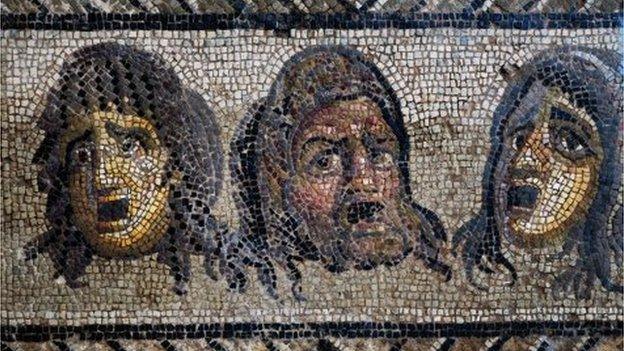

How serious for us is the Greek tragedy?

- Published

- comments

There is something a bit too deja-vu-ish about this election campaign, especially the tragic Greek economic backdrop.

Just like five years ago, Greece is on the brink of default. But 2015 is very different from 2010 in one important respect: other eurozone countries and the IMF are signalling they won't be panicked into rushing through another bailout.

If hints from the German finance minister, Wolfgang Schaeuble, and more explicit remarks from EU officials are any guide, Greece will be left to flounder, which means that there is a high probability that - at some point between May and July - the Greek government will fail to make repayments on the billions that fall due for repayment to the IMF, and/or the European Central Bank and/or private-sector providers of short term debts.

For what it's worth, the IMF is owed €200m (£144m) on 1 May and €760m on 12 May, while the ECB is due €6.7bn in June and July.

Greek exit?

Now this does not necessarily mean Greece would leave the euro at the point that it misses a debt payment.

The government could follow the example of Cyprus and impose restrictions on the export of capital from the country, to conserve as much cash as possible in a banking system too close to collapse for comfort.

And it could create its own IOUs, a sort of parallel domestic currency interchangeable with euros, to pay its employees and trade creditors.

In these dire circumstances, it would not really be part of a proper monetary union, it wouldn't be a full member of the eurozone. But it would still have the euro as legal tender.

This would be a pretty ghastly scenario for the Greek people - who would struggle for a period to obtain the things they need from abroad. And if the economy is limping along now, it would contract sharply for a period, as businesses and banks went kaput.

But strikingly the German government is putting it about that financial contagion to the rest of the eurozone would be limited.

Which may be hopeful, wishful thinking or naive.

Stark signal

It is certainly true that the eurozone and IMF can afford the likely losses on Greece's debts.

But that is not really the point. A Greek default would signal in the starkest way that European Monetary Union is about national convenience, not a political project to integrate the governance and balance sheets of members.

As such a Greek departure risks creating an economic schism between the rich north of Germany, the Netherlands, Austria and Finland, and the poorer south and east - with France in an uneasy no-man's land.

Capital would gravitate to the north. Funding costs for businesses and households would be permanently lower there. And the rich north would get richer and richer relative to the stagnating south and volatile east.

If that were to foster resentment on either side of the Alpine divide, it would not be a benign outcome.

As for us, the Greek drama represents unwelcome instability as we choose our next leaders.

But for the avoidance of doubt, the short-term risks to our prosperity are much lower than they were five years ago - whereas the long term risks, of a Europe permanently failing to pull together to create the conditions for sustainable growth and prosperity, may be greater.