Summer Budget 2015: What to watch out for in the Budget

- Published

George Osborne will take centre stage again on Wednesday

The last time George Osborne stood up to deliver a Budget, the Conservative MPs in the audience were in a minority.

On Wednesday, he will perform a Budget encore.

No chancellor has given a speech to a Conservative majority since November 1996, so this time he can expect a more rousing reception from the House.

Will this be his chance to try out some new material in front of a favourable audience or will he simply repeat his best bits from the pre-election Budget in March?

The likelihood is there will be a bit of both. So, how will this affect you?

The new stuff

This time, unlike in March, the chancellor will be performing to a Conservative majority

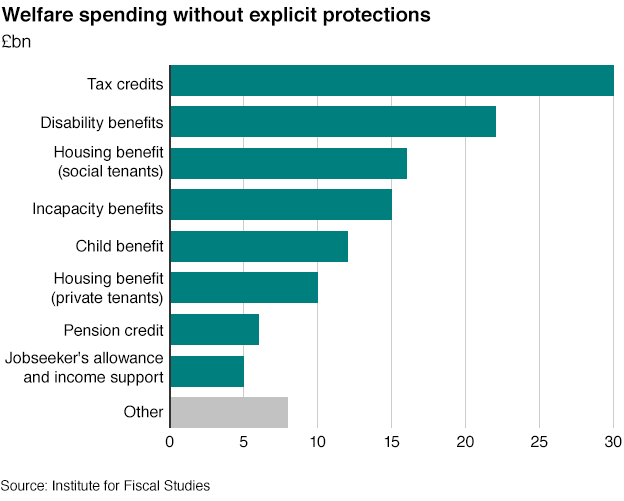

Critics of the chancellor's performance in March said there was not enough detail on how he was going to cut £12bn from the annual welfare budget in two years, as part of a bid to balance the books.

The total welfare bill is £220bn. That includes benefits, tax credits and the state pension. Some £120bn of that is spent on pensioners, about £95bn of which are pensions and universal benefits that the Conservatives have vowed to protect. So, most of the £12bn of cuts will have to come from the £100bn that goes to those of working age.

"He's announced about £2bn [of cuts] and we know nothing about where the further £10bn are coming from," said Paul Johnson, director of the Institute for Fiscal Studies (IFS) on the day after the March Budget.

"He will have to implement some significant cuts in some significant benefits."

The first year of a new Parliament may be the most well-timed opportunity, politically, for Mr Osborne to outline where the axe will fall.

This is expected to include cuts to:

Child tax credits. About four million people receive them, getting £545 per year as a flat payment, plus up to £2,780 per child

The benefits cap, external. Mr Osborne plans to cut the benefit cap to £23,000 in London and to a lower figure in the rest of the country.

Housing benefit, external. Could be stripped from 18 to 21-year-olds who are claiming jobseekers' allowance

The prime minister has spoken about the "merry-go-round" of subsidising low pay with tax credits. This may be an example of "pitch rolling" - preparing the ground for a new policy.

The changes to the benefits cap will extend a pledge in the Conservative party's election manifesto. Housing benefit was also outlined in the party's election programme.

The Budget could include an incentive for businesses to improve the salaries of low-paid workers, to compensate for the blow of tax credit cuts.

New lines

Plans to scrap part of the UK's main sickness benefit, Employment and Support Allowance, are being considered, a leaked Whitehall paper seen by the BBC suggests.

In addition to the welfare cuts, there will be an estimated £30bn cut to unprotected government departments.

There may be some more detail about this in the Budget ahead of a spending review. The impact is likely to be job losses in the public sector, and potential changes to workplace benefits for these employees.

The Conservative manifesto pledged a change to the amount that the wealthy can put tax-free each year into their private pension pots.

This is likely to mean that anyone earning £150,000 a year will be able to put £40,000 a year into their pension. Those earning more will see the maximum contribution level fall on a sliding scale, down to £10,000 for those earning £210,000 a year.

Mr Osborne said in the build-up to the Budget that local authority and housing association tenants in England who earn more than £30,000, or £40,000 in London, will have to pay a larger amount in rent.

Ones we have heard before

Families can already budget for some of the changes due to come in

There have been a lot of announcements in Mr Osborne's previous Budgets and Autumn Statements that people can account for in their personal budgets.

These include:

An increase in how much can be earned before paying income tax, known as the personal allowance, external, from £10,600 in 2015-16, to £10,800 in 2016-17, and £11,000 in 2017-18. The manifesto pledge is for it to reach £12,500 by the end of the Parliament

The threshold at which people start paying 40% income tax to rise from £42,385 to £43,300 in 2017-18. The manifesto pledge is for this to reach £50,000 by 2020-21

A tax-free personal savings allowance, external to apply to the first £1,000 of interest earned on savings for basic rate taxpayers, and the first £500 for higher rate taxpayers from April 2016

A Help to Buy Individual Savings Account will launch in the autumn, through which the government will top up by £50 every £200 saved for a deposit to buy a home up to a top-up limit of £3,000

A family home allowance of £175,000 in inheritance tax means that a married couple or civil partners can potentially leave property worth up to £1m to their children without an inheritance tax charge from April 2017

The amount that can be saved in a pension free of tax over the course of a lifetime will fall from £1.25m to £1m from April 2016

Currently there is a 1% cap on rises in public sector pay and working age benefits

The national minimum wage will increase by 20p an hour to £6.70 from October. The hourly rate for younger workers will also rise, and for apprentices it will go up by 20% - or 57p - to £3.30 an hour

A plan for a fully flexible cash Individual Savings Account (Isa) was announced in the last Budget but required consultation with providers. This will allow savers to take money out, and put it back in later in the year, without losing any of their tax-free entitlement. This is scheduled to be introduced in the autumn.