Sir Mervyn King writes to van man about bank loan

- Published

Sir Mervyn King told Mike Benson to try asking a Swedish bank for a loan

All Mike Benson wanted for Christmas was a brand new Ford Transit for his business.

And a modest loan to pay for it.

When his bank said no, he decided to write to the top. Not just to the boss of his bank, but to the boss of the Bank of England, Sir Mervyn King.

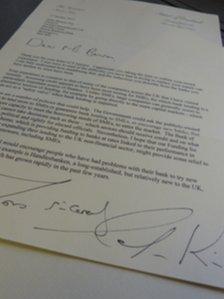

To his great surprise, Sir Mervyn wrote back to him, sympathising about the behaviour of the banks.

"I was sorry to read of the difficulty you have had in trying to replace your transit van," he wrote.

"I can fully understand how maddening that, and the behaviour you describe from the banks you have spoken to, must have been."

As if acknowledging the collective failure of British banks to lend to small businesses, Sir Mervyn suggested he try one of the UK's new banks, such as the Swedish firm, Handelsbanken.

Loan turned down

Sir Mervyn King said he could understand how maddening the behaviour of banks must be

Mike Benson has not yet framed Sir Mervyn's letter, but no doubt he will. Sitting in his office near Bromsgrove in Worcestershire, he relishes the words of the country's senior banker.

"Sir Mervyn King's letter was absolutely delightful," he says.

"He was obviously quite cross that the banks were not lending money to profitable businesses."

And Mike Benson's business, supplying parts for air compressors across the world, has been quietly profitable for the past 15 years. As a company that exports to countries as far afield as the US, Chile and the Marshall Islands in the north Pacific Ocean, it is just the kind of business the UK needs to encourage, if the economy is to return to decent growth.

But when he asked for a £10,000 loan to go towards the cost of a £17,000 Ford Transit, he was turned down.

The Bank of Scotland (BOS) argued that he did not have sufficient "fixed assets" in the business - items that can be sold if a loan goes wrong - to act as security.

In his rejection letter, BOS offered him a free business mentor instead.

"I thought that was sweet and patronising," says 65-year-old Mike.

"To offer counselling to someone who has been in business for this long, and at my age!"

'Deeply disappointing' figures

The Bank of Scotland says that Mr Benson was offered alternatives to the loan, such as a hire purchase agreement. Because he did not have sufficient fixed assets in the business, they also asked him for a personal guarantee.

Mike Benson with the van he eventually had to buy without a loan

"On a case by case basis, there can be circumstances when we ask for security for a loan through a personal guarantee and we do our best to make this clear to our customers," a spokesperson told the BBC.

The bank also made it clear that Mr Benson could have appealed against the decision to reject his loan, but he chose not to.

Latest figures show that lending to businesses has continued to fall.

Data from the Bank of England this week shows that lending to businesses and individuals in the final quarter of last year dropped by £2.4bn. Lloyds Banking Group, which includes the Bank of Scotland, reduced its lending by more than £3bn over the period, more than any other bank.

And the British Bankers Association reported a fall of nearly £300m in lending to four million small and medium-sized businesses at the end of last year.

The news was heavily criticised by politicians and business leaders, with the Business Secretary, Dr Vince Cable calling the figures "deeply disappointing".

Two government-backed schemes, Project Merlin and Funding for Lending (FLS) have apparently had little effect on business lending so far.

"Merlin was supposed to be a magician," says Mike Benson.

"But there's certainly no magic about what the banks have been doing."

'Sayonara to the banks'

But the Bank of England argues that lending to business will take a while to pick up, partly because of the time it takes for banks to approve lending applications. And it points out that all lending did improve significantly in January.

The British Bankers Association, which represents all the major banks, says many businesses are preferring to save money at the moment, rather than borrow it.

"It is more of a demand issue than a supply issue," said a spokesman.

The Treasury is keen to point out that FLS has had an impact, but so far only on mortgage rates.

"It has already succeeded in reducing borrowing costs, with some mortgage rates at their lowest for five years," said a Treasury spokesperson.

But Mike Benson is unimpressed, and is thinking of turning to other lending schemes which do not involve banks, like peer-to-peer lenders.

"There will come a point when we don't need the banks. And sayonara to the banks!"

That is why he eventually decided to buy his van with his own cash.

- Published4 March 2013

- Published15 February 2013

- Published4 March 2013