'I am definitely a working person' says cafe owner

Scott Griffiths, co-owner of Penguin Cafe in Wednesfield, said running a small business was "a daily struggle"

- Published

A cafe owner said he was "unequivocally" a working person and running a small business was a "daily struggle", ahead of the government’s budget on Wednesday.

Labour made an election pledge not to increase taxes on "working people", but there have been indications that the government will increase National Insurance contributions for employers.

It has also come under fire for attempting to define "working people".

"People think, because you’ve got a business, automatically you're a millionaire - and it could not be any further from the truth," said Scott Griffiths, co-owner of Penguin Cafe in Wednesfield.

"It's a struggle on a daily basis."

Chancellor Rachel Reeves, who will deliver Labour's first Budget for 14 years, has warned that it will involve "difficult decisions".

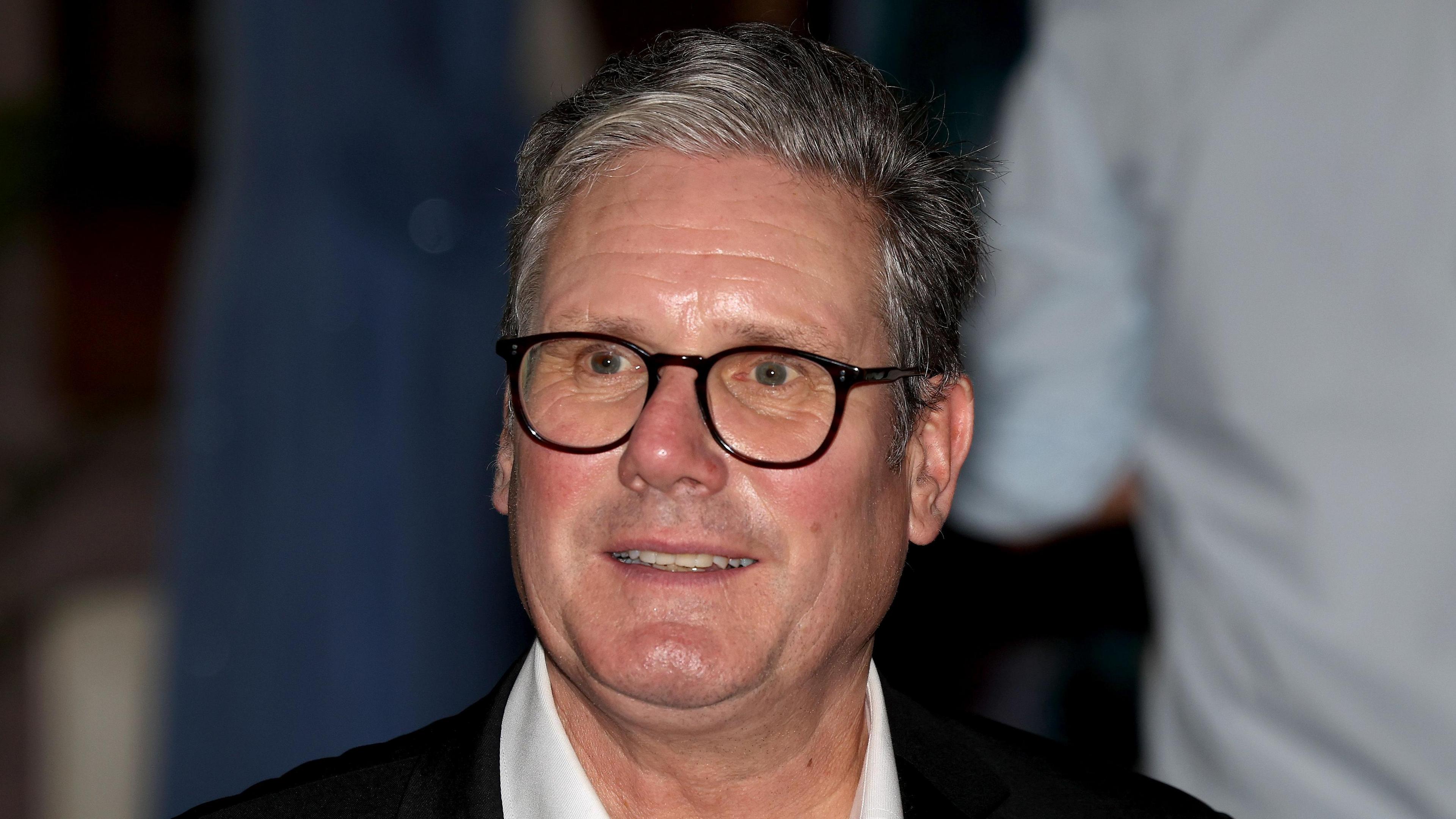

Sir Keir Starmer also gave a speech in Birmingham on Monday to prepare the ground for the Budget, saying that Britain "must embrace the harsh light of fiscal reality".

Government sources have told the BBC the Budget could include tax rises and spending cuts to the value of £40bn.

Mr Griffiths said that, while he understood that the government needed to plug gaps in the national finances, they should try to "be fair" and consider options that did not penalise small businesses.

'Backbone of Britain'

"Small businesses like us, we really work hard to make ends meet," said Debbie Newbould, managing director of Flume Research, a market research agency in Solihull.

Ms Newbold said that increasing employers' taxes could still affect employees, because business owners would have to "think twice" about whether they could afford pay rises and bonuses for their workers.

She added that small businesses were "the backbone of Britain" because they created jobs, and she certainly saw herself as a "working person".

Get in touch

Tell us which stories we should cover in Birmingham and the Black Country

Follow BBC Birmingham on BBC Sounds, Facebook, external, X, external and Instagram, external.

Related topics

- Published30 October 2024

- Published25 October 2024