UK inflation rate rises to 0.1% in November

- Published

Falling clothing prices helped keep inflation close to zero, according to the ONS

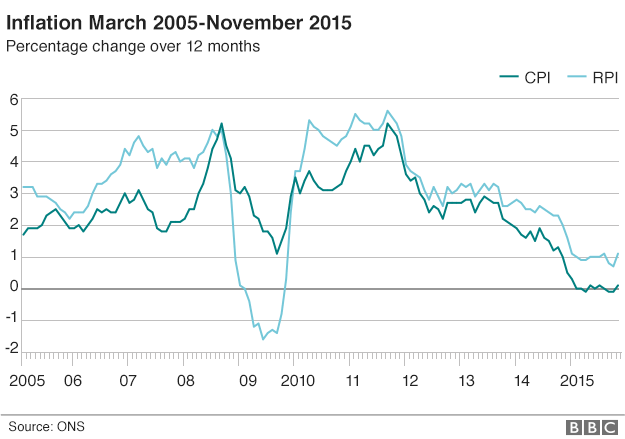

The UK's inflation rate turned positive in November for the first time in four months, official figures show.

The rate as measured by the Consumer Prices Index rose to 0.1%, the Office for National Statistics (ONS) said., external

Transport costs, alcohol and tobacco prices were the main contributors to the rise in the rate, the ONS said.

However, this was partially offset by a drop in clothing prices, which for the first time fell between October and November.

This is usually the time prices rise as shoppers buy Christmas gifts. The ONS said that it logged prices before Black Friday sales discounts took effect.

Monthly inflation has been between -0.1% and 0.1% for the past 10 months, with low oil prices and a fiercely competitive environment for supermarkets keeping prices down for consumers.

November's inflation rate compares with a rate of -0.1% a month earlier. Analysts had expected a figure of about zero.

Last week, UK interest rates were left unchanged again at 0.5% by the Bank of England's rate-setters.

The nine policymakers on the Monetary Policy Committee voted 8-1 for no change, with the Bank predicting that inflation will stay below 1% until the second half of next year.

Inflation remains well below the Bank's 2% target, and the absence of inflationary pressures has led analysts to push back their estimates of when UK interest rates might rise.

"UK inflation remained largely absent in November, and looks set to remain weaker for longer than forecasters have recently been expecting," said Chris Williamson. chief economist at data firm Markit.

"Falling prices for oil and other commodities are helping drive down companies' costs.

"Weak wage pressures and fierce competition in the retail sector are also helping keep a lid on prices. Hence clothing prices showing a record fall between October and November."

Ben Brettell, senior economist at broker Hargreaves Lansdown, said that while core inflation - which strips out volatile components such as food and energy - had risen slightly, it "remained weak at 1.2%".

"This offers little suggestion that underlying inflationary pressures are building in the UK economy. Furthermore there are signs that wage growth is flattening out - figures due out tomorrow are expected to show pay growth has slowed from 3.0% to 2.5%."

Inflation as measured by the Retail Prices Index (RPI) was 1.1%, up from 0.7% in October.

RPI includes housing costs such as mortgage interest payments and council tax, whereas CPI does not.

- Published11 December 2015

- Published10 December 2015