ECB raises eurozone growth forecast to 1.5% for 2015

- Published

The European Central Bank has raised this year's eurozone growth forecast to 1.5%, up from 1% previously.

It also said it would start its quantitative easing programme, first announced in January, next week.

Bank boss Mario Draghi said economic growth in the eurozone would strengthen slowly to reach 2.1% by 2017.

He also said there would be low negative inflation in the months ahead before prices began to rise in late 2015, with 1.8% inflation in 2017.

Earlier, the bank kept the eurozone's key interest rate unchanged at 0.05%, as expected.

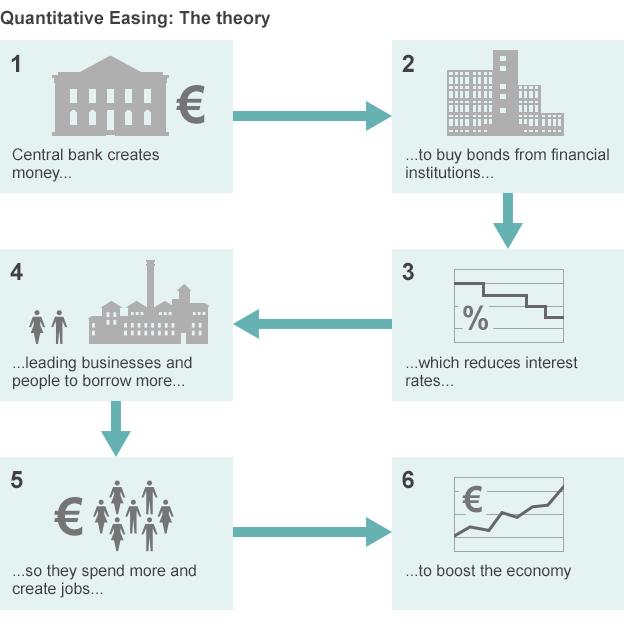

The ECB also confirmed the basis of its quantitative easing (QE) plans, first revealed in January.

The scheme will inject at least €1.1 trillion (£834bn) into the eurozone economy by purchasing €60bn of assets a month from next week until September 2016, Mr Draghi added.

"We will on 9 March 2015 start purchasing euro-dominated public sector securities in the secondary market," he said.

"We will also continue to purchase asset-backed securities and covered bonds which we started last year."

Economist Howard Archer, of IHS Global Insight, said the ECB had indicated that under its QE programme, no bonds would be bought where the yield was less than -0.20%, which is currently the ECB's deposit interest rate.

"This effectively puts a floor under eurozone interest rates," he said.

'Rule-based'

Mr Draghi said eurozone economic growth in the fourth quarter of 2014 had been higher than expected. The bloc grew by 0.3% in the quarter, helped by rapid growth in Germany.

"The latest economic data and, particularly, survey evidence available up to February point to some further improvements in economic activity at the beginning of this year," he said. "Looking ahead, we expect the economic recovery to broaden and strengthen gradually."

However, he said that high structural unemployment and low growth in certain parts of the eurozone meant there no "grounds for complacency". In a clear reference to Greece he added that structural reforms "needed to be implemented swiftly... and credibly".

He also said Greece could not rely on the ECB to raise the limits on Athens' issuance of short-term debt, and that the rules also meant the ECB could not buy Greek bonds under its new asset-buying programme.

"The ECB is a rule-based institution. It is not a political institution." he said.

But he said the amount of Emergency Lending Assistance (ELA) available to Greek banks had been increased, adding that Greek banks were solvent and had capital levels above minimum requirements.

The euro fell to an 11-year-low against the dollar of $1.1022, its lowest since September 2003, after Mr Draghi revealed which bond yields would meet ECB buying approval.

He also said there may be a chance that the QE programme would continue beyond September 2016.

The euro was down 0.25% against the pound at €0.7239.

"When President Draghi revealed that there would be a cap on the QE program - the ECB would not buy bonds whose yields were below the interest rate corridor floor of -0.20% - the euro hit the skids," said Christopher Vecchio, currency analyst at Daily FX,

The latest meeting of the bank's governing council took place in Nicosia in Cyprus, one of its twice-yearly meetings away from its German HQ in Frankfurt.