Asian markets down as yuan falls further

- Published

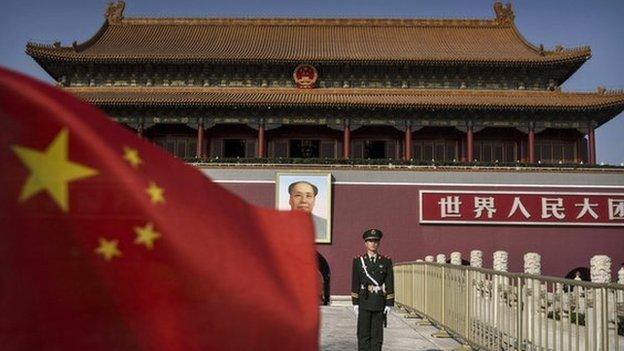

Why has China devalued the yuan?

Asian shares fell again as China's central bank guided the value of the yuan down against the dollar for a second consecutive day.

The People's Bank of China fixed the daily midpoint for the currency down 1.6% to 6.3306 against the dollar.

The Shanghai Composite share index closed down 1.1% at 3,886.32 while markets in the rest of the region fell even more sharply.

Hong Kong's Hang Seng index ended 2.4% lower at 23,916.02.

China's central bank tried to calm market concerns on Wednesday, saying that there was no basis for a sustained depreciation of the yuan given global and domestic economic conditions.

Overnight, US stocks had fallen sharply in reaction to Beijing's surprise decision, leading to a negative start to morning trading across Asia.

In Japan, the Nikkei 225 index, closed down 1.6% at 20,392.77.

South Korea's benchmark Kospi index ended the day down 0.6% at 1,975.47.

However, Korean carmakers bucked the downward trend. Strong sales figures for Kia and Hyundai helped shares in both of their companies rose by more than 5%.

Also, feeling the aftershocks of China's surprise move, the Australian S&P/ASX 200 index finished 1.7% lower at 5,382.10.

Shares in the country's biggest bank, the Commonwealth Bank of Australia, were halted from trading as the lender announced a A$5bn capital-raising in order to meet stricter regulatory requirements.

- Published12 August 2015

- Published12 August 2015

- Published11 August 2015