Warren Buffett's Berkshire Hathaway buys Precision Castparts

- Published

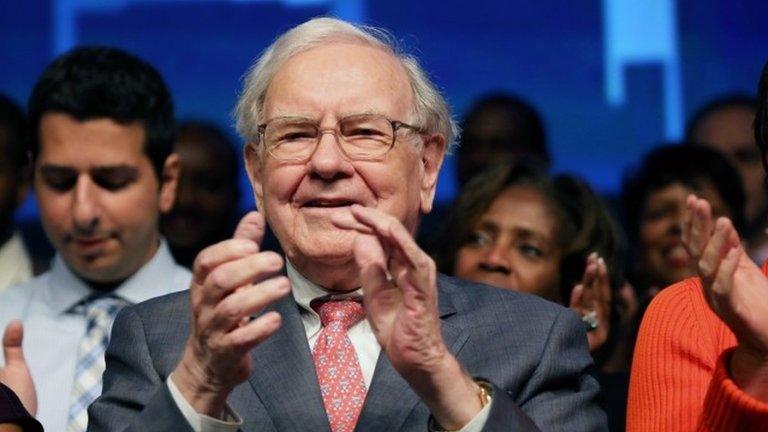

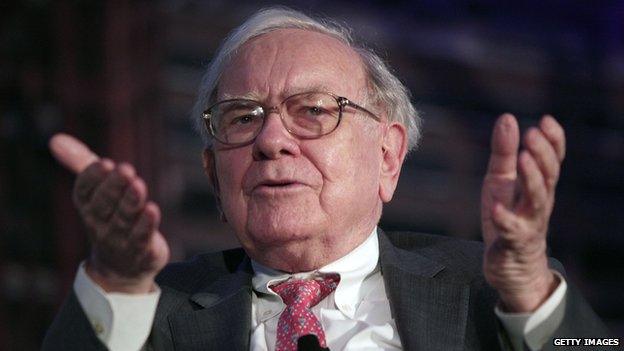

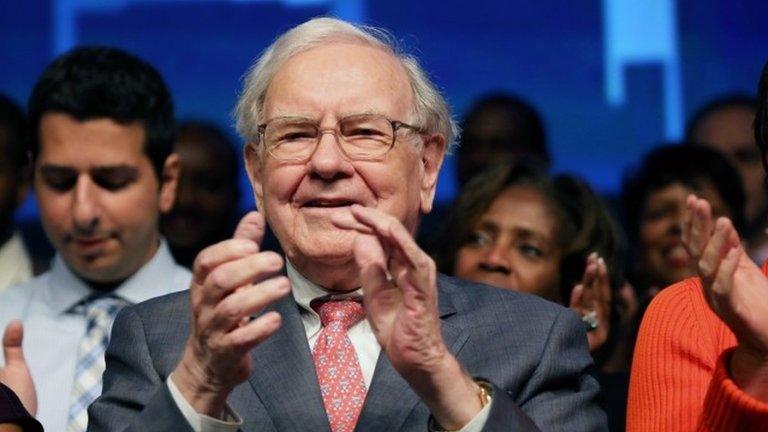

Warren Buffett's investment firm Berkshire Hathaway has agreed to buy aircraft components manufacturer Precision Castparts Corp (PCC) in a deal worth $37.2bn (£24bn).

Mr Buffett said he had "admired PCC's operation for a long time".

Berkshire Hathaway said it expected the deal, which is subject to PCC shareholder approval, to close during the first three months of next year.

If the deal goes through, it would be the biggest buy-out Berkshire has made.

"For good reasons, [PCC] is the supplier of choice for the world's aerospace industry, one of the largest sources of American exports," Mr Buffett said, external.

"Berkshire's board is proud that PCC will be joining [us]."

Talking to US media, he added: "When you get a chance to buy a wonderful company, there is usually some reason why you are getting that chance and perhaps a slump in oil and gas helps us in this case".

The oil price has fallen by more than 50% in the past 12 months, reducing demand for components in some industries, not least oil and gas exploration.

'Compelling'

The price being paid represents $235 a share, and the announcement of the deal sent shares in PCC sharply higher in early trading, to $230, up almost 20% on Friday's closing price.

Mark Donegan, PCC chief executive, said the deal offered "compelling and immediate value for our shareholders".

Analysts said the deal was likely to go ahead.

"Although the takeout price looks a little low to us, we doubt if PCC's shareholders will say no to Warren Buffett, especially given the year-to-date performance in a tough equity market," said Robert Stallard from RBC Capital Markets.

In the past 12 months, shares in PCC have fallen almost 30%.

The company makes complex metal components for the aerospace, power and industrial sectors.

- Published25 March 2015

- Published13 November 2014

- Published16 October 2014

- Published2 October 2014