Tata Steel: 'Nationalisation not the answer' says Javid

- Published

Business Secretary Sajid Javid says UK steel industry is "absolutely vital" for UK

Business Secretary Sajid Javid says nationalisation is not the answer for the Port Talbot steel works in Wales.

Indian owner Tata Steel is planning to sell its entire UK business, which employs about 15,000 people.

A Labour Party call for Parliament to be recalled early has been rejected, but the prime minister will chair a meeting of key ministers on Thursday.

Mr Javid is cutting short a trip to Australia - and says he is looking at some kind of government support.

'Absolutely vital'

"I don't think that nationalisation is going to be the solution," he said.

"Because I think everyone would want a long-term viable solution, and if you look around Europe and elsewhere, I think nationalisation is rarely the answer, particularly if you take into account the big challenges the industry faces."

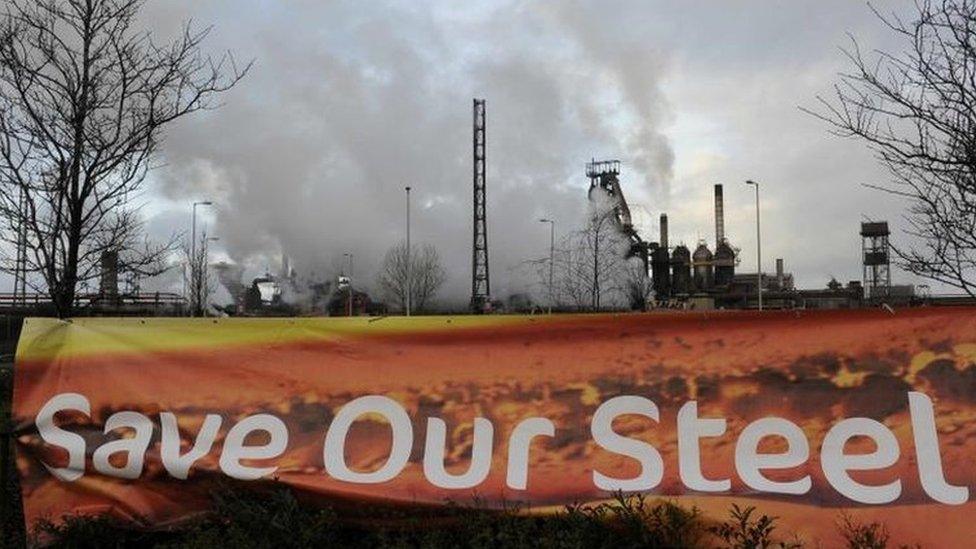

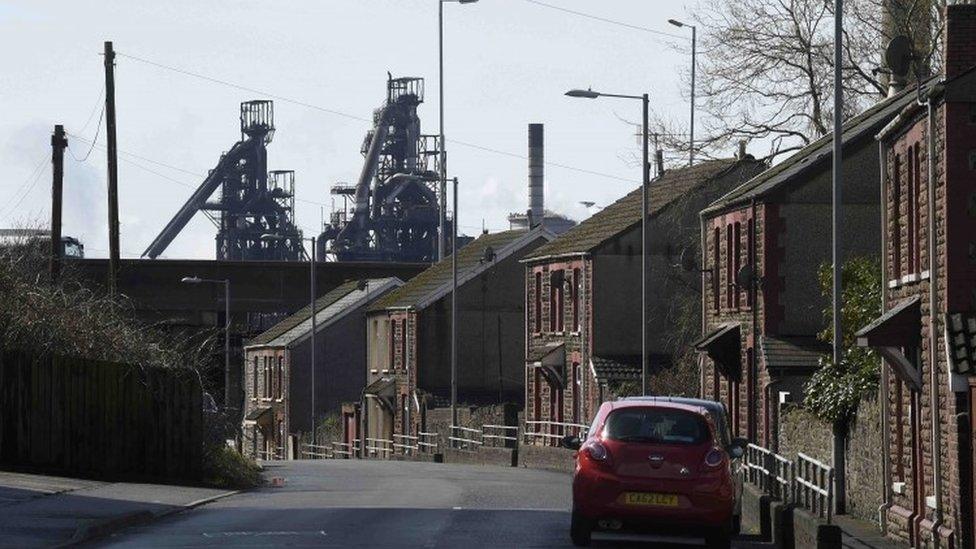

Tata's Port Talbot site employs 5,500 of Tata UK's current 15,000-strong UK workforce.

