Home ownership falling in major English cities, says think tank

- Published

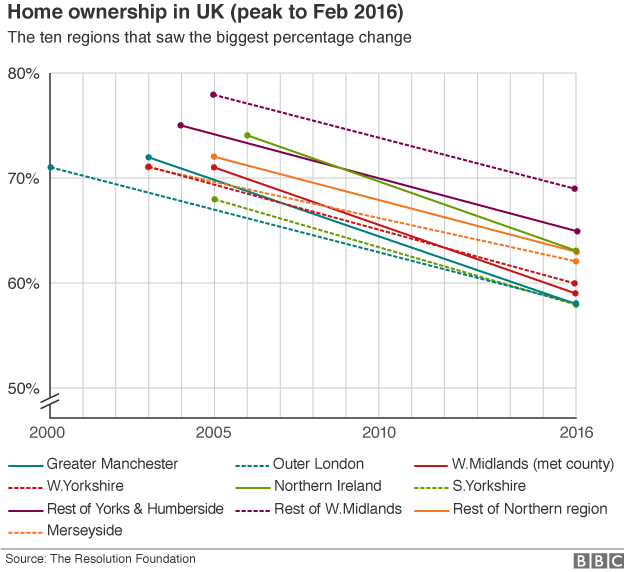

The chances of owning a home have fallen fastest in Greater Manchester

Major English cities - particularly Manchester - have seen the sharpest falls in home ownership since a peak in the early 2000s, analysis suggests.

The Resolution Foundation said homes were becoming increasingly unaffordable for struggling potential buyers.

The proportion of home owners dropped from 72% in April 2003 to 58% this year in Greater Manchester, it said.

West Yorkshire, the metropolitan area of the West Midlands and outer London have also recorded double-digit falls.

Explaining the falling rates of home ownership, Matthew Whittaker, chief economist from the Resolution Foundation, told the BBC's Today programme: "What we particularly have seen since 2002-03 is that incomes simply haven't kept pace with house prices, so it's not just that house prices have gone up.

"We had access to lots of relatively easy credit and the position we're in now is that credit has been turned off.

"We have this sense now that house prices have become detached from people's earnings ... and we no longer have the route through 100% mortgages and the like for getting on to the housing ladder."

The average first time buyer paid just under £30,000 for their new home in the 1980s compared with more than £150,000 now, the think tank said.

The Resolution Foundation used data from the Office for National Statistics' Labour Force Survey (LFS).

The report follows recent data from the government's English Housing Survey showing the total number of buyers has fallen by a third in 10 years, and those who do buy their first home increasingly rely on the bank of mum and dad for help.

The Resolution Foundation's analysis of the LFS found that home ownership in England peaked in 2003 at 71% of the population and had now dropped to just under 64%.

The reduction in the proportion of people owning their own home was also recorded in other parts of the UK. The figures suggest home ownership:

Fell from its 2006 peak in Northern Ireland of 73% to 63% now

Dropped from 69% in Scotland at its 2004 peak to 63% now

Decreased from 75% in Wales at its 2006 peak to 70% now

'Big problem'

The Resolution Foundation, a not-for-profit research and policy organisation campaigning for people on low and modest incomes, said its analysis showed that the struggle to own a home was no longer just a "London-centric issue".

"London has a well-known and fully blown housing crisis, but the struggle to buy a home is just as big a problem in cities across the North of England," said Stephen Clarke, the foundation's policy analyst.

"The chances of owning a home have fallen fastest in Greater Manchester over the last decade, though the Leeds and Sheffield city areas have also experienced sharp drops."

'Unfriendly market'

Polly Steiner says that she could settle down were she able to buy a home

In Manchester, Polly Steiner, 33, who volunteers for the Greater Manchester Housing Action Network, said: "I am a graduate, I have lived in Manchester for 10 years now and I am not someone who is silly with money, but there is no way that this market is friendly for someone like me who works for a charity.

"It is not possible for me to buy. Buying a property would help me to plan and settle down."

Another area that was highlighted in the report was the metropolitan area of the West Midlands.

It said ownership had fallen from 70% in April 2005 to 59% now.

Mark, who lives in Dudley, said: "We've been renting for six years. We have paid almost £60,000 in rent.

"As much as I would love to buy my own house, it grieves me to rent, but we just can't get on the ladder due to the deposit. Instead of doing the Help to Buy scheme, the government should bring back 100% mortgages, and maybe help us with the deposit.

"If the government was to pay the deposit, we could go out tomorrow and buy a house."

Twitter reaction to the report includes some who point out the changing nature of society and the housing market.

Susan Freeman says the "increase in numbers renting may also be due to changing lifestyles". Jerome, who is a landlord, says people are too fussy in their expectations for a first home.

Neil Leydon says that buy-to-let investors have taken the bottom out of the market for first-time buyers, and @thetoyfinder says: "We have paid over £120k in rent over the past 14 years regularly to the same landlord - but can't get a mortgage".

Renting v ownership

The think tank also confirmed that the fall in ownership corresponded with a rise in renting from private landlords.

The proportion of private tenants rose from 11% in 2003 to 19% last year, it said. In Greater Manchester, the move was more pronounced - rising from 6% to 20% over the same period.

While accepting that home ownership was rather a national obsession, it pointed out that those in the private rented sector spent more of their income on housing than their owners, and there was more insecurity in short-term tenancies.

"The shift to renting privately can reduce current living standards and future wealth, with implications for individuals and the state," Mr Clarke said.

"We cannot allow other cities to edge towards the kind of housing crisis that London has been saddled with."

In her first speech as Prime Minister, Theresa May referred to the "injustice" in the fact that "if you're young, you'll find it harder than ever before to own your own home".

Housing charity Shelter has regularly called for the government to do more to tackle what it calls a "drastic shortage of genuinely affordable homes".

A Department for Communities and Local Government spokesman said more than 300,000 people had been helped into home ownership through government-backed schemes since 2010.

The government has done "a huge amount" to help get people into homes says Gavin Barwell.

It also said that a 10-year decline in home ownership had stopped.

"However, we know there is more to do, which is why we have set out the most ambitious vision for housing in a generation, including delivering hundreds of thousands of homes exclusively for first-time buyers," he said.

The Local Government Association last week argued that councils should be given the opportunity to restore their "historic role" as house builders.

First-time buyer help: What happens elsewhere?

In Australia, first time buyers in some States are given a grant of up to $10,000 (£5,091) when purchasing a property

In the US, various States offer incentives. In Florida, for example, the State government uses tax credits to make mortgages easier to afford once the property is purchased

China has a mandatory deposit of 25% or more, but this is cut to 20% for first-time buyers in large cities such as Beijing

Are you an aspiring first time buyer struggling to get your foot on the property ladder?

Email us at haveyoursay@bbc.co.uk, external. If you're happy to be contacted by a BBC journalist please include a telephone number.

You can also contact us in the following ways:

WhatsApp: +44 7525 900971

Tweet: @BBC_HaveYourSay, external

Text an SMS or MMS to 61124