The global oil glut is squeezing the US shale industry

- Published

Petrol at one Michigan service station hit 47 cents (33 pence) a gallon last Sunday as a price war between local stations forced the owner to reduce prices to levels not seen in decades.

The sub-dollar level is unusual even in the US, where the average national price on Sunday was $1.89, according to the American Automobile Association.

But the steep drop in Michigan is indicative of the struggle engulfing the oil industry in the US and globally. Growing competition, excess supply and shrinking demand are forcing the price of oil to record lows.

The average price of a gallon of petrol has been falling fast in the US

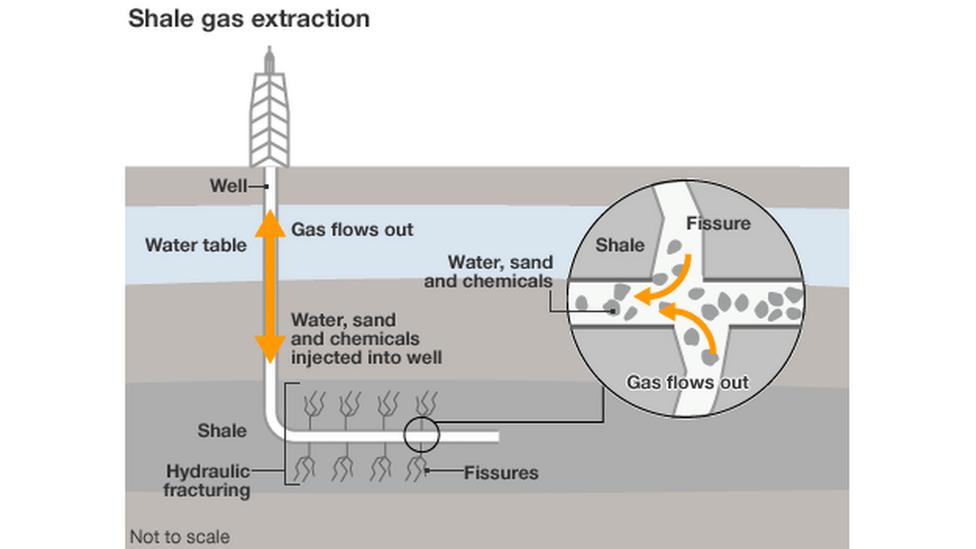

In the US, perhaps, no group understands this more clearly than the hydraulic fracturing (fracking) industry - the producers of shale oil and gas.

Frack this

Fracking took off in the US in 2010 as a means to extract large reserves of oil from within hard rock.

The industry had support from the government as a means of achieving energy independence and bringing down prices at the pump.

As a worldwide oversupply has grown and the price of oil has dropped to a 12-year low - below $30 a barrel - many shale oil producers have been forced to shut their doors or make cuts to keep costs down.

By November last year, 93,800 people had been laid off by US-based energy companies in 2015, according to research compiled by Challenger, Gray & Christmas.

Research suggests 93,800 workers were laid off by US-based energy firms by November 2015

"All the companies that survive will be leaner and be able to do more with less," says Sam Ori, executive director of The Energy Policy Institute at the University of Chicago.

According to law firm Haynes & Boone, 42 oil and gas companies filed for bankruptcy in North America in 2015. This number is expected to increase this year as the industry struggles to cope with mounting corporate debt and oil prices that have dropped 70% in 18 months.

A third of US oil and gas companies could be gone by the middle of 2017, according to Wolfe Research.

Oversupply

Getting to that leaner point will not be easy.

The US shale oil boom took off in just a few years and now adds millions of barrels per day to the global supply.

OPEC, a powerful group of big oil producing nations, typically cuts output to maintain prices

And global oil inventories continue to grow after OPEC's (Organization of the Petroleum Exporting Countries) decision to keep output high.

OPEC, a group of some of the largest oil producing nations, typically cuts production to keep global oil prices high. In the face of growing US competition driving prices down, the group opted to maintain high levels of production, resulting in a global oil glut.

There was an excess of 2.6 million barrels of oil produced each day in 2015, according to the International Energy Agency (IEA).

Face with this excess, and resulting low prices, US frackers are cutting costs. Many have opted not to drill new wells, instead focusing on creating technologies that allow them to get more oil out of the wells they have already drilled.

According to Mr Ori, the number of shale producers that has failed is smaller than many expected, but most analysts still anticipate consolidation in 2016 as companies merge or buy up weaker rivals.

To cope with falling oil prices, US shale companies are getting leaner

Cutting costs

One reason the situation is expected to be so hard in the US is because the cost of fracking is much higher than other extraction methods.

Fracking requires drilling horizontally into rock and then blasting water at high pressure to extract oil and gas.

To get started, many companies relied on debt, which they guaranteed with oil reserves. As the price of oil has dropped, it has become harder for companies to pay off this debt and harder to convince banks to extend new loans.

"The cash flows that companies are turning out are lower and they have less borrowing capacity because lenders are more nervous," says Dan Pickering, head of asset management at Tudor, Pickering, Holt & Co, an energy focused investment bank.

According to him, the lack of access to borrowing and lower cash flows have made it harder for frackers to reinvest in new projects. This lack of investment could see supplies shrink and prices rise.

'Tightening up'

This rebalancing could still take several years. According to the IEA, global demand for oil is expected to grow by just 1.2 million barrels a day in 2016 a slowdown from the growth of 1.8 million barrels per day in 2015. This will make it more difficult to cut the oversupply particularly as OPEC, US shale producers and new oil producers like Iran add to the inventory.

Many projects are now being put on hold due to financing difficulties

In a report published this week, the IEA estimated the global oil industry would produce 1.5 million excess barrels per day in 2016.

"This inventory overhanging will have to be drawn down for the market to tighten up," says Mr Pickering, though he is still convinced oil prices will pick up by the end of the year.

"The under investment that is happening in the oil patch will translate to lower supply and that will be most visible in North America, and that will show up in the rest of the world in 2017 or 2018," he says.

Most oil companies, especially in the US, are not counting on that increase. The industry is expected to see more job cuts on top of the over 250,000 global layoffs that took place in 2015, making the overall outlook for the industry pretty bleak.

- Published18 January 2016

- Published4 January 2016