Standard Chartered rejects Iran allegations

- Published

The chief executive of scandal-hit Standard Chartered has said it "fundamentally rejects" accusations that it laundered as much as $250bn (£161bn) for Iran.

"There was no systematic attempt to circumvent sanctions," Peter Sands said in a conference call.

But he apologised for some deals that, he admitted, violated US sanctions.

It came as a report said that the US Treasury is also investigating the bank over Iran.

In a letter to the UK Treasury from the US Treasury Department's Office of Foreign Assets Control, director Adam Szubin said that his office "is investigating the bank for potential Iran-related violations as well as a broader set of potential sanctions violations".

The letter was seen by news agency AFP.

On Monday, New York's State Department of Financial Services said that the US unit of the bank had illegally hid 60,000 transactions with Iran for nearly a decade.

"We believe there are no grounds to take this action," Mr Sands said.

"We were surprised in the manner of the announcement and that it was done without giving us any notice," he added.

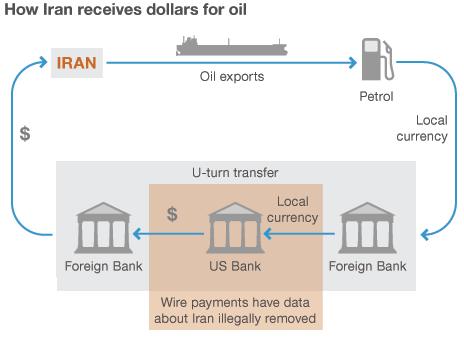

The bank was accused of falsifying Swift wire payment directions by stripping the message of unwanted data that showed the clients were Iranian, replacing it with false entries.

Shares in the bank rebounded 7% in London trade, after wiping $17bn off the bank's market value on Tuesday.

'Clearly wrong'

Standard Chartered admitted that some of its transactions did break US sanctions - but the amount was only 300 transactions, worth about $14m.

"This was clearly wrong and we are sorry that they happened," Mr Sands said.

He also denied a now-infamous email that the regulator said showed "obvious contempt for US banking regulations" from a bank executive director to a New York branch officer that used an expletive to refer to Americans.

"Who are you [Americans] to tell us, the rest of the world, that we're not going to deal with Iranians," the complaint quotes the director as saying.

What is Standard Chartered accused of? The BBC's John Moylan explains

Mr Sands said this was not from any emails or documents on record.

"It was from a meeting several years and none of the participants can remember anyone saying it," he said. "We don't believe this to be accurate."

Anti-British bias?

But the latest accusation against a British bank from US authorities has angered some politicians in Britain, who have spoken of a perceived "anti-British bias" in Washington, designed to weaken London as a financial centre.

Bank of England Governor Sir Mervyn King criticised the US regulator for lacking discretion while the investigation was under way.

"One regulator, but not the others, has gone public while the investigation is still going on," he told a news conference.

"I think all the UK authorities would ask is that the various regulatory bodies that are investigating the particular case try to work together and refrain from making too many public statements until the investigation is completed," he added.

Meanwhile, Boris Johnson, the mayor of London, warned that regulation in New York should not become "a self-interested attack on London's status as the pre-eminent financial centre".

John Mann, a member of the UK Parliament's finance committee, said: "I think it's a concerted effort that's been organised at the top of the US government. I think this is Washington trying to win a commercial battle to have trading from London shifted to New York."

- Published7 August 2012

- Published10 December 2012

- Published6 August 2012

- Published24 July 2012