Boeing signs £3bn deal for nine marine patrol planes

- Published

Boeing's P8 maritime patrol plane

The UK government will buy nine new maritime patrol planes from Boeing in a decade-long deal worth £3bn.

The Ministry of Defence's deal for the submarine-hunting P-8A Poseidon aircraft also covers training, maintenance and support.

Boeing will build a new £100m facility for the planes at RAF Lossiemouth in Moray.

The US company will also deliver 50 Apache AH-64E attack helicopters to the British Army.

Boeing expects to create about 2,000 new UK jobs in the coming years by expanding its maintenance and support operations for both military and commercial customers in Europe.

Prime Minister David Cameron announced the P-8A deal on Monday at the start of the Farnborough Airshow.

He said it showed that the UK was open for business despite the referendum vote to leave the EU.

"Whatever uncertainties our country faces, I want the message to go out loud and clear: the UK will continue to lead the world in both civil and defence aerospace," Mr Cameron said.

Take off for the Farnborough Airshow

A history of the Farnborough Airshow

The P-8A planes will fill a gap in the UK's defence capabilities that has existed since 2010 when the Nimrod was retired.

"Boeing is committed to the UK government's prosperity agenda and we share the goals of enhanced economic growth that the prime minister has set out to us," said Dennis Muilenburg, its chief executive.

Aaron Heslehurst looks at what will be on display at this year's Farnborough Airshow

Boeing has doubled its UK workforce and more than doubled its annual spending with the UK supply chain over the last five years to more than 2,000 people and £1.8bn respectively in 2015.

Separately, the UK government announced a further £365m worth of aerospace research and development, to be jointly funded with industry.

New orders

The Farnborough show is expected to see a crop of aircraft orders announced, although not as many as the record haul of £204bn at the last event in 2014.

Nevertheless, the long-term prospects for the industry are positive, Boeing said.

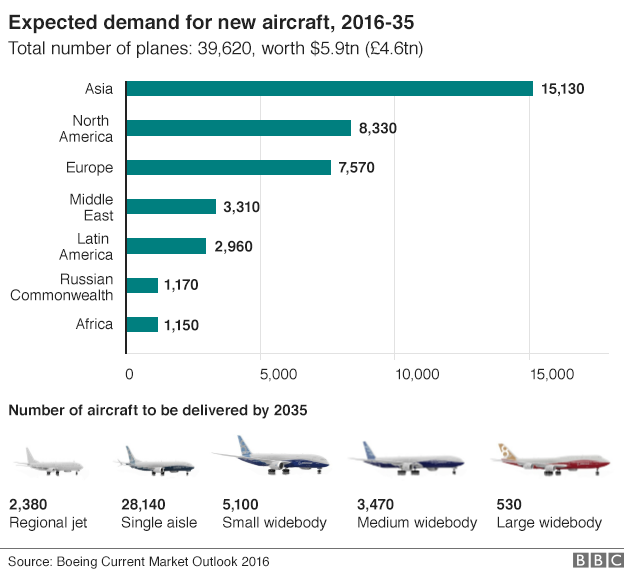

Also on Monday, the company unveiled its latest annual outlook for demand for civil aircraft. Boeing predicted that huge growth in air travel over the next 20 years will mean demand for more than 39,600 new aircraft.

The company said the biggest growth would come from Asia, as airlines and fleet operators expand and replace aircraft.

The increase marks a 4.1% rise on Boeing's forecast in 2015, with the aircraft valued at $5.9tn (£4.6tn).

Passenger traffic will grow 4.8% a year over the next two decades, Boeing said.

"Despite recent events that have impacted the financial markets, the aviation sector will continue to see long-term growth, with the commercial fleet doubling in size," said Randy Tinseth, vice-president of marketing at Boeing Commercial Airplanes.

In an industry that needs long-term planning and investment, Boeing's annual Current Market Outlook, launched on Monday at Farnborough, is regarded as one of the most comprehensive analysis of industry trends.

Boeing said the strongest growth would come from Asia, with demand for 15,130 new aircraft, followed by North America, with 8,330 aircraft. Europe is third, with a demand for 7,570 aircraft.

Narrow-body demand

As well as growth in air travel, demand will also be driven by airlines' need for more fuel-efficient and environment-friendly aircraft.

Boeing said the most popular market segment would continue to be for single-aisle - or narrow-body - aircraft, which are the workhorses of the industry. The US manufacturer predicted that more than 28,000 single-aisle aircraft would be needed over the next two decades.

"Airplanes that size already account for 76% of the current single-aisle global backlog, and our products have the clear advantage in that space," said Mr Tinseth.

Boeing's new 737 MAX is pitched at the booming market for single-aisle aircraft

A report published last week by Alix Partners, a global advisory firm, estimated that Boeing and rival Airbus already had a 13,400-order backlog stretching years ahead, fuelled by demand for narrow-body aircraft.

Boeing and Airbus have been ramping up production of their 737 and A320 families of aircraft to meet the single-aisle demand, and have new products in preparation that they hope will win orders at this week's Farnborough show.

Meanwhile, other manufacturers, including Canada's Bombardier, are trying to chip away at the bottom end of the single-aisle segment.

Demand for larger aircraft, the wide-body segment, will be for 9,100 aircraft, with airlines forecast to step up fleet replacements between 2021-2028, Boeing said.

With cargo traffic forecast to grow at 4.2% a year, Boeing forecast a need for 930 new freighters and 1,440 converted freighters over the next 20 years.