Inflation - a growing global concern?

- Published

Food price inflation is a serious issue for the world's poorest people

We have had a recession - most economies are growing again so the past tense is appropriate.

But now we are starting to worry about price rises.

So far the focus has been mainly on the prices of specific goods, rather than the general level of prices.

Take food, for example. The Food and Agriculture Organization (a United Nations agency) compiles an index of food prices.

It is at an all time high, above even the level it hit in the food price crisis of 2008.

Now this is not a consumer price index. It is based on international commodity markets.

For many people, the impact of rising international prices, in dollars, has been softened by the weakness of the US currency.

But it is a warning sign of what might be on the way.

Recovery threat?

Energy is another important example. The cost of oil in particular has been a factor in several economic downturns.

The International Energy Agency fears high oil prices could harm the global economic recover

The International Energy Agency has warned that at current levels, more than $90 a barrel, it could pose a threat to the recovery now underway in most developed countries.

Inflation is now becoming more of a concern in some developing countries.

The situation is a long way from the episodes of very rapid price rises high or hyper inflation in the past.

There are a few countries with inflation in double figures, including Venezuela and Argentina.

But quite a few have high single figures and they would rather have less.

Thailand's central bank raised interest rates this week to address the danger.

Rate rises can bring another problem with them.

They can attract foreign finance seeking better returns than are available in the rich world.

That tends to push up further the currencies of developing countries who are already worried about the impact on their competitiveness.

Too low?

It is a rather different story in the rich countries where inflation is generally low. In some cases it is too low.

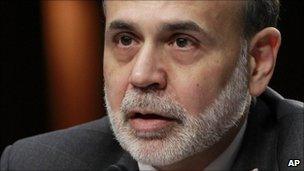

Federal Reserve boss Ben Bernanke is concerned at the US's low inflation levels

In Japan, prices are falling. In the United States, core inflation, which excludes volatile food and energy prices, is less than 1%.

That in the view of the Federal Reserve is too low.

The danger is that falling prices can encourage consumers to delay purchases and can also aggravate debt problems, because debts are fixed in cash terms even if some debtors' incomes are falling.

The Fed has been pursuing some unusual policies intended to combat the danger, buying US government bonds.

Some observers worry that this might create an inflation problem in the future, because the Fed buys assets with newly created money.

In normal times that might well happen, but it hasn't turned out that way and the Fed Chairman, Ben Bernanke says he has the tools to prevent it. But some people are worried.

There is a similar issue in Britain, where the Bank of England has taken similar steps to reinforce the economic recovery and might do more of it if there is a setback to growth.

And inflation is already significantly higher in Britain, above the Bank's target.

What we have then is a pattern of inflation that varies around the world.

It could get worse, and certainly the cost of some specific items might get a lot higher.

Food and energy and the prime examples and they are especially important to people with low incomes.

- Published13 January 2011

- Published13 January 2011

- Published31 May 2011

- Published5 January 2011

- Published5 January 2011

- Published7 January 2011