Heseltine calls for government role in foreign takeovers

- Published

- comments

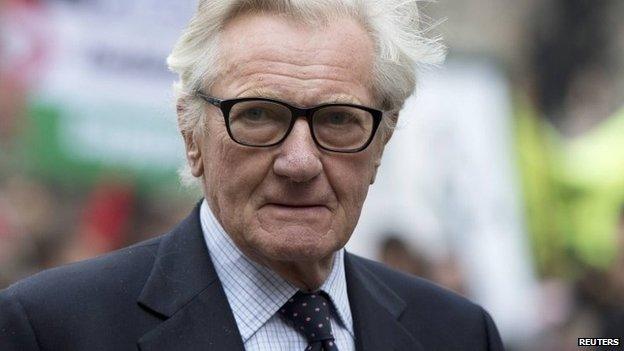

Lord Heseltine is a former trade minister and an adviser to the prime minister on economic growth

Conservative peer Lord Heseltine has said the government should have greater powers to intervene when British companies are the target of takeover bids by foreign businesses.

The former deputy prime minister told the BBC takeovers "could be very helpful", but the UK should do more to protect its national interests.

This week, American drugs giant Pfizer announced it was bidding for British pharmaceutical company AstraZeneca.

The firm has 6,700 employees in the UK.

If successful, the deal would be the biggest ever takeover of a UK business by a foreign company.

Lord Heseltine, who is an adviser to Prime Minister David Cameron on economic growth, told the BBC's business editor Kamal Ahmed that ministers should have "reserve powers" to protect British companies when crucial interests, such as the country's science base, were at risk.

"Foreign takeovers can often be hugely helpful and I have no doctrinal preoccupations - I've done enough takeovers of small businesses myself to know how valuable they can be," he said.

"But the important point is that every other advanced economy has mechanisms of some sort on a failsafe basis to scrutinise foreign takeovers and we're the only country that doesn't."

AstraZeneca employs many scientists and researchers and has links to top British universities

The proposed acquisition of AstraZeneca has prompted protests by some who feel the deal would jeopardise Britain's science and medical industries.

AstraZeneca has eight sites in the UK and about 6,700 employees.

'Reserve powers' needed

Pfizer has said it would relocate large parts of its business to the UK, if the deal goes through. It has also suggested it wants to invest in research which could create more jobs.

But Lord Heseltine expressed his reservations over the deal.

"There are so many issues about the science base, about the supply chains, about employment prospects that ought to be explored and I don't see any way in which this can be adequately done unless the government has reserve powers.

"It's a question of where their headquarters are, where the decisions are taken, who determines what research is done and where, how much government money goes into supporting the science base within a co-operative arrangement, where the supply chains are going to be and what the motive is," he said.

Labour's business spokesman Chuka Umunna, who has also criticised the proposed deal, said ministers already had powers to intervene in takeovers in certain circumstances and his party was looking at whether these should be strengthened as party of its pre-election policy review.

Bentley boosted

Some British business figures have benefited from foreign buyouts.

Michael Straughan, a board member for manufacturing at Bentley Motors, which was bought by Volkswagen Group at the turn of the century, says the company grew as a result of the takeover.

"Volkswagen has invested millions and millions of pounds in new models and infrastructure here at the site in Crewe," he told the BBC.

"The benefit of being owned by such a big company like Volkswagen is the use of technologies from group, which as a very small brand we could never afford on our own."

British stalwart Bentley Motors is now owned by German firm Volkswagen

Made in France

Earlier this week, French president Francois Hollande summoned the boss of General Electric to the Elysee Palace, after the company announced its interest in buying Alstom - makers of the iconic TGV trains and one of France's biggest private sector employers.

The country's economy minister, Arnaud Montebourg, said the government wanted "to make sure that French companies... do not become prey."

The French government is famously protective of its national companies. Back in 2005, an attempt by Pepsico to buy France's Danone was blocked by the government, who claimed it was a strategically important company.

Last year, Yahoo abandoned a bid to buy French online video site Dailymotion, following objections from government officials.

In stark contrast, the UK is the "most open market on earth" for foreigners to come and buy businesses, venture capitalist Jon Moulton told the BBC.

While highlighting the many benefits, including more readily-available capital, competitive pressure on companies, and a better deal for shareholders, Mr Moulton says "people who are buying from overseas are undoubtedly biased towards their own bases".

"It's not likely that somebody who's running a Chinese manufacturing plant will have much empathy for how a UK plant should be run."

- Published1 May 2014

- Published1 May 2014

- Published30 April 2014

- Published30 April 2014

- Published29 April 2014