BHS gets 'multiple offers for some or all' of the chain

- Published

BHS' administrators have received "multiple offers" to buy some or all of the business, the BBC understands.

The offers will now be put to secured creditors for consideration, but the level of interest will raise hopes that some of the 164 shops and almost 11,000 jobs currently at risk can be saved.

Potential buyers had until 5pm Tuesday to submit a firm offer for BHS.

The High Street chain collapsed into administration two weeks ago with debts of £1.3bn.

"It's understood that there have been multiple firm offers for some or potentially all of the business," said BBC business correspondent Emma Simpson.

Those reported to be interested in buying all of BHS include Sports Direct, Edinburgh Woollen Mill and Preston-based millionaire property owner Yousuf Bhailok.

Firms including Swedish furniture chain Ikea and discount chain B&M are reported to be interested in buying parts of the group.

The stores, currently in the hands of administrator Duff & Phelps, will continue to trade as the sales process continues.

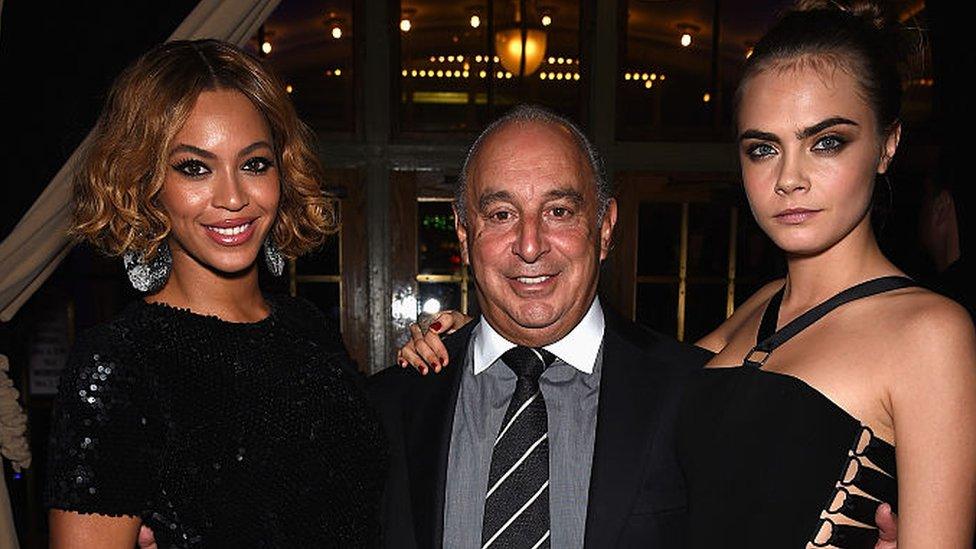

In 2000 billionaire Sir Philip Green bought BHS and made it part of the Arcadia Group, then the UK's second-largest retail empire, but was ultimately unable to stem its losses

BHS was sold for £1 by Sir Philip Green, the owner of Arcadia, 13 months ago.

BHS effectively ran out of cash after its new owners, a consortium called Retail Acquisitions, failed to secure more than £100m of funding for a turnaround plan. It also had a huge pension deficit to service.

Earlier, research indicated the retailer could have saved more than £15m last year if there had not been a delay in the revaluation of business rates.

Colliers International, the commercial real estate agency and consultancy, says business rates at 90% of BHS stores would have been cut, had the last revaluation gone ahead as planned.

In a Commons select committee session on the BHS failure on Monday it emerged that the pensions watchdog was first in discussions with BHS in 2009 about its pension fund deficit.

As soon as the sale of BHS by Sir Philip Green was announced, the Pensions Regulator said it had opened an anti-avoidance case to determine whether the previous owners should be pursued to make up the fund's shortfall.

- Published9 May 2016

- Published10 May 2016

- Published8 May 2016

- Published26 April 2016