Will Opec cut oil production?

- Published

Why has the price of oil been so volatile?

The Organization of the Petroleum Exporting Countries (Opec) is back in the news.

How will the group respond to the fall of 30% in the price of crude oil since June?

Energy ministers from the group's 12 member countries are meeting at their headquarters in Vienna this week.

The big question is whether they will decide to cut their production ceiling in an effort to boost prices.

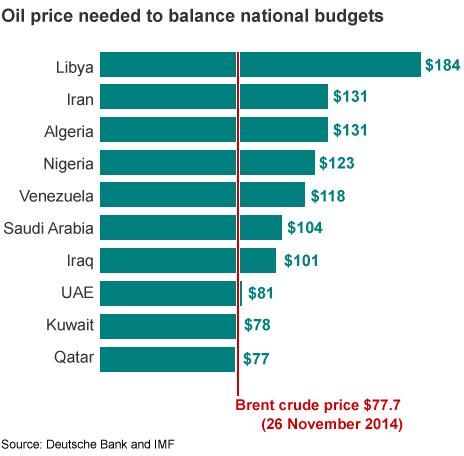

The slide in the oil price is a real problem for some Opec members. They are highly dependent on oil revenue to fund their government budgets.

In the case of Saudi Arabia almost 90% of government revenue comes from oil, external, though it is better able than many to cope with prices at current levels.

It is a much bigger problem for Iran, Venezuela, Nigeria, and, outside Opec, for Russia too.

To cut or not?

They face a rather simple dilemma. They could cut oil production, which would boost prices or at least limit any further falls. Opec members account for 40% of global oil production so they can make a difference. That is as long as they comply with their own production limits, which they often fail to do.

Some Opec countries have urged cuts, including Iran and Venezuela. Kuwaiti officials have said cuts are unlikely - in other words, they don't support them. Kuwait and other Arab countries in the Gulf can generally cope better with lower prices.

The big one, and the big unknown, is Saudi Arabia, by far Opec's biggest player. In the past it has often taken the lead in seeking to stabilise the market. It is sometimes known as the "swing producer".

This time Saudi Arabia is seen as reluctant to take the responsibility on its own. Recent discounts given by the Kingdom to some customers have been interpreted as showing a determination to maintain market share.

The uncertainty about just what Opec will do is reflected in diverging analysts' expectations. A recent survey of 20 experts by Bloomberg, external found exactly half expecting a cut and half expecting no change.

One intermediate option the group could well consider is to leave the formal production ceiling unchanged at 30 million barrels a day, but to agree to rein back production above that limit - estimated at about 600,000 barrels a day in October, according to the International Energy Agency, external.

The oil price has been falling since the summer on abundant global supply, partly due to the US shale boom, and lower demand in Europe and Asia.

Supply and demand

Opec's predicament reflects developments in both supply and demand sides of the market.

Demand for oil has been affected by a weakening global economic outlook. That reflects the persistent problems in the eurozone and a slowdown in growth in some emerging economies, notably China.

At the same time the growth of the shale oil business in the United States has ensured there is plenty of supply. Before the shale revolution US oil production had been in long-term decline. Now it is at its highest since July 1986, external.

The price of crude oil has also been affected by the strength of the US dollar. As oil is priced in the US currency a higher dollar makes it more expensive in other currencies, further weakening demand. In other words, buyers whose home currency has declined against the dollar are not getting the full benefit of cheaper oil.

One striking thing about the current episode is how the markets have shrugged off instability in the Middle East - a factor that has in the past caused major price increases.

There was, it's true, a brief spike in prices in June when the markets realised how significant a force Islamic State had become.

President Obama met King Abdullah of Saudi Arabia in March in an effort to mend relations

But as it became clear they were unlikely to hit Iraq's southern oilfields that effect faded.

The markets have also stayed fairly calm in the face of the ups and downs in Libya's oil industry due to the conflict there.

Conspiracy theories

There are other theories about what might be behind the falling oil price. One idea is that Saudi Arabia is deliberately keeping supplies up and the price down to make shale oil less profitable and weaken a source of competition.

Some suggest that the US and Saudi Arabia have shared geopolitical aims that are helped by a lower oil price. The New York Times columnist Tom Friedman asked, external: "Is it just my imagination or is there a global oil war under way pitting the United States and Saudi Arabia on one side against Russia and Iran on the other?"

He wonders whether the US and Saudi Arabia are trying to do what he says they did before to Soviet leaders: "pump them to death".

These are controversial ideas. What is clear is that there are real economic forces of supply and demand that are at the very least contributing to Opec's problems.

- Published19 January 2015

- Published28 November 2014

- Published24 November 2014

- Published14 November 2014

- Published6 November 2014