Tax office says it was prevented from sharing HSBC tax data

- Published

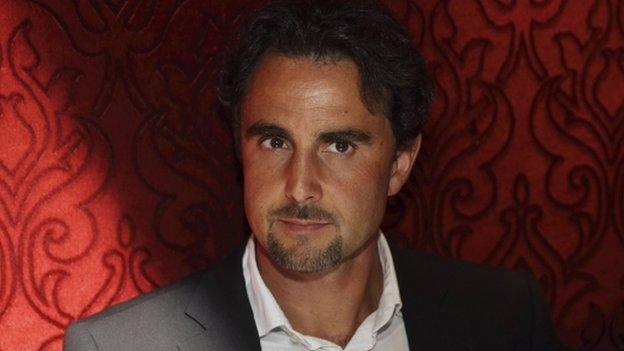

FCA boss Martin Wheatley was not told about the HSBC tax allegations before they emerged in the media

The UK tax office said it was prevented by an international agreement from sharing information about HSBC's possible involvement in tax evasion.

Amid a row over what ministers knew and the regulator's role, HM Revenue & Customs said the details it had could not "move outside the department".

HMRC was passed a hoard of documents in 2010 from France about clients of HSBC's Swiss operation.

The scandal has triggered promises of scrutiny from around the world.

The US government has been asked to reveal what it knew about the documents and the US Justice Department is among the bodies looking at whether action should be taken against HSBC.

'Restrictions'

The Financial Conduct Authority (FCA) chief executive Martin Wheatley had earlier told the Treasury Committee that he was "not aware" of his organisation being told of specific claims of collusion in tax evasion.

He said: "It's quite clear that the number of scandals that we've seen in financial services, particularly in banks, has been staggering, and the latest allegations I think are equally scandalous."

In the UK, a Downing Street spokeswoman said no ministers were aware of the claims.

HMRC told the BBC that under a deal with France it could not share the information.

"We received the data under an international treaty agreement with France which had tight restrictions. We couldn't move it outside the department," a spokesman said.

The information about the activities of HSBC's Swiss arm could only be used to look into potential tax-dodging, he added.

Since the disclosure that HSBC's Swiss operation may have helped wealthy clients across the world avoid tax, there has been a growing row about why the details have only just come to light.

The prime ministers' spokeswoman said ministers were only aware of the allegations from media reports in the last couple of days.

'Staggering'

Later, business minister Matt Hancock said it was "entirely appropriate" that ministers were not informed about the allegations concerning HSBC, even though it was the UK's biggest bank.

"Politicians don't know and aren't told about the individual tax affairs of individual people. Britain's biggest bank is also a private company and so it is entirely appropriate," he told BBC Radio 4's The World At One.

He pointed out that the HSBC information, leaked by a former IT employee at the bank, dated from before the coalition government.

But Labour's shadow chancellor, Ed Balls, told the same radio programme: "At no point was any allegation put to me or any other ministers."

He said it was "staggering" that the coalition government appointed former HSBC chairman Stephen Green a trade minister without "any investigation into whether it was appropriate".

Meanwhile, MPs criticised the City watchdog, the FCA for not knowing about the claims until media reports emerged.

One MP said the FCA could not operate effectively without knowing the facts.

Committee member John Mann questioned how the FCA could do an effective job overseeing the banking industry if it was not informed about potential wrongdoing.

'Skeletons'

Mr Wheatley told MPs that the FCA was "closely monitoring the banks overall... We do have a deep programme of reform in a number of the banks regarding anti-money laundering and HSBC is one of the banks we're working closely with".

He also warned that the FCA had a "number of ongoing investigations which will raise further questions about the banks".

He said banks were obliged to talk to the FCA about any "skeletons in their cupboards" early on, but the problem was that "frankly the chief executives don't know about the skeletons in their organisations".

Committee chairman Andrew Tyrie said after the hearing it was clear that "much more still needs to be done" to reform banking culture.

"Mr Wheatley's comments are further evidence that some banks may be too big to manage", he said.

Tax scrutiny

Authorities in a range of countries are considering examining HSBC's actions in helping more than 100,000 wealthy individuals avoid paying tax.

US Senator, Elizabeth Warren, said: "The new allegations that HSBC colluded to help wealthy people and rich corporations hide money and avoid taxes are very serious, and, if true, the Justice Department should reconsider the earlier deferred prosecution agreement it entered into with HSBC and prosecute the new violations to the full extent of the law."

In the UK, the Public Accounts Committee (PAC) plans to investigate the scandal and will require HSBC's former head to give evidence.

There have also been calls for action in the US, Belgium, France, Argentina and Switzerland itself.

HSBC said it is "co-operating with relevant authorities".

The BBC learnt that HSBC helped wealthy clients evade hundreds of millions of pounds worth of tax.

HSBC's Swiss accounts in numbers

106,000

clients with Swiss bank accounts

203

countries involved

-

$118bn total assets held in Swiss accounts

-

11,235 clients from Switzerland held $31.2bn

-

9,187 clients from France held $12.5bn

-

7,000 clients from UK held $21.7bn

Panorama has seen accounts from 106,000 clients in 203 countries, leaked by whistleblower Herve Falciani in 2007.

In Belgium, a judge is considering issuing international arrest warrants for directors of the Swiss division of the bank, while France has launched an investigation and its prime minister has promised more action both at home and at a European level.

Swiss politicians are asking for a regulatory investigation.

The PAC has a routine meeting scheduled on Wednesday at which the head of HMRC, Lin Homer, will appear.

'Control failures'

HSBC admitted that it was, external "accountable for past control failures." But it said it has now "fundamentally changed".

"We acknowledge that the compliance culture and standards of due diligence in HSBC's Swiss private bank, as well as the industry in general, were significantly lower than they are today," it added.

The bank now faces criminal investigations in the US, France, Belgium and Argentina, but not in the UK, where HSBC is based.

HSBC said it is "co-operating with relevant authorities".

Offshore accounts are not illegal, but many people use them to hide cash from the tax authorities. And while tax avoidance is perfectly legal, deliberately hiding money to evade tax is not.

- Published10 February 2015

- Published9 February 2015

- Published9 February 2015

- Published9 February 2015

- Published9 February 2015

- Published9 February 2015

- Published9 February 2015

- Published9 February 2015

- Published9 February 2015