Cirque du Soleil sold to US and Chinese investors

- Published

Cirque du Soleil says it plans to put on 18 shows in 2015 in countries across the world

Canadian circus firm Cirque du Soleil has sold a majority stake to US and Chinese private investors, valuing the firm at $1.5bn (£1bn).

Guy Laliberte, who founded the firm in 1984, has retained a minority stake.

The two buyers are US private equity firm TPG Capital LP and Fosun Capital Group, which is owned by Chinese conglomerate Fosun International Ltd.

Cirque has staged performances in front of 160 million people in 48 countries around the world.

The company has recently sought to expand in China.

"After 30 years building the Cirque du Soleil brand, we have now found the right partners in TPG, Fosun and the Caisse to take Cirque du Soleil forward to the next stage in its evolution as a company founded on the conviction that the arts and business, together, can contribute to making a better world," said Mr Laliberte said in a statement, external.

Mr Laliberte founded the firm in 1984, which has since expanded to become a billion-dollar business

Quebec pension fund giant Caisse de Depot et Placement will also acquire a minority stake.

Recent troubles

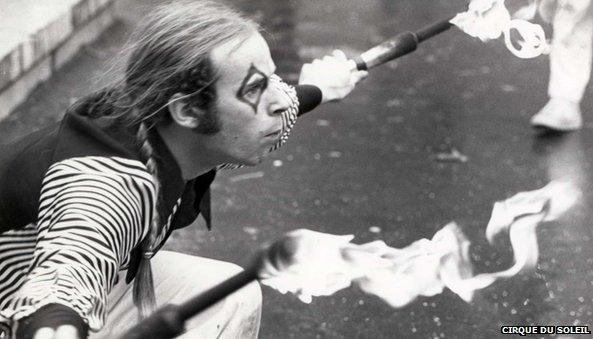

Based in Montreal, the firm started as the project of a small group of stilt-walkers and street performers who formed a performance troupe called the Le Club des Talons Hauts (the High Heels Club) to put on a performance celebrating the 450th anniversary of the European discovery of Canada by Jacques Cartier in 1534.

Since then, the firm has expanded rapidly, taking in approximately $1bn (£600m) annually from 18 global shows, some of which tour and others of which are based in theatres in Las Vegas.

It employs about 5,000 people globally and is known for its mixture of acrobatics, artistic costumes and choreography.

Cirque du Soleil has faced difficulties in its efforts to expand, which led to layoffs in 2012.

In 2013, it was fined by US regulators after one of its acrobats died during a live show in Las Vegas.

- Published30 May 2014

- Published12 December 2013