European bond prices drop sharply in mass sell off

- Published

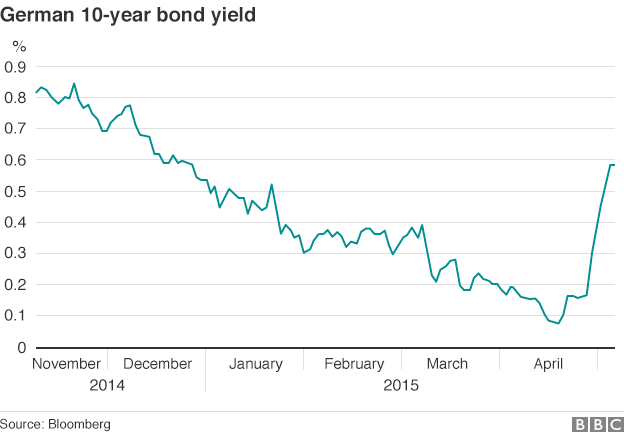

European bond prices have dropped in a widespread sell off, sending investor returns higher, as markets brace for the return of inflation.

Bond yields, the rate of return received by investors, were at their highest levels of the year in Europe, as a week-long rout picked up steam.

Yields, which move up as bond prices fall, are swinging as wildly as they did at the start of the euro crisis.

But traders are divided about what precisely is causing the selling.

Some say the cause is the bond-buying programme the European Central Bank (ECB) launched in March, which was intended to stimulate the European economy.

Investors bought into bonds, betting that prices would continue to rise with the ECB willing to spend huge sums buying them up.

Sentiment

But in recent weeks there has been a shift in sentiment.

And it is proving harder to sell bonds than it was to buy them.

"Banks are unwilling to warehouse inventory [hang on to investments]," says Mr McGuire. "It's harder to find someone to match the other side of the trade."

Investors are scrambling to unload unwanted debt, provoking sizeable daily moves in bond prices.

A sale of Spanish and French debt on Thursday increased supply and depressed prices of other bonds, including German benchmark bonds.

Inflation worries

Investor fear that inflation could be on the rise is also prompting bond sales.

"There are two things that the bond market is afraid of," says Jan Randolph, director of sovereign risk at IHS Economics: "One is default; one is inflation."

Mr Randolph says that as signs of growth emerge from European economies, including Spain, Portugal and Ireland, investors worry that inflation will rise, and bonds will become less valuable.

"They're called fixed income for a reason," Mr Randolph says.

Safe haven

Bonds are often regarded as a safe haven for investors.

Many investors buy into fixed income to seek shelter from uncertainty, returning to more volatile assets when the economy seems stronger.

The ECB started to buy €60bn (£45bn) worth of bonds each month under its quantitative easing programme, external earlier this year.

That helped to trigger the change in the debt market, says Mr Randolph.

"What we're seeing is a return to normal," he says.

As the European economy strengthens, investors are less worried about financial crises, and more concerned about inflation.

Rate watch

Investors are also watching central banks warily for potential interest rate rises.

Chicago Federal Reserve Bank president Charles Evans told CNBC that a rate rise could come at any meeting.

Rising oil prices are also raising worries about imminent rate rises, as higher oil prices often prompt rises in inflation.

- Published6 May 2015

- Published22 January 2015

- Published1 November 2022