ARM founder says Softbank deal is 'sad day' for UK tech

- Published

ARM founder: 'Sad day for technology in Britain'

The founder of ARM Holdings has told the BBC he believes its imminent sale to Japanese technology giant Softbank is "a sad day for technology in Britain".

Hermann Hauser said he was "very sad" at news of the £24bn ($32bn) takeover which was announced on Monday morning.

The Cambridge-based firm designs microchips used in most smartphones, including Apple's and Samsung's.

ARM, which was founded in 1990, employs more than 3,000 people.

Mr Hauser called ARM Holdings his proudest achievement.

'Real strength'

The man who helped spin ARM Holdings out from Acorn Computers in 1990 also said the technology firm had sold 15 billion microchips in 2015, which was more than US rival Intel had sold in its history.

Mr Hauser said ARM gave the UK "real strength".

He said it was a "British company that determined the next generation microprocessor architecture, that is going to be used in all the next generation phones and - more importantly - in the next generation of the internet of things".

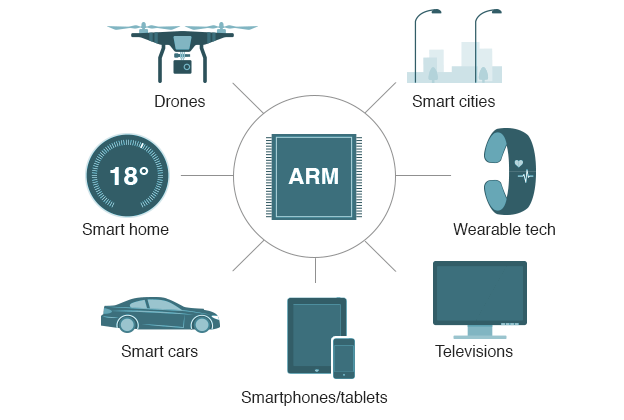

ARM microchips used in many technologies

Televisions - Many modern televisions now run apps, allowing them to provide Netflix and other internet-based services, which are powered by ARM-based processors. The company's technology is also used in TV set-top boxes and remote controls

Smartphones and tablets - ARM's chip designs are at the heart of the vast majority of smartphones as well as many tablets. E-readers and digital cameras typically rely on ARM's technology as well

Drones - Drones are just one of a growing number of products to rely on tiny computer chips called microcontrollers - other examples include the controls for buildings' air-conditioning and lift systems. ARM estimates a quarter of such embedded computer chips made last year used its technology

Smart home - Internet-connected thermostats, electricity meters and smoke alarms are among a growing range of products that promise to make our homes safer and more energy efficient. Many use ARM-based chips to help homeowners cut their bills

Smart cities - Several cities are exploring the use of sensors to cut costs and help their inhabitants. Examples include street lamps that dim themselves when there is nobody close by and parking meters that detect when spaces are empty - or alert nearby wardens when vehicles have overstayed their time slots. ARM believes this sector holds great potential for its business

Smart cars - ARM-based chips are already used within many vehicles' infotainment systems to let them show maps, offer voice recognition and play music. They also carry out the calculations needed to run driver assistance systems - working out when to trigger automatic electronic braking, for example - and are being used within prototype self-driving systems

Wearable tech - From fitness trackers to smartwatches, much of the most popular wearable tech has relied on ARM-based chips for several years. Now, virtual reality and augmented reality headsets are the latest kit to feature the company's technology

The board of ARM is expected to recommend shareholders accept the Softbank offer - which represents a 43% premium on its closing market value on Friday of £16.8bn.

Shares in the UK technology firm ended the day 41.3% higher at £16.80 in London after rising as high as £17.42p a share, adding almost £7bn to ARM's market value.

Mr Hauser said the result of the Softbank deal meant the "determination of what comes next for technology will not be decided in Britain any more, but in Japan".

Japanese entrepreneur

ARM said it would keep its headquarters in Cambridge and that it would at least double the number of its staff over the next five years.

Softbank is one of the world's biggest technology companies and is run by its founder, Japanese entrepreneur Masayoshi Son.

Softbank chief executive Masayoshi Son says the ARM purchase is a long-term investment

It has previously acquired Vodafone's Japanese operations and the US telecoms company Sprint. The $20bn deal was the biggest foreign acquisition by a Japanese firm at the time.

Softbank intends to preserve the UK tech firm's organisation, including its existing senior management structure and partnership-based business model, ARM said.

Mr Son, chairman and chief executive of Softbank, said: "This is one of the most important acquisitions we have ever made, and I expect ARM to be a key pillar of SoftBank's growth strategy."

Analysis: Rory Cellan-Jones, BBC technology correspondent

It's hard to exaggerate just how important ARM is to the UK tech sector - and the shock many are feeling this morning at the news that it is about to lose its independence.

Its brilliance was to realise that if chips were about to come with everything, you didn't have to make them: designing them was the key.

Five years ago, Cambridge was home to at least three world-beating UK-owned technology firms: ARM, Autonomy and Cambridge Silicon Radio (CSR).

Then Autonomy was swallowed up by HP in an ill-fated deal; last year the chipmaker Qualcomm bought CSR; and now ARM - the biggest and best - is about to have a Japanese owner.

In Softbank, ARM may well have found a good parent.

The Japanese firm bought France's Aldebaran robotics business and has gone on to give it a global profile.

But there will still be sadness in Cambridge, and beyond, that Britain's best hope of building a global technology giant now appears to have gone.

'Attractive destination'

Prime Minister Theresa May said the Softbank deal showed the UK economy could be successful after the country voted to leave the European Union.

A spokeswoman said Mrs May believed the deal was in the country's national interest - a gauge that she will use to assess any future foreign takeovers.

"This is good news for British workers, it's good news for the British economy, it shows that, as the prime minister has been saying, we can make a success of leaving the EU," the spokeswoman added.

Dan Ridsdale, analyst at Edison Investment Research, said: "An increase in inbound merger and acquisition activity was one of the obvious consequences of Brexit and weakened sterling, but few expected it to manifest itself so quickly or at so large a scale."

- Published18 July 2016

- Published18 July 2016

- Published16 February 2016