'How will we afford children with rent increases?'

Delia-Ioana said she can't imagine being able to afford a mortgage

- Published

The average cost of renting privately in England has risen by nearly a quarter since the last general election.

In December 2019 rent cost £1,064 a month on average according to the Office for National Statistics (ONS, external). By May 2024 this had risen by 22% to £1,301 for new and existing tenancies.

Renters have told the BBC they have settled for mouldy properties, sofa-surfed or moved back in with relatives.

The National Residential Landlords Association blamed a “chronic shortage” of private rental homes on high interest rates prompting landlords to leave the market.

Hundreds of people have been in touch with the BBC about rent via Your Voice, Your Vote.

'All of us have been homeless'

Delia-Ioana, a 24-year-old freelance production assistant, pays £567 per month for a flat share in Bristol.

She said it took eight months for a dripping tap to be fixed, impacting her water bills, and the walls were mouldy and damp with mineral deposits.

Delia-Ioana plans to move out soon, but said rent was often too expensive, and she worried about the future.

“I was looking at my friends – all of us have been homeless at some point. A floor here, a sofa there,” she said.

“How are we going to afford to have children if we can’t afford a house?”

Average rents in Bristol rose 34% between December 2019 and May 2024, from £1,312 to £1,759 per month, the eighth largest increase among local authorities in England.

Delia-Ioana said every room in her flat share has mould in

How has rent changed in your area?

Why has rent been increasing?

Between December 2019 and May 2024, average private rent in England rose by 22% according to the Office for National Statistics (ONS).

It used a "geometric average", external to account for differences in property types and changes in the rental markets.

Across a similar period (April 2019 to April 2024) the Institute for Fiscal Studies estimated UK earnings rose by 4-6% in real terms, external.

The Bank of England started raising interest rates in December 2021, pushing mortgages up. It has kept them at 5.25% since last summer, aiming to slow the pace of rising prices.

Richard Donnell, property company Zoopla’s executive head of research, said these increases have made it harder for potential first-time buyers.

According to Mr Donnell there are fewer private landlords, meaning the total number of rental homes in the UK has barely changed since 2016 - but demand has continued to soar.

“The big increase in demand happened after the pandemic ended and the economy reopened," he said.

"You had this big return of people to cities, the international borders reopened.”

He said the growth of working from home has made cheaper areas outside big cities more appealing.

Where has rent increased the most?