Prime Minister David Cameron spoke to Welsh First Minister Carwyn Jones this afternoon and "agreed it was an extremely worrying time for the workers and wider community in Port Talbot, and South Wales more broadly", a Downing Street spokesperson said.

The UK and Welsh governments will work "to do everything possible to secure the future of steel making at Port Talbot and elsewhere in the UK", and the governments will "support a sales process" and "remain in close contact in the days ahead", the spokesperson added.

Jeremy Corbyn visited Port Talbot on Wednesday

Labour leader Jeremy Corbyn travelled to Port Talbot, and criticised the government for not responding more strongly to the surge in cheap steel imports from China.

He said the government must recall Parliament and do what it takes to keep the UK steel industry alive, and to ensure British-made steel is used to build infrastructure in the country.

Mr Corbyn added: "We are saving an industry that will provide the basis of all the goods that we all need."

Sian Lloyd visited Port Talbot to speak to some of those who could be affected by the future of the steelworks

The Tata decision, which was announced after a board meeting in Mumbai on Tuesday, also affects workers at its other UK plants, including Rotherham, Corby and Shotton.

Mr Javid had arrived in Sydney on Tuesday for what was due to be a three-day trade visit.

He said the "UK steel industry is absolutely vital for the country. We will look at all viable options to keep steel making continuing in Port Talbot."

He also said that there were "buyers out there" and that the government was "more than ready to look at all way we can provide commercial support to secure the long-term future of steelmaking in Port Talbot."

Analysis: BBC deputy political editor James Landale

The government has certainly been caught on the hop. The prime minister and other ministers are abroad. There was no minister in India negotiating with Tata. In contrast, the Labour leader is on the ground in Wales demanding that Parliament be recalled. So the government is playing catch-up.

That said, the government has decided that this is not just about South Wales, that there is a wider strategic interest that is at stake here. That Britain needs a steel industry for its wider manufacturing, infrastructure and defence needs. That is why it is actively considering some form of state aid.

The problem is that there are constraints on government action here. Can it afford to subsidise steel in the long run? Will the EU allow it? Will Tory MPs accept it? So this is one of those crises where there are few easy answers.

'Competitive position'

Tata Steel said it could not give an "open ended" commitment to keep the UK plants open while a buyer was sought.

Explaining its decision sell the UK business, Tata said trading conditions had "rapidly deteriorated" in the UK and Europe due to a global oversupply of steel, cheap steel imports, high costs and currency volatility.

Tata chief Koushik Chatterjee: "We've taken a significant amount of impairment"

"These factors are likely to continue into the future and have significantly impacted the long-term competitive position of the UK operation," it said.

Koushik Chatterjee, a group executive director of Tata Steel, told the BBC, the company wanted to move quickly to secure that sale.

He said Tata must cut its losses in the UK, where it had lost £2bn in five years, and the sale price was not the most important issue: "It [Tata's UK steel business] has become quite a burden for the company. It is not a valuation exercise, it is an exposure exercise.

"The view the board took finally was we can't sustain this kind of exposure. So it's not about the bid being low or high. It's about some one being willing to buy the business."

Tata's Scunthorpe plant is in the process of being bought, and last week a deal was agreed to sell its two plants in Scotland.

One option for Port Talbot, which is the UK's biggest steel plant, would be a management buy-out.

Sources say that unions and management at Tata Steel have already come up with with a turnaround plan for the 100-year old plant.

The Welsh Assembly has been recalled to discuss the crisis.

'Important link'

The Welsh government-led Tata Taskforce will hold its first meeting on 4 April. It will be chaired by the Minister for Economy, Science and Transport, Edwina Hart, and also include representatives from the Community union and Tata.

Roy Rickhuss, general secretary of the trade union Community, who met representatives from Tata in Mumbai on Tuesday said: "We will not let the steel industry in the UK die. We are not going silently into the night."

Meanwhile, a Network Rail spokesperson said: "British steel is absolutely central to our Railway Upgrade Plan - we buy more than 140,000 tonnes of rail each year and 98% of that is made in Britain.

"Tata Steel is one of the most important links in our supply chain, providing the majority of our steel rail from its subsidiary, Longs Steel UK Ltd, in Scunthorpe.

"We're certain that both Longs Steel and its current prospective buyer remain absolutely committed to helping us build a bigger, better railway for Britain."

- Published30 March 2016

- Published30 March 2016

- Published30 March 2016

- Published30 March 2016

- Published30 March 2016

- Published30 March 2016

- Published30 March 2016

- Published30 March 2016

- Published29 March 2016

- Published29 March 2016

- Published23 March 2016