What happens when the town bank closes?

- Published

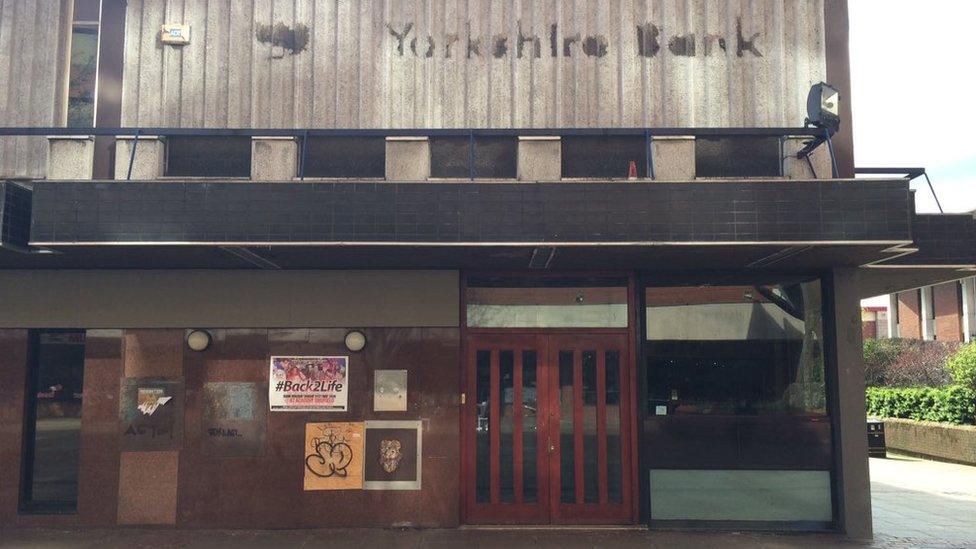

Richard Bolam takes photos of empty shops and banks around Sheffield. This image of the Yorkshire Bank on The Moor was taken on 26 April

More than 600 bank branches have closed in the UK in the past year, according to a BBC report.

People in remote areas have been worst affected, but BBC website users from across the UK, have spoken about how recent closures have affected them.

"It is very difficult if you are self-employed"

Lynda Dellar keeps the books for her husband Roger's art business in Surrey. They changed bank for local branch access.

"Our Barclays Bank in Haslemere closed last November and as I use the bank for paying in cheques regularly, we moved our account to Lloyds. It is very difficult if you are self-employed and still have people who pay you this way.

"My husband is an artist. Picture sales go through the bank, but he teaches and we have classes - and pupils and the Art Society pay by cheque. I'm paying in cheques twice a week. My husband will always work and I will always keep the books.

"I'm with NatWest, who closed in Grayshott recently. Now there are lots of people in the Haslemere branch complaining about coming here."

"We all cram in a post office the size of a very small front room"

James Couling lives in Portsmouth and is medically retired after suffering a brain haemorrhage in 2001. He has no access to a local bank branch.

"Our Lloyds, the only bank in Eastney in Portsmouth, closed this month, leaving our area with no banks at all, just the ones in Portsmouth city centre miles away.

"The bank provided banking for a large area of Eastney, Milton, parts of Southsea and Fratton and all the shops and businesses. Now we all have to cram in a post office the size of a very small front room, it's an absolute joke. The queues are so bad and always out of the door.

"I was due to go to my local bank to discuss taking out life insurance face-to-face with my local staff. I simply don't want to do it online or over the phone. Now the bank is closed I can't be bothered to go all the way over town. I don't drive so have to get a lift.

"With traffic congestion in Portsmouth it takes about 40 minutes to drive into the city centre and then walk down Commercial Road, which is pedestrian-only, then queue, then drive home."

"One's now a domestic appliance shop, one's a coffee shop and the other two are empty"

Birchington in Kent has lost all four of its banks over the past year

Wendy Warner is 52 and suffers from arthritis, diabetes and fibromyalgia but worries how her friends cope with a lack of local bank branches on the coast of Kent.

"Birchington-on-Sea has lost Barclays, NatWest and HSBC in the last year. I banked with Woolwich, which I lost a few years ago.

"One's now a domestic appliance shop, one's a coffee shop and the other two are empty.

"Birchington is semi-urban, one of the largest villages in the country. The number of cashpoints has been drastically cut. Co-op and Sainsburys had to have cashpoint machines put in.

"Birchington is a retirement area full of elderly, disabled and retired people - a lot of my friends from the local church - who do not have laptops, PCs, iPads or mobile phones or the capacity to travel all the way to Margate or Canterbury on infrequent, crowded buses.

"I have a mobile and a computer but if there is a problem you have to go to the bank and, being disabled, this is not very easy.

"The banks need to listen to the majority of their customers in that particular area and cater for them, which was not what was done. Most of the banks here were well-used and you always had to queue. What about a bank-share facility? I know NatWest have a mobile branch, but that was not advertised locally.

"There is a reduced size post office in the Co-op. Of course, elderly and/or disabled people do not have the capacity to wait long with no seating area in the middle of a shop."

"The cash machine was taken out of the wall and bricked up the day the bank closed"

Keith Dunderland's village of Cerrigydrudion had its only cashpoint bricked up the day HSBC closed

Keith Dunderland is a retired engineer in the farming community of Cerrigydrudion in Conwy, Wales.

"HSBC has closed our branch in the village where I live in rural Wales. The cash machine was taken out of the wall and bricked up the day the bank closed.

"We have rubbish broadband speed, 2Mbps if you are lucky and have been told via a customer letter to use the internet for banking.

"It was that or go on a round trip of 25 miles to use the cash machine at the nearest branch. We don't have a mobile signal where we are.

"Lots of old and retired people around here, that generation, has a bit of mistrust of having a banking system on a computer. And they are put off by the cost of running a computer on a limited income just to do their banking.

"We now have a cash machine from HSBC in the wall of a roadside cafe in a dangerous place on the other side of a main trunk road.

"It is often out of cash as visitors use it as well as locals. The last time it ran out, it was a week before the security van arrived to fill it up! This is not an isolated occurrence.

"Like rural broadband, all services in rural areas all over the UK are now at a low point of no investment and understanding of the overall situation that now exists for our communities."