resort".

Mortgage repossessions highest in five years

Data obtained by the BBC's investigations team showed mortgage repossession orders in England and Wales reached 10,853 in 2024-5 - the highest number in five years.

Andrew Goodwin, senior economist at Oxford Economics, said rising unemployment and interest rates had been contributing factors in recent years.

Reporters were sent to courts in Northampton, Peterborough and Norwich in the East, as well as Stratford, Wandsworth and Croydon courts in London to hear cases and the pressures facing mortgage-holders and tenants.

The courts heard matters concerning both mortgage and rental repossessions.

In Croydon, a former management consultant said he and his wife both lost their jobs in 2024, leaving them in mortgage arrears.

The prospect of his son losing his childhood home had hit hard, adding it was "the perfect place for us". They now have until March to pay the arrears.

In Stratford, a tearful woman who had not lived in her property for 15 years after her marriage broke down had the home with £87,000 in mortgage arrears repossessed.

Other stories heard throughout the day included:

Three homes repossessed in less than an hour at Stratford Magistrates' Court, including one with arrears of £87,672

A Wandsworth case where a tenant of 30 years faced losing his rental property because the landlord needed to put the rent up

A 75-year-old man in Peterborough, living in social housing, ended up in nearly £3,000 worth of arrears, telling the court he had been a victim of a scam

A single mother at Norwich County Court who owed her landlady £5,200 in unpaid rent

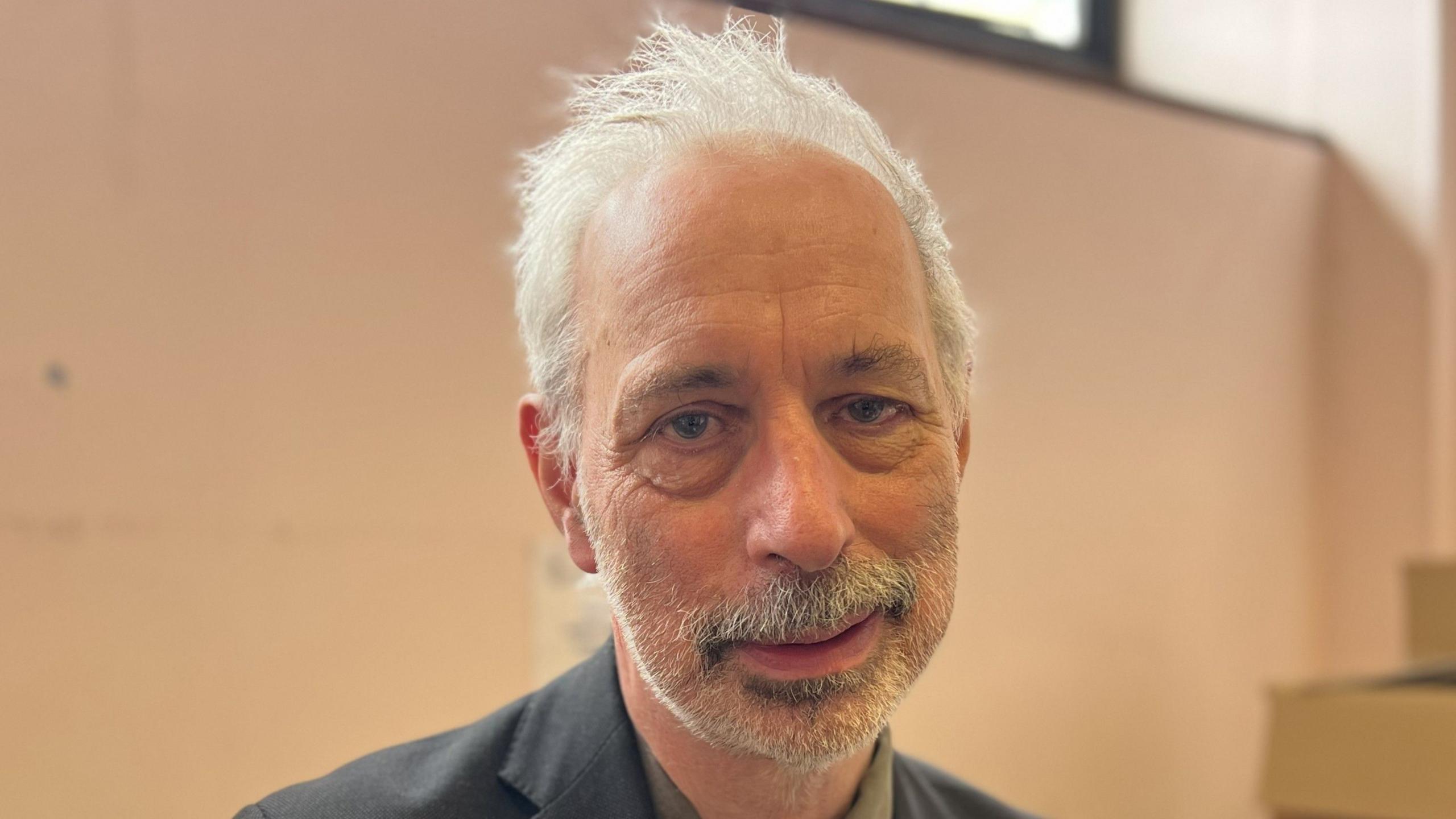

Angus King said the absence of free legal aid for housing, unaffordable rents in London and a chronic lack of housing were all contributing factors

Case workers 'overrun'

It was not just those facing the loss of their homes sharing their challenges.

Case workers and solicitors across the courts revealed they were being "overrun" with requests for help.

"When I began my career, up until a few years ago, I would think to myself 'that person won't actually end up homeless'," said Angus King, a housing solicitor from Southwark Law Centre.

"I knew we would find some way to keep them from it, but now that simply isn't the case."

Billy Harding, a Southwark Law Centre housing case worker assisting at Wandsworth County Court on Wednesday, said people were turning up "at crisis point".

The BBC found that across England the number of people asking their council for help to prevent becoming homeless was increasing.

Figures from 244 councils that responded to Freedom of Information requests showed three-quarters of them reported a rise.

For 2024/25, Broxbourne in Hertfordshire had the highest rate, where 95 out of 100,000 people were seeking help.

Similarly bailiff repossessions were rising again after a dip during the Covid-19 pandemic.

'I have never done this before,' says landlord

One landlord attending Norwich County Court also told of how anxious she was about coming to court to try to collect £2,200 in unpaid rent.

She told the judge the tenant, a carpenter, had offered to repair the windows of the property in lieu of rent.

"That was OK, but he never got back to me about that," she said.

Speaking on behalf of landlords in a separate court, one solicitor said the landlords also had bills to pay or financial issues themselves and couldn't be expected to subsidise their tenants.

Karina Hutchins, of UK Finance - which represents the banking industry - said seeking to repossess a home is "always a last resort" for lenders.

With additional reporting by Charlotte Rose, Gabriela Pomeroy, Stephen Menon, Jon Ironmonger, Phil Shepka, Matt Precey and Jessica Ure

If you have been affected by this story or would like support then you can find organisations which offer help and information at the BBC Action Line.

Get in touch

Do you have a story suggestion for the East of England?

Related topics

- Published16 hours ago

- Published14 August