Why you can't keep the yen down

- Published

Bazookas. Quantitative Easing. Negative interest rates.

Whichever way you look at it, the Bank of Japan has used pretty much everything it has to try to jumpstart the economy.

But as Frederic Neumann, co-head of Asian Economics at HSBC bank in Hong Kong said in a recent report, external "things haven't exactly gone to plan".

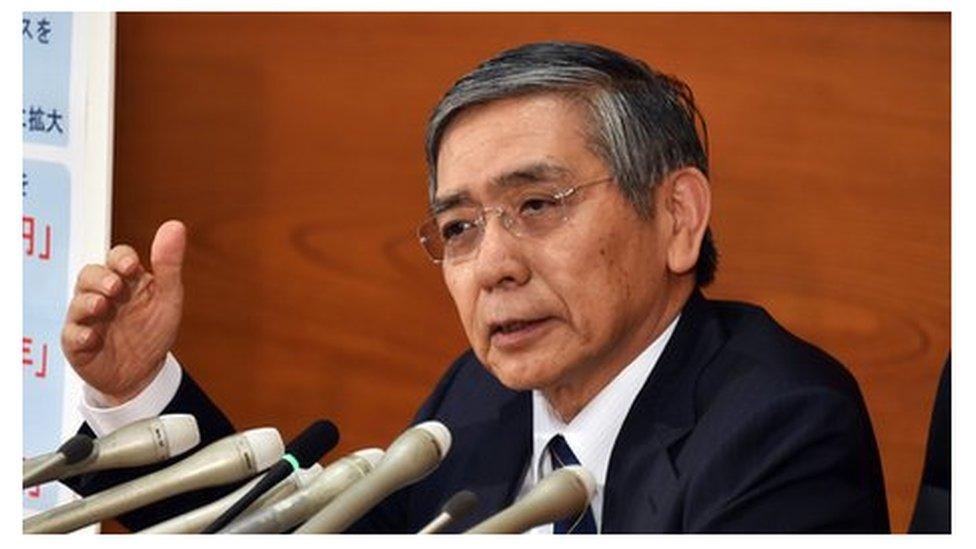

It's not just a worry for Japan's central bank governor Haruhiko Kuroda, but also for all of his counterparts who are meeting in Washington this week at the International Monetary Fund and World Bank's Spring gatherings. Japan's attempts to get its economy growing again have been closely watched by central banks around the world.

Mr Kuroda and his deputies will likely be in the hot seat in Washington over what their next moves will be, particularly with regard to the yen.

But what can the Bank of Japan realistically do next?

The Japanese dilemma

The Bank of Japan wants the yen to weaken, so that Japanese exporters - car-makers, motorcycle companies and electronics firms - can sell their goods overseas more cheaply - which would in turn help boost businesses' profits.

But even a dramatic move like pushing interest rates into negative territory hasn't worked. The theory is that if interest rates are low there's less incentive to hold on to the currency. But that plan has backfired.

Instead, the yen strengthened to an 18-month high recently, a sign of its safe-haven status as investors worry about the political situation in the US and the fears of Brexit in the EU.

Bank of Japan governor Haruhiko Kuroda and other central bankers are meeting in Washington this week

Not an easy position to be in, or get out of.

Of course, the BoJ could push rates further into negative territory - but that would almost certainly be met with even more incredulity than the very first move into below zero interest rates earlier this year. Or it could intervene in the currency markets, although all it says about this is that it "remains vigilant". And if it does indeed intervene, it risks being labelled a currency manipulator at a time when China is under fire for doing just that.

No easy options

One possible solution proposed by Mr Neumann at HSBC is helicopter money - handing cash directly to Japanese people to spend as they see fit - and, in theory, boost consumption. Controversial - but frankly after negative interest rates didn't work, may be the BoJ is willing to try anything. It has very little ammunition left in its arsenal.

Of course, there is a much bigger problem underlining all of this. Investors may be losing faith in the chaps in charge to steer the economy through these difficult times.

"The market is losing confidence in the ability of central banks to boost the global economy through monetary easing," says DBS bank in an investor report. "The market knows that Japan's economy has been growing sluggishly despite three years of aggressive BoJ easing."

The BoJ meets next on 28 April. It is almost certain the yen will continue to rise before that. Governor Kuroda's next move will be very closely watched indeed.

- Published15 February 2016

- Published7 April 2016

- Published24 March 2016