AIIB: Chinese investment paving the new silk road

- Published

"It's seen as yet another challenge to Western domination of the global economy," says Mariko Oi

The China-led Asia Infrastructure and Investment Bank (AIIB) is seen as a rival to the World Bank, and part of Beijing's challenge to US global dominance. As it prepares to convene its first annual meeting, the BBC's Andreas Illmer asks whether Western concerns about Beijing's ambitions for the bank been realised.

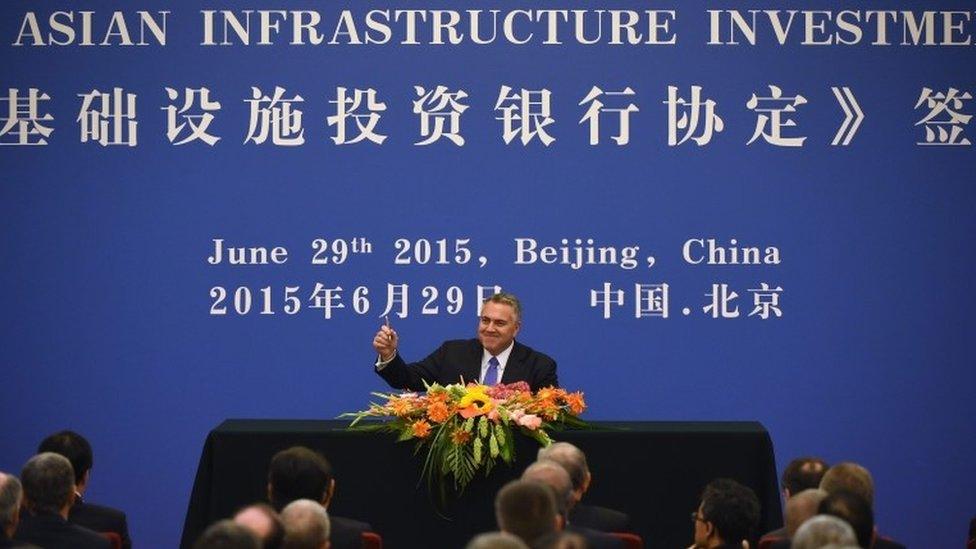

When the development bank was set up in 2015, the US was so concerned it even tried to stop its Western partners from joining.

Most of them joined nonetheless, with the most notable exceptions being Japan and of course the US itself, seen by many as a strong political statement by Washington and Tokyo.

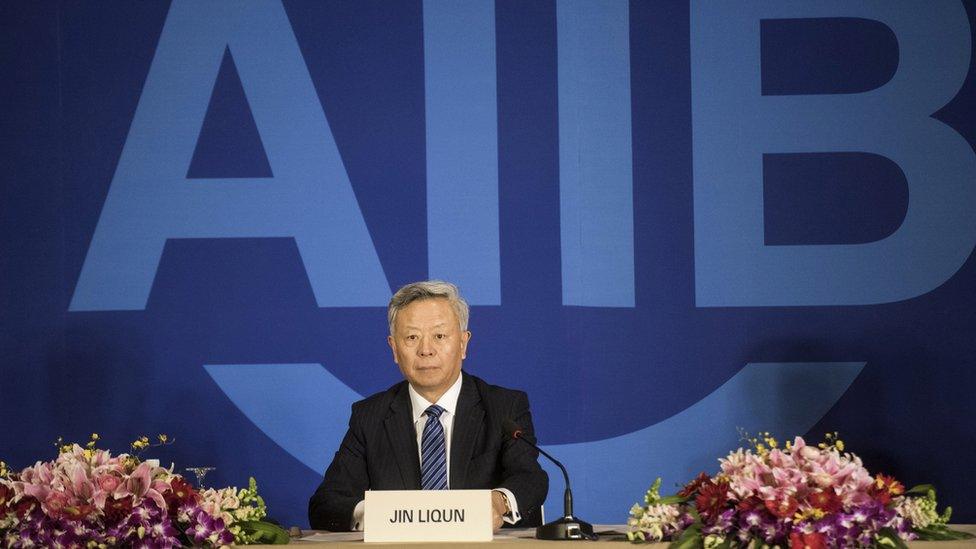

AIIB's President Jin Liqun said Washington risked "forfeiting its international relevance" by opposing the bank, warning no empire had ever governed the world forever.

So has the Beijing backed bank really become a new stage for a US-China clash over who gets the upper hand on the global economic stage? Is there, as its opponents feared, a political bias in the AIIB towards funding projects that will solely benefit China's international interests?

Improving infrastructure along the former silk road would be crucial for China

"It's a very Western view to be threatened by the AIIB - it is when the others do their own thing that we feel threatened," said Antonio Fatas, economics professor with the Insead business school in Singapore.

"But in fact they're doing the same thing that we've been doing for decades and it never threatened us; simply because it's been us doing it."

"In an ideal world, all countries would come together with some amazing institutions and there would be even more collaboration. But that's not realistic, that's just not the way the world works."

What has the bank been doing?

Over the past months, the AIIB has unveiled its first investment projects.

Projects so far have focused on Pakistan, Tajikistan and Bangladesh - all countries which are close to Beijing's economic interests and to its ambitious new silk road project, a plan to develop China's neighbours roughly along the former silk road through Central Asia.

No empire lasts forever, the AIIB's Mr Jin said in an aside to Washington

By doing that, China creates investment opportunities for Chinese companies, markets for its goods and can better connect its inner western provinces to a wider economic framework.

This appears to confirm the concerns that the AIIB will disperse its money close to Beijing's economic interests, making it the investment arm behind the new silk road.

Yet at the same time, these projects are done in co-operation with the AIIB's alleged competitors: The Asian Development Band (ADB) and the European Bank of Reconstruction and Development (EBRD). A project in Indonesia is in fact conducted in alliance with the World Bank.

The ADB has Japan as its main backer, the largest single contributor to the EBRD is the US and the World Bank is based in Washington.

So this co-operation with its Western "competitors" seems to fly in the face of fears that the AIIB would operate as a rival to its Western counterparts or that it would have lower governance standards on human rights and environmental guidelines.

Some observers think China is bound to dominate Asia economically

China pushing to the fore

Despite the tight co-operation with other international lenders, it is likely there will be many more project where AIIB money will be put to use in countries which already have close economic ties to Beijing - or where there are hopes for closer ties in the future.

"I wouldn't put this as purely politics," says Mr Fatas. "It's a combination of political and economic interests but economic interests that make sense. From an economic point of view, China is bound to dominate Asia. It is in fact already dominating most of it."

The fact that other, Western-dominated development banks are joining forces with the AIIB does show that those are projects are also considered worth funding from a European, US or Japanese perspective.

It's no secret that one of the major reasons for Beijing to launch the AIIB was its frustration with not having enough representation in the existing global lenders.

If the future investment projects are funded by a mix of money from the AIIB and whatever other international lender they co-operate with, it might just create that situation Beijing was after all along: global development investments from a pool of countries with Beijing having what it sees as its rightful say in how and where the money is spent.

- Published29 June 2015

- Published13 March 2015

- Published28 June 2015