HBOS' demise: How it happened

- Published

HBOS was the result of a merger between the Bank of Scotland and Halifax plc

The long-awaited report co-authored by two regulatory bodies - the Bank of England's Prudential Regulation Authority and the Financial Conduct Authority - was finally published on Thursday.

The report has shed more light on the reasons behind the demise of HBOS bank.

Yet, how could HBOS, the result of a merger of a traditional building society and a prudent Scottish banking institution, go so wrong so quickly?

The marriage between the Halifax Building Society and The Bank of Scotland was valued at £30bn, but it collapsed just seven years later - with all of that value completely wiped out.

HBOS became part of the Lloyds Banking Group and needed a £20.5bn injection from UK taxpayers to prevent it from crashing.

The three men at the top of the organisation; chairman, Lord Stevenson and two chief executives, James Crosby and Andy Hornby were blamed for the collapse by a group of MPs.

Senior executives said that the bank's failure was due to the market's reaction following the collapse of Lehman Brothers. However, MPs accused the bank of "reckless" lending policies, and in fact by 2008 the gap between loans and deposits was a staggering £213bn.

The Halifax Building Society became Britain's fifth-biggest bank when it demutualised in 1997

Early days

1997: Halifax Building Society is demutualised and becomes a new bank - Halifax plc. More than 7.6 million customers receive an allocation of shares worth around £2,500 at the time

2001: HBOS is formed from the merger of Halifax and Bank of Scotland, with James Crosby as its chief executive.

Investigations

2002- 2003: The regulator at the time, the Financial Services Authority (FSA) conducts a full risk assessment of HBOS. It identifies the need to "strengthen the control infrastructure within the group".

It also commissions a report from PricewaterhouseCoopers (PwC) on the HBOS risk management framework.

The FSA expresses concern about HBOS's failure to properly address the 2002 review's findings by increasing the capital requirement on the bank by 0.5% to 9.5%.

2004: Despite his role at HBOS, Mr Crosby is appointed as non-executive director of FSA. Discussions at HBOS board meetings say FSA was reported as viewing HBOS as an "accident waiting to happen". FSA commissions PwC to undertake a skilled persons review.

Having conducted another risk assessment of HBOS, the FSA concludes that "the risk profile of the group had improved and that the group had made good progress", but it adds that "the group risk functions still needed to enhance their ability to influence the business".

2006: The FSA writes to HBOS with another full risk assessment saying that "the growth strategy of the group posed risks to the whole group and that these risks must be managed and mitigated".

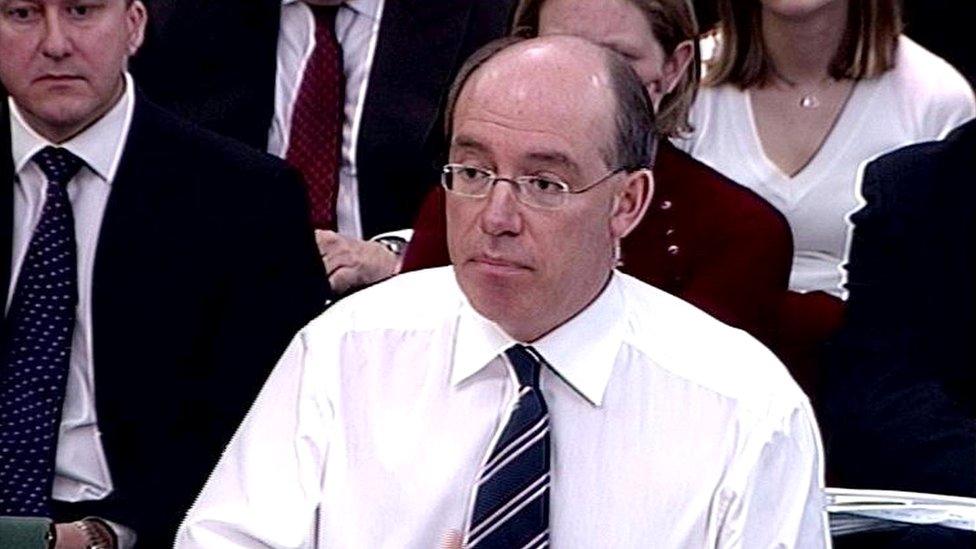

Sir James Crosby appearing before a Commons Select Committee, 1 February 2005

James Crosby's knighthood is announced in the birthday honours list and in July he steps down from his job at HBOS. Andy Hornby, aged 38, takes over. The former Asda executive is promoted from chief operating officer to the top job

2007: Sir James Crosby is appointed to the role of deputy chairman of the FSA.

The Lloyds takeover

2008: The FSA writes to Peter Cummings, HBOS's head of corporate lending, to inform him that the review has identified shortcomings in the sphere of credit risk management and processes.

In July, having raised £4bn through a rights issue, only 8% of which is taken up by existing shareholders, HBOS reveals that its six-month profits have fallen 72%.

Lloyds TSB announces it is to take over HBOS in September. The deal follows a run on HBOS shares.

The following month, as part of government plans to recapitalise the banks, Lloyds TSB and HBOS receive £17bn of public money between them.

2009: Paul Moore, HBOS's former head of risk, who was dismissed five years earlier alleged to the Treasury Select Committee that he'd been sacked by Crosby for raising concerns about risky lending

In February Sir James Crosby resigns from the FSA, although he maintains that Mr Moore's allegations do not have any merit. Lloyds Banking Group stuns the City by revealing £11bn of losses at HBOS.

Lloyds chairman Sir Victor Blank is forced to step down after losing the confidence of major shareholders.

Andy Hornby receives an annual pension entitlement of £240,000 when he leaves HBOS. He parts company with the bank once the merger with Lloyds has been completed.

In 2008, Lloyds TSB took over HBOS

In November, the government invests another £5.7bn in Lloyds to maintain the taxpayer's stake at 43% after a rights issue.

2010: Lloyds returns to profit for the first time since the banking crisis and earlier than expected.

The bank announces chief executive Eric Daniels will stand down in 2011, surprising the City. He is eventually succeeded by Santander boss Antonio Horta-Osario.

Punishment?

2012: FSA censures HBOS but decides to not to impose a fine in order to save taxpayers' money. Former director, Peter Cummings is fined £500,000 and banned from financial services.

2013: Parliamentary Commission on Banking Standards publishes report titled: "An Accident Waiting to Happen: The failure of HBOS".

MPs call for the regulator to consider bans from financial services for senior HBOS executives after the report highlights individual and regulatory failures. It says that the bank's former bosses Sir James Crosby, Andy Hornby and Chairman Lord Stevenson were guilty of a "colossal failure" of management.

A 2013 Parliamentary report called HBOS "an accident waiting to happen"

Sir James asks for his knighthood to be taken away and says he is "deeply sorry" for his role in HBOS's failure. He also offers to hand back 30% of his annual £580,000 pension - though will still collect £406,000 a year - 80 times as much as the average private sector worker. He also quits his £125,000-a-year role on the board of catering company Compass.

After a three-year investigation the Crown Prosecution Services charges and bails 11 people, including HBOS Reading branch manager Lynden Scourfield, other bank executives, business associates and their wives. Charges include conspiracy to defraud, hiding the proceeds of crime and blackmail. They deny the charges.

The trial is repeatedly postponed at the request of CPS because of the "sheer volume of evidence" and is now due to be heard in September 2016.

- Published11 July 2014

- Published3 July 2014

- Published11 June 2013

- Published5 April 2013