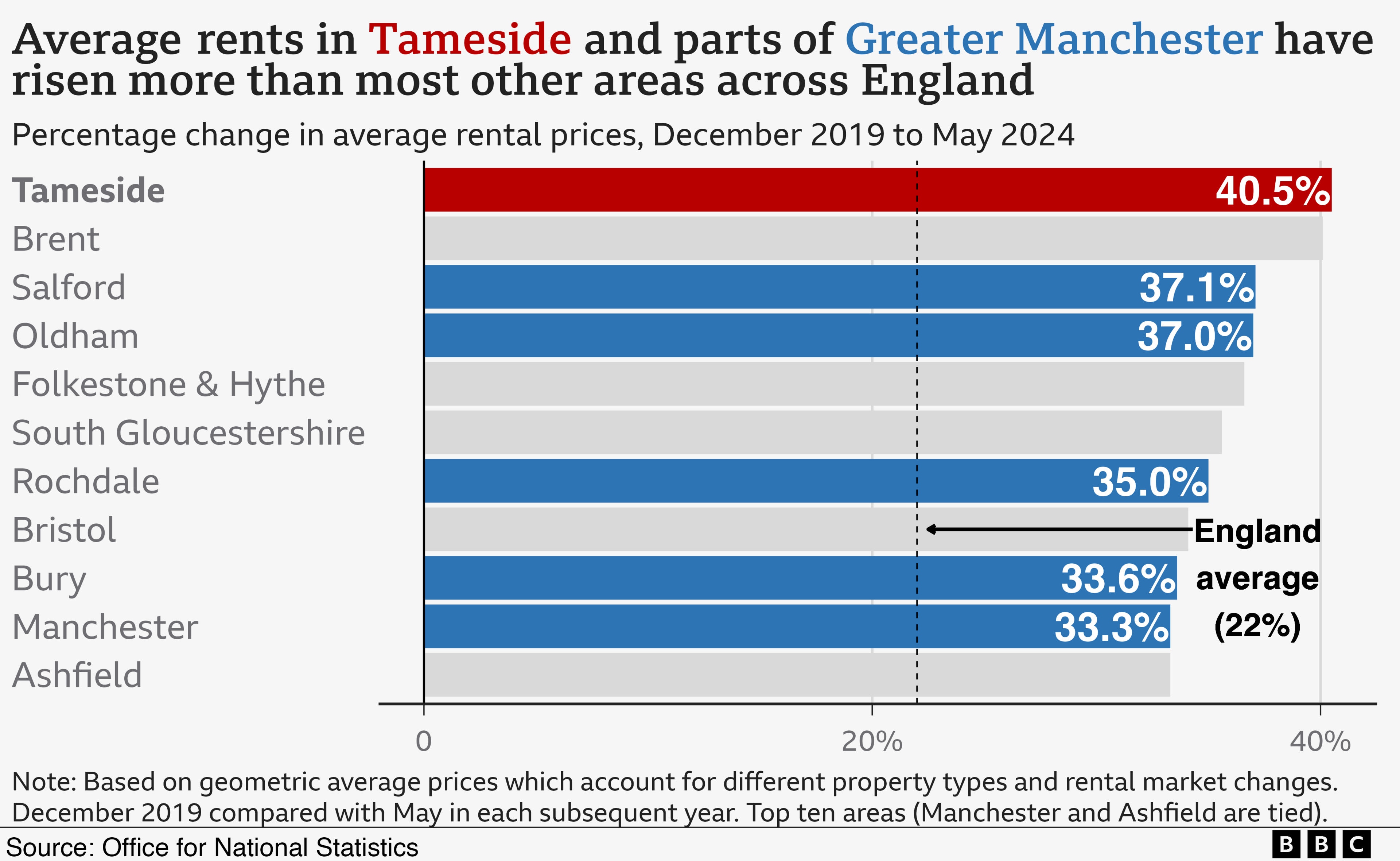

London has the highest average rent in England. But Tameside in Greater Manchester saw the largest percentage increase, up by more than 40% - from £555 in December 2019, to £780 in May 2024.

Six Greater Manchester local authorities were among the areas with the biggest percentage rises in England.

'It was like a bidding war'

Luisa, a civil servant renting in Tameside, lived with her two adult children in a three-bedroom house for £695 per month in 2022.

On 25 September that year, her landlord sent her a letter saying he was selling the property. He cited government decisions, interest rate increases, rising insurances and legislation he said unfairly tackled landlords.

Two days earlier, then Prime Minister Liz Truss’s chancellor Kwasi Kwarteng shared a ‘mini budget’ intended to stimulate economic growth.

This included £45bn of unfunded tax cuts - now mostly reversed. Following this, inflation and interest rates increased.

A Liberal Democrat spokesperson blamed "Liz Truss' botched budget" for "driving up rents for tenants" and a Labour spokesperson said "time and time again, the Tories have failed to stand up for renters".

A Conservative Party spokesman said “Covid and the war in Ukraine hiked up inflation and put pressure on renters, but we have got inflation down to normal levels”, adding they were committed to creating a fairer market for renters.

Luisa spent four months looking for somewhere to live.

“People were offering over the asking price or six months’ rent up front. I wasn’t in a position to do that,” she said.

“It was like a bidding war – I’d turn up and there was a block viewing with about eight to 10 different people there.”

Luisa rented the sixth house she viewed for £900 per month.

She said: “I feel sorry for my children because my daughter’s 20 and at uni, my son is 26 – he has to help me out with rent. He’s unable to save up for his future.”

How does your area compare to the rest of England?

What do the different parties promise on rent?

Conservatives: Build 1.6 million homes over five years, introduce a new Help to Buy scheme requiring a 5% deposit and scrap stamp duty for properties up to £425,000

Labour: Help build 1.5 million homes over five years, introduce a permanent mortgage guarantee scheme to help first-time buyers, and end rental bidding wars. Extend protections around damp, mould and cold.

Liberal Democrats: Build 380,000 homes a year and make three-year tenancies the default

Reform UK: Prioritise local people and those who have paid into the system for social housing, and encourage more people to become landlords by scrapping some taxes

Green Party: Create 150,000 new social homes a year, implement rent controls and bring empty homes back into use

The Renters (Reform) Bill, which would have banned landlords from evicting tenants without a reason, was not passed ahead of the general election being called.

The Conservatives, Labour, the Liberal Democrats and the Green Party have all pledged to end no fault evictions if elected.

Reform UK wants to scrap the Renters Reform Bill and say they will boost “the monitoring, appeals and enforcement process for renters with grievances".

- Published15 May 2024

- Published20 June 2024