US debt ceiling debate rages ahead of looming shutdown

- Published

With a shutdown of the government looming, lawmakers on Capitol Hill find themselves at an impasse over the debt ceiling - a limit set by Congress on how much the US can borrow.

President-elect Donald Trump wants a provision included in the spending bill that would raise or suspend the nation's debt limit.

But some of his own Republican Party lawmakers have balked at supporting a bill that would increase government spending.

On Thursday, 235 members of the House of Representatives - including 38 Republicans - voted against this Donald Trump-backed deal.

Here's what to know about the debt ceiling.

What is the debt ceiling?

The debt ceiling is the limit on the amount of money the government can borrow to pay its bills.

This includes paying for federal employees, Social Security and Medicare, as well as the US military and interest on the national debt and tax refunds.

Since first setting a debt limit of $45bn in 1939, the debt ceiling has been raised 103 times.

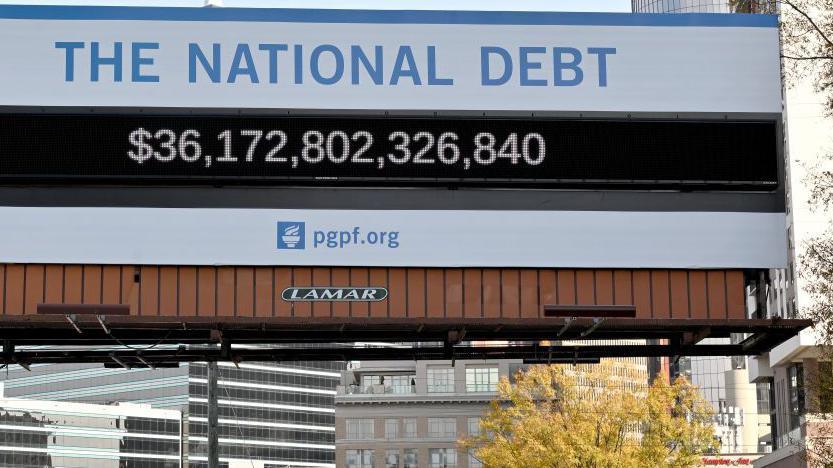

The last time the debt ceiling was reached, in January 2023, the figure stood at $31.4 trillion.

Under a deal reached in June that same year, Congress suspended the debt ceiling until 1 January, 2025.

What happens when the debt ceiling is reached?

In simple terms, this would mean that the government is not allowed to borrow any more money.

To borrow money, the government issues bonds, that it must pay back with interest. But once the debt limit is reached, the US Treasury Department cannot issue more securities, essentially stopping a key flow of money into the federal government.

The Economic Policy Innovation Center, a conservative think tank, has projected that the debt ceiling could be reached as soon as mid-June.

Initially, the government would be able to avoid breaching the limit by taking emergency steps such as suspending planned investments into retirement and health benefit funds, which would eventually be re-topped at a later date.

Those measures could only buy time for a few months, until the US creeps dangerously towards defaulting on its debt.

A default could be catastrophic for the US economy.

It would mean that authorities would have to make drastic cuts - including salaries and social security cheques - to make interest payments while other obligations go unpaid.

Any default could also ruin trustworthiness in the US economy, weaken the dollar and cause borrowing costs to spike.

What does Donald Trump want?

Trump hopes that Congress will raise or abolish the debt ceiling issue ahead of his return to the White House on 20 January.

On his Truth Social platform, Trump called on lawmakers to "get rid of, or extend out to, perhaps 2029, the ridiculous debt ceiling".

The new, Trump-backed plan would have funded federal agencies until mid-March and suspended the debt limit for another two years.

But it was met with resistance from Democrats and fiscally conservative lawmakers in the House, who objected to any plan that would raise or suspend borrowing limits without simultaneous spending reforms.

One of the Republicans in opposition, Texas representative Chip Roy, was quoted by Reuters as saying that he is "absolutely sickened by a party that campaigns on fiscal responsibility".

Related topics

- Published20 December 2024

- Published21 December 2024

- Published20 December 2024