EDF finance chief quits ahead of Hinkley Point decision

- Published

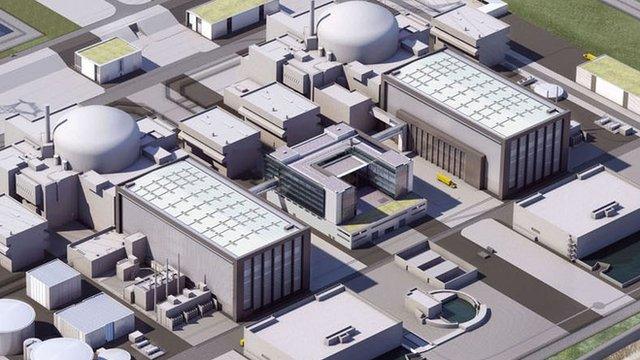

The new nuclear plant will be built next to two existing facilities at Hinkley Point in Somerset

EDF has confirmed that its finance director has quit ahead of an expected final investment decision on the £18bn Hinkley Point nuclear power plant.

Thomas Piquemal stepped down because he feared the project could jeopardise EDF's financial position, according to reports.

EDF shares are trading 6.6% lower.

Last month, Chris Bakken, the director of the project that could produce 7% of UK electricity by 2025, said he was leaving to pursue other opportunities.

Jean-Bernard Levy, chairman and chief executive of EDF, said Mr Piquemal told him of the decision to leave last week and that he regretted the "haste" of Mr Piquemal's departure.

The company's board is expected to finalise in April how it will fund the project after postponing the decision a number of times.

Mr Levy said the board was studying the investment in Hinkley Point to ascertain the best way to finance the power plant. He added that EDF aimed to announce a final investment decision "soon".

EDF has provisionally appointed Xavier Girre, who joined the company last year as finance director of its French business, as the group finance chief.

Analysis: Kamal Ahmed, BBC Economics Editor

At first take, it might appear the resignation of a company's finance director reveals a business in crisis.

And EDF's share price fall this morning seems to bear that out.

But, for supporters of the building of a new £18bn nuclear power station at Hinkley Point in Somerset - the world's most expensive power project - the resignation of Thomas Piquemal looks like clearing the way for the EDF board to give the final go-ahead for the scheme.

Mr Piquemal was widely reported as being a trenchant critic of the costly nuclear project.

His fate appears to have been sealed last week when the French government, which largely owns EDF, confirmed that it is still backing the scheme

That came after the meeting between Francois Hollande and David Cameron - also an enthusiastic backer.

On this occasion, political will has trumped any financial concerns.

A global surge in nuclear power investment

The project has been plagued by delays, but publicly the firm has insisted a decision to move forward is imminent.

In October last year, EDF agreed a deal under which China General Nuclear Power Corporation (CGN) would pay a third of the cost of the £18bn project in exchange for a 33.5% stake.

But according to reports, EDF is struggling to find the cash for its remaining 66.5% stake and is seeking help from the French government, which owns 84.5% of EDF.

Hinkley is expected to provide 7% of the UK's electricity once it is operational

The company is also facing opposition from French union officials, who have suggested that investment in Hinkley Point C should be delayed until 2019.

The CFE-CGC Energy union said there were problems with a similar reactor design in France that needed to be solved.

Francois Raillot from the union which has a seat on EDF's board, said the company could sell some assets to finance Hinkley Point, but added: "It is a very bad time to do it because the price of energy is so low.

"The state, which is a shareholder, will have to give [EDF] money to do it. But another problem is that the French state has no money."

The new Hinkley plant was originally due to open in 2017, and it has come under fire for both its cost and delays to the timetable for building.

The British government has also been criticised for guaranteeing a price of £92.50 per megawatt hour of electricity - more than twice the current cost - for the electricity Hinkley produces for 35 years.

A UK Government spokesperson said: "We continue to fully support the project and President Hollande said himself on Thursday afternoon that it has the full support of the French Government."

Financing issues

Tony Roulstone, from the Cambridge Nuclear Energy Centre, said the departure of Mr Piquemal was "a big blow".

He said EDF was already facing a number of other financing issues, including a decision to buy a majority stake in Areva's nuclear reactor unit, adding: "They are committed to upgrading their existing power stations in France at a cost of €55bn over 15 years."

"At a commercial level there is a way for the government to step aside but at a political level, this is part of the energy strategy," he said.

Tom Greatrex, the chief executive of the Nuclear Industry Association, said: "What I think is vitally important is we get a decision on Hinkley, and then we get on with replacing our generation stock which is going off line.

"We need new nuclear as part of that low carbon balance linked to the future. And Hinkley is an important part of that."

Tom Burke, chairman of environmental think tank E3G, said there was now "a serious question mark" over the future of Hinkley Point.

"You've now had two senior people leave within a month, both clearly having trouble convincing their colleagues to go ahead in the direction that their colleagues want to go."

- Published7 March 2016

- Published1 March 2016

- Published3 February 2016

- Published27 January 2016

- Published25 September 2015

- Published21 September 2015