Steel imports from China investigated by European Commission

- Published

The European Commission is opening three investigations into steel products made in China as cheap imports add to the woes of the UK industry.

It said it would not allow "unfair competition" to threaten Europe.

Producers of steel in the UK have laid off thousands recently and there have been warnings of more to come.

It is the latest probe into cheap imports from non-EU countries. There are nine other anti-dumping investigations already under way.

The EC said it was investigating steel products including seamless pipes, heavy plates and hot-rolled flat steel.

Europe also brought in provisional anti-dumping duties on cold-rolled flat steel from China and Russia.

Recent months have been marked by a slew of job loss announcements from the UK's remaining steel producers, most of which is foreign-owned these days.

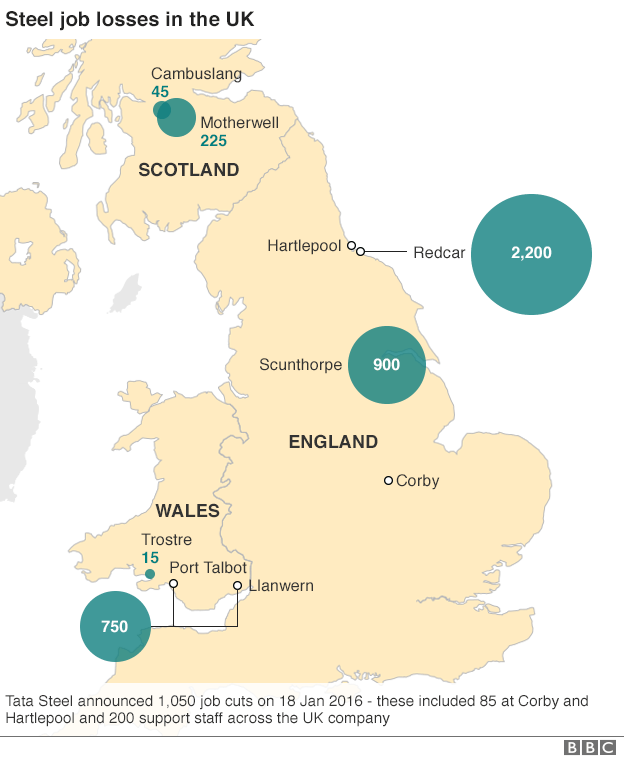

Tata Steel last month said another 1,050 jobs would go from its UK operations, adding to the 1,200 jobs axed by the Indian-owned giant last October and the 720 jobs it cut in July.

Also in October, Thailand's SSI announced it was closing down its Redcar works with the loss of 2,200 jobs, then parts of Caparo Industries' steel operations went into administration putting 1,700 jobs potentially at risk.

Last week, the Luxembourg-based steel giant ArcelorMittal blamed China for its $8bn loss last year.

'Threat'

EU Trade Commissioner Cecilia Malmstroem said in a statement: "We cannot allow unfair competition from artificially cheap imports to threaten our industry. I am determined to use all means possible to ensure that our trading partners play by the rules."

The UK steel industry says it has been hit by a combination of factors: the strength of the pound, relatively high electricity prices, the extra cost of climate change policies, and competition from China - which is believed to be selling steel in the UK at unrealistically low prices.

Last month, the steel industry warned of more job losses as a result of the EU's failure to impose high import tariffs.

UK Steel said that Chinese companies have taken more than 45% of one part of the market, the UK rebar market, having had none of it four years ago.

The main maker of rebar in the UK is Celsa Steel, the Spanish-owned steelmaker, which is based in Cardiff.

Analysis: Tim Bowler, business reporter

Demand for steel worldwide has not returned to pre-financial crash levels. With economies - particularly China's - still seeing weak growth, global demand for steel is set to remain sluggish, falling by 1.7% in 2015 and rising by 0.7% in 2016.

A strengthening pound has been one of the factors making UK steel expensive, external on the international markets.

In summer 2015, sterling reached a seven-year high against a basket of currencies, after Bank of England Governor Mark Carney signalled the first rise in interest rates since the crash could sooner than expected.

At the same time, global steel prices have fallen sharply. Meanwhile, China's own economic slowdown has led Chinese producers to seek export markets as their home demand has stalled.

As a result, UK imports of Chinese steel have increased dramatically. In 2014 the UK imported 687,000 tonnes of steel from China compared to 303,000 tonnes the year before.

- Published30 March 2016

- Published18 January 2016

- Published29 January 2016

- Published28 January 2016

- Published19 January 2016

- Published20 January 2016

- Published18 January 2016